Futures Brace To Spike Higher (Or Lower) Depending On Today’s CPI Number

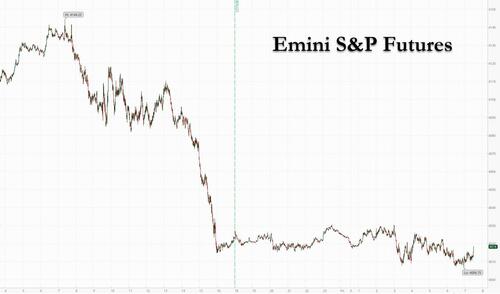

After a furious late-day selloff on Thursday as markets digested the probability of another red hot inflation number, S&P Futures traded in a narrow range on Friday ahead of the crucial May CPI Print which will dictate the path of Federal Reserve policy (it means the difference between a 25bps and 50bps Sept rate hike… or 0bps), and which is expected to come in 8.3% Y/Y and 0.7% M/M for headline and 5.9% Y/Y and 0.5% M/M for core. S&P 500 contracts fluctuated between modest gains and losses, while Nasdaq 100 futures rose about 0.4% as of 7:30 a.m. ET. The dollar rose slightly, although it has been trading largely flat throughout the session. The yield on the 10-year Treasury is unchanged at 3.04%, while the 2-year Treasury yield rose about 3.4 basis points to 2.8455%. Gold and bitcoin fell. Oil rose.

In premarket trading, DocuSign slumped 25% after the e-signature company earnings missed expectations and cut its full-year billings outlook. Netflix and Roblox declined after Goldman Sachs analysts cut their recommendations on the stocks to sell from neutral amid macroeconomic concerns. Bank stocks are lower in pre-market trading Friday as investors await the release of key inflation data later this morning. In corporate news, Credit Suisse shares hovered near the lowest in at least three decades after State Street Corp. denied that it is interested in taking over the Swiss lender. Here are some other notable premarket movers:

Stitch Fix (SFIX US) slides 14% in premarket trading as analysts cut their price targets on the online styling platform operator after the company reported earnings that missed estimates and confirmed plans to cut 15% of its salaried workforce.

Advanced Micro Devices (AMD US) shares rose 1.2% in premarket trading after the chipmaker hosted an analyst event where it outlined long-term financial targets, Xilinx synergies and its plans to take more market share from peers.

Chinese stocks in US bounce back in premarket trading, a day after the group posted its biggest one-day drop since May. Alibaba (BABA US) rises 3.8% as investors assess whether Beijing’s easing in regulatory crackdown on internet firms supports speculation that Ant’s IPO may be revived.

Investors will be closely watching the US inflation reading. An upside surprise would be a setback for both the Fed and markets, raising doubts about how well rates are working to subdue prices rising at a clip of more than 8%.

Policymakers “are looking for ‘clear and convincing evidence’ that inflation in the US is going to start falling back from its eye-watering level,” Nick Chatters, investment manager at Aegon Asset Management, wrote in a note. “Wishful thinking?”

“In an environment where most major developed market central banks are taking aggressive action to bring inflation down, risk assets are likely to remain volatile and struggle to sustain rallies,” said UBS Global Wealth Management CIO Mark Haefele in a note. “This dynamic should persist until there is clear indication that inflation is trending lower, which may not occur until well into the second half of the year.”

Meanwhile, Bank of America strategists said investors are putting billions of dollars into cash and stock funds as they seek protection from surging inflation, citing EPFR Global data. US equities were the primary beneficiaries of inflows with about $13 billion, while bond fund outflows resumed, the data showed.

While US rates were also rangebound, Euro-area peripheral spreads continued blowing out as the ECB left a wide room for interpretation on what their anti-fragmentation policy might be while they begin to raise rates. 10y BTP/Bund widens ~6bps to 222bps, short end lags. Bund, Treasury and gilt curves all bull flatten while Greek bond yields hit the highest level since early 2019.

The bond turmoil depressed European markets which saw the stoxx 600 slump 1.5% to session lows, with Italy’s FTSE MIB underperforming regional peers in a weak session for European equities. Euro Stoxx 50 slumps as much as 1.7%. FTSE 100 outperforms but remains down ~1.3%. Real estate, banks and insurance are the worst performing sectors. Italian stocks underperformed as the country’s bonds slid, banks plunged: the FTSE MIB was the worst-performing index among major European countries Friday, with banks dropping the most as Italian bonds slide, following the ECB meeting on Thursday. FTSE MIB -3.5% vs a decline of 1.4% at the Stoxx Europe 600 Index. BPER -11%, BAMI -6.9%, Unicredit -6.7%, Intesa -6.5%.

Here are the biggest European movers:

Just Eat Takeaway.com shares rise as much as 9.1% after a Bloomberg report that its US unit Grubhub is attracting preliminary interest from private equity firms including Apollo.

Scandic shares rise as much as 13% after the Swedish hotel group flagged “very strong earnings development” during the second quarter on a “greatly improved” hotel market.

SAS shares surge as much as 46% after the Danish government reiterated its support for the ailing Scandinavian airline, forgiving and converting its debt and increasing its ownership share.

Aryzta shares advance as much as 4.2% after Kepler Cheuvreux upgraded the Swiss baker to hold from reduce, citing “credible” new financial targets and improved balance sheet.

Ericsson shares fall as much as 4.6% after the Swedish telecommunications manufacturer said the US SEC will open an investigation into the company’s handling of a 2019 corruption scandal.

Shipping stocks drop again, with Maersk down as much as 5.8% and Hapag-Lloyd as much as 7.2% lower, amid ongoing concerns about demand and the normalization of freight rates.

Swisscom shares slump as much as 4.6% after UBS cut the telecommunication company to a sell recommendation from neutral, citing “a number of headwinds.”

Credit Suisse shares fall as much as 6% on Friday, extending yesterday’s 5.6% slump after State Street said it is not pursuing any acquisition of the Swiss lender.

Ageas shares fall as much as 2.5% as ING initiates coverage on the insurer with a hold recommendation, saying that while the potential is there, the “timing is not right.”

Earlier in the session, Asian stocks dropped, giving up gains for the week, as chipmakers slid amid renewed concerns about inflation and Covid lockdowns in Shanghai. The MSCI Asia Pacific Index declined as much as 1.2%, with tech and financials sectors the biggest drags. Most major benchmarks in the region were down, with gauges in Japan, South Korea, Australia, India, the Philippines and Indonesia each falling more than 1%. The region’s semiconductor heavyweights, TSMC and Samsung Electronics, were the largest contributors to the Asian stock benchmark’s decline. China’s tech shares reversed early losses as investors bet the worst of Beijing’s crackdown on the sector may be over even as the nation’s regulator denied a Bloomberg News report that it started early-stage discussions on reviving the initial public offering of Ant Group.

Asian shares also slumped after the European Central Bank opened the door to a half-point interest-rate hike in the fall. In addition, sentiment was fragile as investors monitored virus flare-ups in China. Read: Covid Flares Again in Shanghai, Putting Areas Back in Lockdown “We are seeing a reversal in several developments that had helped markets rebound in the past weeks,” said Heo Pil-Seok, chief executive officer at Midas International Asset Management in Seoul. “With China possibly entering lockdowns again and the ECB moving to raise interest rates, all of these are pouring cold water on markets which believed fear about inflation had eased.” Asia’s equities benchmark is on course for its first weekly loss in four weeks, paring a rebound from a two-year low hit in May

Australian stocks tumbled, with the S&P/ASX 200 index falling 1.3% to 6,932.00, its lowest level since Jan. 27. The gauge notched its biggest weekly loss since April 2020, down 4.2%. Global growth concerns and the RBA’s larger-than-expected rate hike weighed on investor sentiment. All sectors dropped Friday, with real estate and consumer discretionary shares leading declines. In New Zealand, the S&P/NZX 50 index fell 0.7% to 11,136.28.

In FX, the Bloomberg Dollar Spot Index was steady after rising to the highest in three weeks in the previous session. NZD and AUD are the strongest performers in G-10 FX, CAD and GBP underperform. USD/JPY drifts back up toward a 134-handle. Economists see US consumer costs rising 8.3% year-on-year in May when data is released later Friday. Investors are taking profits on dollar-long bets, said Patrick Bennett, strategist at Canadian Imperial Bank of Commerce in Hong Kong. “Dollar gains have dominated recently, there appears to be some squaring into US CPI”.

In rates, the Treasuries curve has extended Thursday’s flattening move ahead of today’s CPI print, with 10Y yield trading roughly unchanged from yesterday at 3.04%, and 2s10s, 5s30s near session lows in early US trading following a wider flattening move seen across German curve as markets continue to digest Thursday’s ECB policy announcement. Into front-end Treasuries underperformance, 2- and 3-year yields reach year-to-date highs. US yields are cheaper by up to 3.5bp across front-end of the curve while 7-year out to long-end are richer by up to 2bp with 20- year sector outperforming — 2s10s, 5s30s spreads flatter by 4.3bp and 2.2bp at ~18bp and ~7bp respectively. IG dollar issuance slate empty so far; Thursday session was quiet and Friday also expected to be subdued with CPI data release. In Europe, the German 2s10s, 5s30s curve are both flatter by over 5bp while bunds outperform Treasuries by ~1.5bp over early European session.

In commodities, oil rose after erasing an earlier loss triggered in part by new restrictions in Shanghai. Chinese President Xi Jinping called on his government to adhere “unwaveringly” to its Covid Zero policy, while at the same time striking a balance with the needs of the economy. WTI rose 0.3% to trade near $121.80. Most base metals trade in the red; LME nickel falls 1.5%, underperforming peers. Spot gold falls roughly $5 to trade near $1,842/oz.

Bitcoin is softer on the session, though only modestly so, and as such remains in recent ranges which continue to pivot USD 30k.

Looking at the day ahead now, economic data slate includes May CPI (8:30am), June University of Michigan sentiment (10am) and May monthly budget statement (2pm). Central bank speakerss include the ECB’s Holzmann and Nagel.

Market Wrap

S&P 500 futures up 0.2% to 4,022.75

STOXX Europe 600 down 1.3% to 428.90

MXAP down 0.9% to 166.71

MXAPJ down 0.8% to 551.64

Nikkei down 1.5% to 27,824.29

Topix down 1.3% to 1,943.09

Hang Seng Index down 0.3% to 21,806.18

Shanghai Composite up 1.4% to 3,284.83

Sensex down 1.8% to 54,330.71

Australia S&P/ASX 200 down 1.3% to 6,931.98

Kospi down 1.1% to 2,595.87

Brent Futures little changed at $122.99/bbl

German 10Y yield little changed at 1.40%

Euro little changed at $1.0618

Gold spot down 0.1% to $1,846.06

U.S. Dollar Index little changed at 103.24

Top Overnight News from Bloomberg

Shanghai will briefly lock down most of the city this weekend for mass testing as Covid-19 cases continue to emerge, causing more disruption and triggering a renewed run on groceries days after exiting a grueling two-month shutdown.

Investors are putting billions of dollars into cash and stock funds as they seek protection from surging inflation.

A selloff in Europe’s weakest bond markets is showing no signs of easing, piling pressure on the European Central Bank to make clearer how it plans to keep diverging borrowing costs contained.

Public confidence in the Bank of England is at an all-time low, with Britons expecting above-target inflation to persist for years

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly negative after the glum mood rolled over from global counterparts with a hawkish ECB meeting and fresh COVID restrictions in Beijing stoking growth slowdown concerns. ASX 200 was dragged lower by the energy and mining-related sectors after recent declines in underlying commodity prices and with participants taking risk off the table ahead of the extended weekend in Australia. Nikkei 225 retreated beneath the 28k level amid the broad risk aversion and as the domestic currency found some reprieve from its weakening trend. Hang Seng and Shanghai Comp. were both initially subdued after weak earnings and Ant Group’s denial regarding plans to relaunch its mammoth IPO, while participants also digested the mixed inflation data from China and the latest COVID restrictions in Beijing, although the mainland then spent the session recouping lost ground.

Top Asian News

South Korean Transport Ministry held a meeting with the trucker union leadership on Friday and is holding a working-level meeting with the union, while it added that about 7,500 unionised truck drivers were expected to strike today. It was also reported that striking South Korean truckers halted and turned around non-union truckers from trying to enter the Ulsan petrochemical complex and the movement of containers through South Korea’s Ulsan port was totally suspended amid the trucker strike, according to Reuters.

Beijing City reports 21 (prev. 3) cases during the 15 hours to 3pm on June 10th, according to an official, via Reuters.

Japan Officials Fire Warning on Forex With Yen Near 1998 Low

Top Toyota Supplier Denso Mulls $3 Billion Chip Unit Spinoff

China’s Moderating Inflation Leaves Room for More Easing

Covid Lab Leak Theory Needs More Inquiry, WHO Advisers Say

The mood across European equities remains downbeat as the region plays catch-up to yesterday’s Wall Street tumble; Euro Stoxx 50 -1.6%. European cash bourses trade lower across the board with the Dutch AEX and UK’s FTSE 100 slightly more cushioned. Sectors in Europe are all lower but largely hold a defensive bias; EZ Periphery banks continue to lag post-ECB while Luxury slips on China/COVID updates. US equity futures trade with modest gains with the ES -0.2% just about holding onto the 4,000 handle. TSMC (2330 TW) – May (TWD): Sales 185.7bln, +65% YY, +7.6% MM. January-May Sales 849.3bln, +44.9% YY.

Tesla (TSLA) CEO Musk says the next FSD beta version will be coming out in two weeks. Amazon (AMZN) is planning to pull out of the USD 7.7bln race for IPL cricket rights, according to Bloomberg.

Top European News

On the ECB decision, one dovish member said “impression is everybody lost”, described the EGB and EUR downside as “..not what you want”; conversely, a hawk described the meeting as having gone very well. Additionally, re. QT, a dovish member does not believe this will happen any time soon, according to FT.

UK employers hired staff at the slowest pace since early 2021, according to a survey by REC cited by Reuters which showed the measure declined for a sixth consecutive month to 59.2 from 59.8 M/M but remained in expansion territory above the 50 benchmark level.

Former UK Brexit Minister Frost has warned that PM Johnson must deliver a “new Conservative vision for Britain” or risk being removed from his position by the autumn, according to the Telegraph.

FX

DXY recovers from overnight lows of 103.04 heading into the US CPI release.

Antipodeans stand as the current G10 outperformers with NZD leading the charge, with the AUD/NZD cross subsequently paring back recent ground and falling under 1.1100.

CAD is under some pressure pre-jobs data; USD/CAD today sees its 100 DMA at 1.2700, 21 DMA at 1.2722, and 50 DMA at 1.2723.

EUR and GBP are now under pressure as the dollar recovers from early losses.

The Yen attempts to claw back some ground after the BoJ, MoF, and FSA expressed concern in a joint release.

Fixed Income

BTP-Bund spread continues to widen, out to 234bp thus far, though, offset amid incremental Bund upside via Holzmann.

Hawk Holzmann took perhaps an incrementally more ‘dovish’ line than usual re. September’s hike increment, alluding to a non-standard increment move.

USTs are essentially unchanged at 117.30+ pre-CPI though the yield curve continues to flatten in-line with EGBs and after well received long-end issuance.

Commodities

WTI and Brent futures are choppy with relatively modest intraday gains following yesterday’s China-induced weakness.

WTI Jul’ resides just under USD 122/bbl (vs low 120.09/bbl), whilst Brent Aug’ trades around USD 123.50/bbl (vs low 121.60/bbl).

Kuwait set July KEC crude OSP for Asia at Oman/Dubai +USD 6.15/bbl vs prev. premium of USD 4.35/bbl in June, according to Reuters.

A minimum of four north-Asian refiners are facing crude oil supply cuts from Saudi in July, according to Reuters sources.

Peruvian communities said they are ready to end the 51-day shutdown at MMG’s (1208 HK) Las Bambas mine and allow the copper mine to restart, while the mine will not begin construction of the Chalcobambas pit during a 30-day truce and the Peru government will lift the state of emergency in the Las Bambas mine area, according to Reuters.

Metals markets are relatively tentative and uneventful; spot gold trades on either side of its 21 DMA (1,844/oz), while base metals similarly hold a mild downside bias.

US Event Calendar

8:30am: US CPI MoM, May, est. 0.7%, prior 0.3%; YoY, May, est. 8.3%, prior 8.3%

8:30am: US CPI Ex Food and Energy MoM, May, est. 0.5%, prior 0.6%; YoY, May, est. 5.9%, prior 6.2%

2pm: US Monthly Budget Statement, May, est. -$136.5b, prior -$132.0b

DB’s Jim Reid concludes the overnight wrap

I’ll be another year older on Sunday which is a sobering thought. In addition, yesterday marked 10 years since I proposed to my wife up the top of a mountain. I wasn’t 100% sure I was doing the right thing at the time but am certain of it now! She was 100% certain it was the happiest day of her life back then, but now she’s not so sure. Anyway, we shall be celebrating both tomorrow night in a rare evening out alone.

It’s been another dramatic 24 hours in markets as the ECB kicked off an incredibly busy week ahead of macro events, including US CPI today, by laying the groundwork for a sustained campaign of rate hikes starting next month. Our European economists’ full ECB wrap, and all new updated rates call, is available here.

The immediate headlines of their decision were much as expected, with a confirmation that net asset purchases would conclude at the end of the month, and that their conditions for rates liftoff had been satisfied. But looking forward, not only did they confirm their intent to hike by 25bps in July, they formally opened the door to a 50bps increase at the subsequent meeting in September, saying that the “a larger increment will be appropriate at the September meeting” if the inflation outlook “persists or deteriorates”. It seems by “persists”, all that need to happen is for their staff inflation forecast for 2024 to at least remain at 2.1%, the level it got upgraded to yesterday. Core CPI was projected to be at +2.3% that year, a bigger move than expected.

More broadly, the ECB’s statement and President Lagarde’s press conference struck a hawkish tone, and the first paragraph of the statement openly acknowledged the inflation challenge and the need to return it back to target. And when it came to a potential tool to deal with fragmentation in bond markets, Lagarde said that they would “deploy either existing or new instruments that will be made available.”

In light of the decision, our European economists have added to their existing view of a 50bp hike in Q3 and now expect a second 50bp hike in Q4. So their new baseline is for a 25bp move in July, then two consecutive 50bp moves in September and October, and then a 25bp move in December that puts the deposit rate back up to 1% by year-end. The team still thinks the terminal deposit rate will be 2%, reached in the middle of next year, but the path there will be quicker given inflationary pressures and hawkish tone from the ECB.

When it came to the market reaction, investors interpreted the ECB’s decision in a hawkish light, with a fresh selloff in sovereign bonds taking yields up to multi-year highs yet again. Those on 10yr bunds were up by +7.4bps to a post-2014 high of 1.42%, with those on OATs (+10.3bps) and BTPs (+22.2bps) also hitting their highest in years. Meanwhile, the decision also coincided with a serious widening in peripheral spreads, with both the Italian and the Spanish 10yr yield spread over bunds widening to 2-year highs of 216bps and 118bps respectively. That widening in spreads was seen on the credit side too, with iTraxx Crossover up 15.9bps to 471bps, and closing back in on its post-Covid closing high of 488bps.

Importantly, our European economists connected the peripheral spread widening to an apparent lack of progress on anti-fragmentation tools, with President Lagarde apparently leaning on using PEPP flexibility to support implementation in the interim. They believe a tool is inevitable, but will require market stress first so that policymakers can pass off the tool as “proportionate” to make it more legally durable. That proportionality is harder to prove in advance. So this feels like a slow-motion crisis building for Italy but one that will have a solution with limited stress. An odd state of affairs.

Back to markets, and the hawkish rhetoric from the ECB proved similarly bad news for European equities, with the STOXX 600 (-1.36%) losing ground for a third consecutive session. US equities saw an even heftier decline, with the S&P 500 down -2.38%. The Index opened down following the ECB, and slid lower still in the last hour or so of New York trading. Every sector was lower in a broad-based decline, with all but three sectors down by more than 2%.

Alongside the ECB, risk appetite was further dampened by an unexpectedly large jump in the US weekly initial jobless claims, with the number for the week through June 4 coming in at 229k (vs. 206k expected), which is also their highest level since January, as well as the largest week-on-week jump in claims since last July. One week doesn’t make a trend but this series has been a bit more volatile of late which will increase its relevance in the weeks ahead.

Given the ECB’s move yesterday, investors in turn reassessed the likelihood that other central banks were set to move in a more hawkish direction. In fact there was a significant milestone yesterday, since Fed funds futures moved to price in their most aggressive profile of rate hikes for 2022 so far, with the implied rate by the December meeting now at 2.92%, which surpasses the previous record of 2.88% in early May. That was seen for other central banks too, with the rate implied by the December meetings for the Bank of England also at its highest to date.

Those moves led to a further rise in bond yields elsewhere, with 10yr US Treasuries up 2.0bps to a one-month high of 3.04%. Real yields led the bulk of the move higher, and the 5yr real yield almost breached positive territory, before ending the day at -0.04%. Meanwhile 10yr gilt yields (+7.6bps) hit a post-2014 high of 2.32%.

Speaking of Treasuries, there’s another focal point today in the form of the US CPI reading for May, which is the last major piece of data the FOMC will get before their next decision on Wednesday. Our US economists expect that the monthly headline print will accelerate again to +0.7% (from +0.3% in April), which will keep the year-on-year measure at +8.3%. That’s because of re-accelerating gas prices along with solid food inflation, and they expect the monthly core reading to fall back to +0.5% (vs. +0.6% expected), which will push the year-on-year rise in core down to +5.8%. Given the FOMC are now in their blackout period ahead we won’t be able to get their reaction, but it’s been 9 months since we last saw the monthly CPI print come in beneath the Bloomberg consensus, and it would now be a massive surprise at this point if the Fed did anything other than a second consecutive 50bps hike next week. So most of the action from this report will come in the form of September onwards Fed pricing. A potential portent of today’s print, yesterday the Atlanta Fed wage growth tracker ticked higher to 6.1% in May, its highest reading since the series began publication back in 1983.

Overnight markets have stabilised a bit with Chinese equities higher after relatively subdued inflation. PPI climbed 6.4% (vs 8% last month), in-line with estimates but the lowest print since March 2021, with CPI up 2.1%, a tenth lower than expectations and in-line with last month. This has seemingly encouraged markets to believe China can continue to ease policy offsetting the news over the last 24 hours that Shanghai is going to lockdown 7 districts at the weekend for mass testing after six community infections were found. The lockdown may only be for the period of testing but the risk is clearly that more cases are found. Chinese equities are around half a percent higher with tech stocks out-performing as regulatory concerns are easing. Elsewhere the Nikkei is catching down with US markets and is around -1.5% lower as we type. US futures are slightly higher and 10yr treasury yields are up another basis point with 2yr yields up a couple.

To the day ahead now, and the highlight will be the aforementioned US CPI reading for May. Other data releases include the University of Michigan’s preliminary consumer sentiment index for June, as well as Italian industrial production for April. Finally, central bank speakers include the ECB’s Holzmann and Nagel.

Tyler Durden

Fri, 06/10/2022 – 07:51