Oil Price Spike Has Yet To Spark Gasoline Demand Destruction

Worries about demand destruction for gasoline appear overblown. Consumers are tolerating record-high prices at the pump as demand continues to rise.

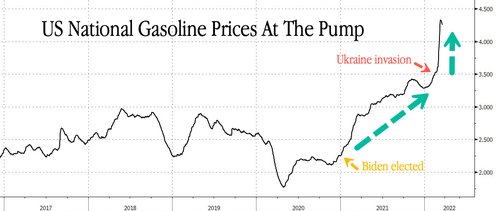

US Energy Information Administration (EIA) data show gasoline prices are up a staggering 51% from a year ago, averaging around $4.32 a gallon on a national level.

Record-high prices at the pump trigger fear that demand destruction is imminent, but that’s not what the data shows in the first half of March.

EIA noted gasoline consumption is up 6% over the year, to 8.9 million barrels per day for the week ending March 11. Demand was 2.3% higher than the two weeks prior. Over the last month, average weekly US gasoline consumption is up 8.6% versus the prior year, to 8.8 million barrels a day.

Skyrocketing fuel prices and significant inflationary pressure have yet to crimp demand as consumers appear to tolerate high prices as they must drive to work, drop off their kids at school, and run errands. Yes, millions of Americans are furious with the Biden administration about soaring costs but being irate and actually cutting back are two separate things.

“Higher oil and gasoline prices are certainly crimping consumer pocketbooks, but they are not yet causing a decline in demand,” research firm DataTrek said.

On Sunday, Patrick De Haan, head of petroleum analysis for Gas Buddy, verified the trend and said weekly gasoline demand “surged to highest since last summer.”

Weekly US gasoline demand surges to highest since last summer… data incoming

— Patrick De Haan ⛽️📊 (@GasBuddyGuy) March 20, 2022

DataTrek continued: “Given more workers commuting back to the office and incremental employment, we expect demand to continue to improve as the year continues. It always amazes us that the US uses the better part of 10 million barrels/day of gasoline…”

Consumers are reducing their discretionary spending to offset high gas prices. For instance, BofA’s research analyst Sara Senatore points out all restaurant spending through the week ending March 12 decelerated. The decline in restaurant spending coincides with the spike in fuel prices following Russia’s invasion of Ukraine in late February.

Other indications consumers are paring back discretionary spending comes from consumer goods companies who said their ability to continue raising prices has likely hit the ceiling. Macy’s Inc. CEO Jeff Gennette recently told WSJ that price increases on mattresses and sofas were met with fierce consumer pushback. Clothing brand Bella Dahl hiked shirt prices by $20 and immediately saw sales crater. “There was a revolt,” said Steven Millman, Bella Dahls’ brand officer. “If we go any higher, we’ll do half the sales.”

The good news is Americans’ average monthly wage share for fuel costs is by far the least among all OECD countries. This means the wage share can increase though discretionary spending will decrease.

Gas is a necessity, and even though consumers complain about soaring prices, they are belt-tightening and reducing spending elsewhere to offset their driving needs. Prices might have to rise much higher to reach the demand destruction threshold.

Tyler Durden

Mon, 03/21/2022 – 22:00