Key Events This Week: First Post-War PMIs And Deluge Of Fed Speakers

It’s a relatively quieter week compared to the last week’s central bank/quad-witching emotional rollercoaster (if that is possible at a time when the Second Cold War has broken out) and one of the key events this week according to DB’s Jim Reid will be Thursday’s March flash PMIs from around the world where we’ll see the first impact of the Russia/Ukraine conflict on activity, especially in Europe.

Outside of that, UK CPI data on Wednesday is going to be very interesting after the BoE warned on both growth and inflation last week in their surprisingly dovish hike. See our UK economist’s review here. There is also the Spring UK (Budget) Statement on Wednesday (preview here) where all things fiscal will be in focus.

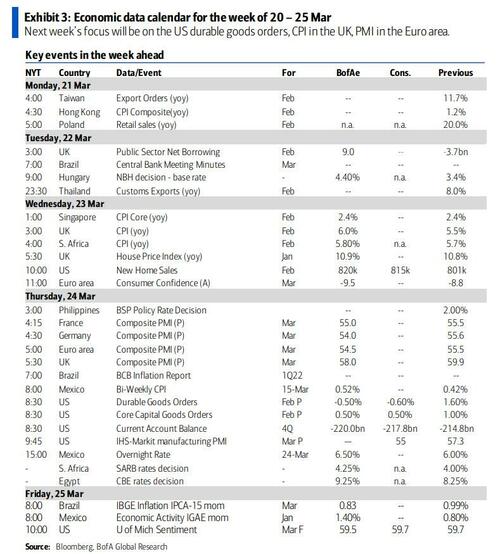

Wednesday’s new home sales, Friday’s pending home sales and Thursday’s durable goods are the main economic releases in the US. The week’s key evon events are summarized in the table below:

There’s also plenty of Fed speak to sharpen up the message from last week’s FOMC but don’t expect a chorus line singing from the same song sheet. The dot plot showed the range of YE ’22 Fed funds rates, as forecast by the committee, was a historically wide 1.4% to 3.1%. Boston (non-voter hawk) and Chair Powell himself are up today with the latter also on the docket on Wednesday. Williams (dove) will be on a panel tomorrow but also gives a speech on Friday. Daly (non-voter / dove) speaks tomorrow, Wednesday and Friday. Mester (voter / hawk) speaks tomorrow. Bullard (voter / hawk) is up on Wednesday and remember he was the lone 50bps dissenter last week. Kashkari (non-voter / dove), Governor Waller (hawk) and Chicago President Evans (non-voter / dove) speak on Thursday. Barkin (non-voter / hawk) concludes the Fed’s business for the week on Friday.

Here is a day-by-day calendar of events, courtesy of Deutsche Bank

Monday March 21

Data: Germany PPI

Central banks: PBoC announces 1 and 5-year loan prime rates, ECB’s Lagarde, Nagel, Makhlouf speak, Fed’s Powell and Bostic speak

Earnings: Nike, Pinduoduo

Tuesday March 22

Data: Eurozone construction output, US Richmond Fed manufacturing index, Canada industrial product price

Central banks: ECB’s Lagarde, Guindos, Villeroy, Lane and Panetta speak, BoE’s Cunliffe speaks, Fed’s Williams, Daly and Mester speak

Earnings: Carnival, Adobe, Xiaomi, Foxconn

Wednesday March 23

Data: UK CPI, RPI, house price index, Eurozone consumer confidence, US new home sales

Central banks: BoJ minutes of January meeting, BoE Governor Bailey speaks, ECB’s Lagarde, Nagel speak, Fed’s Powell, Daly, Bullard speak

Earnings: Tencent, Cintas, China Mobile, General Mills

Other: UK Chancellor’s budget statement

Thursday March 24

Data: Japan, France, Germany, Eurozone, UK, US PMIs, Japan PPI services, US initial jobless claims, durable goods orders

Central banks: ECB publishes economic bulletin, ECB’s Elderson speaks, BoE’s Mann speaks, Fed’s Bullard, Bostic, Kashkari, Waller speak

Earnings: Daimler

Other: BoE financial policy committee report

Friday March 25

Data: UK GfK consumer confidence, retail sales, Germany IFO business climate, Italy consumer confidence index, manufacturing confidence, economic sentiment, Eurozone M3

Central Banks: Fed’s Daly, Waller, Williams and Barkin speak

***

Finally, looking at just the US, Goldman writes that the key economic data release this week is the durable goods report on Thursday. There are several scheduled speaking engagements by Fed officials this week, including remarks by Chair Powell on Monday and Wednesday, and remarks by New York Fed President Williams on Tuesday and Friday.

Monday, March 21

There are no major economic data releases scheduled.

08:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will give a speech at the annual National Association for Business Economics economic policy conference. Text and audience and media Q&A are expected. In his last public appearance, on March 1st, President Bostic argued that the Fed “[does] not need to have [its] policy in a maximally accommodative stance,” and noted that, “for the rest of 2022, we will be hard pressed to get inflation below 3%.” In earlier remarks, President Bostic noted that “to the extent we start to see [monthly sequential inflation] trend down, then I will be comfortable pretty much with a 25 basis-point move. If that continues to persist at elevated levels, or even moves in the other direction, then I am really going to have to look at a 50-basis-point move for March.” Since then, the FOMC hiked by 25bp for the first time since the pandemic began at last week’s March meeting, and the March Summary of Economic Projections delivered a hawkish message by showing a median of seven hikes for 2022 and an above-neutral terminal rate of 2.75%.

12:00 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will give a speech at the annual NABE economic policy conference. Text and moderated Q&A are expected. Following last week’s FOMC meeting, Chair Powell reinforced the Committee’s hawkish tone by stressing that hiking by 50bp was “certainly a possibility,” that the FOMC will be “attentive to the risks of further upward pressure on inflation and inflation expectations,” and that he sees the risk of recession as “not particularly elevated.” We continue to expect the Fed to hike seven times in 2022. Chair Powell also said that the FOMC could finalize and implement its plan for balance-sheet reduction “as soon as our next meeting in May.” We see this as a strong hint and now expect the FOMC to announce the start of balance sheet reduction in May (vs. June previously).

Tuesday, March 22

10:00 AM Richmond Fed manufacturing index, March (consensus +2, last +1)

10:35 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will take part in a virtual panel discussion hosted by the Bank for International Settlements. Moderated Q&A is expected. In his last public appearance, on March 3rd, President Williams noted that “it’s clear with inflation so high that we need to get monetary policy away from where we are today,” and that the FOMC has “the ability to adjust interest rates higher” if inflation is more persistent than expected. In earlier remarks, on February 18th, President Williams stated that he did not “see any compelling argument to take a big step at the beginning [of the hiking cycle].”

02:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will take part in a virtual panel discussion hosted by the Hamilton Project at the Brookings Institution. On February 23rd President Daly argued that “inflation is well above our price stability goal and the lesson from the 1970s is we need to demonstrate to the American people that we’re committed to having that not be a perpetuating spiral,” but cautioned that while the FOMC has to “get policy in line … [it] can’t be impatient about doing it all today.” On February 24th, President Daly said that the FOMC needs to “ensure that we don’t make adjustments to the balance sheet at each and every meeting, because we just don’t know enough about it to make it a surgical tool.”

05:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss the economy and monetary policy at an event hosted by John Carroll University in Ohio. Text and audience Q&A are expected. In her last public appearance, on March 3rd, President Mester stated that “starting with [a] 25[bp hike] followed by further increases in coming months I think puts us in a good position,” but signaled she was open to a faster hiking pace, noting that “if by the middle of the year … we don’t see inflation moving back down, that would be a signal to me that we have to remove accommodation at a stronger pace, at a faster pace, because inflation isn’t moving down as we expected.” President Mester also indicated that “it could very well be that interest rates will have to move up above that long-run level.”

Wednesday, March 23

08:00 AM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will take part in a panel discussion on challenges for central banks in a digital world hosted by the Bank for International Settlements. Moderated Q&A is expected.

10:00 AM New home sales, February (GS -1.0%, consensus +1.3%, last -4.5%): We estimate that new home sales declined 1.0% in February, following a 4.5% decline in January.

11:45 AM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will take part in a moderated discussion at the Bloomberg Equality Summit in New York.

03:00 PM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will take part in a moderated discussion on the economic outlook at an event hosted by the Mid-Sized Bank Coalition of America. Audience Q&A is expected. President Bullard dissented from the FOMC’s decision to raise the federal funds rate by 25bp to 0.25%-0.50% in March, arguing that “raising the target range to 0.50% to 0.75% and implementing a plan for reducing the size of the Fed’s balance sheet would have been more appropriate actions.” President Bullard also argued that the FOMC should “try to achieve a level of the policy rate above 3% this year.”

09:05 PM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will take part in a moderated discussion on the economic outlook at a virtual conference in Hong Kong.

Thursday, March 24

08:30 AM Initial jobless claims, week ended March 19 (GS 220k, consensus 211k, last 214k); Continuing jobless claims, week ended March 12 (consensus 1,400k, last 1,419k): We estimate initial jobless claims edged up to 220k in the week ended March 19.

08:30 AM Current account balance, Q4 (consensus -$218.0bn, last -$214.8bn)

08:30 AM Durable goods orders, February preliminary (GS -0.5%, consensus -0.6%, last +1.6%); Durable goods orders ex-transportation, February preliminary (GS +1.2%, consensus +0.5%, last +0.7%); Core capital goods orders, February preliminary (GS +1.2%, consensus +0.5%, last +1.0%); Core capital goods shipments, February preliminary (GS +1.0%, consensus +0.5%, last +1.9%): We estimate durable goods orders pulled back 0.5% in the preliminary February report, reflecting fewer commercial aircraft orders. However, we also expect strong gains in core capital goods orders (+1.2%) and core capital goods shipments (+1.0%), reflecting strong goods demand, higher prices, and the 2.0% rebound in industrial production of business equipment. We are not assuming a significant drag from the Russian invasion of Ukraine on February 24, as Russia accounts for only 0.4% of goods exports and 0.6% of machinery and computer exports.

08:30 AM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will speak at the Midwest Economic Outlook Summit, hosted by the Fargo-Moorhead Chamber of Commerce. Audience Q&A is expected. In an essay published on Friday, President Kashkari noted that “if … high inflation … [proves] transitory …, then I believe the FOMC will need to remove accommodation and get modestly above neutral [of 2%] while the inflationary dynamics unwind. However, if … the economy is in a high-pressure, high-inflation equilibrium, then the FOMC will need to act more aggressively and bring policy to a contractionary stance in order to move the economy back to an equilibrium consistent with our 2 percent inflation target.” President Kashkari also noted that high levels of household income and large state-government budget surpluses suggested that “inflation may be sustained and in fact might not be transitory.” In a public appearance later on Friday, President Kashkari stated that he was “in favor of beginning to shrink the balance sheet soon, I mean as early as the next meeting,” and suggested “a much faster pace [of balance-sheet reduction],” noting that “if I had to pick a number I’d say shrink the balance sheet at roughly double the pace that we did last time.” We expect the Fed will start the process of balance-sheet normalization in May at a pace of $100bn per month, which is double the last cycle’s pace.

09:10 AM Fed Governor President Waller (FOMC voter) speaks: Fed Governor Christopher Waller will discuss the housing market at a virtual event hosted by Tel Aviv University and Rutgers University. Text and moderated Q&A are expected. In an interview on Friday, Governor Waller noted that “the data is screaming at us to go 50 [basis points] but the geopolitical events were telling you to go forward with caution, … so those two factors combined pushed me off of advocating for a 50 basis-point hike at this meeting and supporting the 25 [basis-point] hike.” Governor Waller stated that he favors “front-loading our rate hikes,” and that “the way to front-load it is to pull some rate hikes forward, which would imply 50 basis points at one or multiple meetings in the near future.”

09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 56.5, last 57.3): S&P Global US services PMI, March preliminary (consensus 54.2, last 55.9)

09:50 AM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will discuss the outlook for the economy and monetary policy at an event hosted by the Detroit Regional Chamber. Text and media Q&A are expected. In an interview on March 4th, President Evans argued that the FOMC needs “to be moving towards a more neutral monetary policy certainly by the end of the year so that we’re within striking distance of taking a position that would deal more forcefully with inflation if that’s necessary. I don’t quite think that’s necessary, but I have to say we need to be positioned for that.”

11:00 AM Kansas City Fed manufacturing index, March (consensus +21, last +29)

11:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will take part in a virtual discussion hosted by Spelman College. Audience Q&A is expected.

Friday, March 25

09:10 AM Fed Governor President Waller (FOMC voter) speaks: Fed Governor Christopher Waller will discuss central bank digital currencies at a virtual event hosted by Rutgers University. Moderated Q&A is expected.

10:00 AM Pending home sales, February (GS -3.5%, consensus +1.0%, last -5.7%): We estimate that pending home sales decreased by 3.5% in February, following a 5.7% decrease in January.

10:00 AM University of Michigan consumer sentiment, March final (GS 59.4, consensus 59.7, last 59.7); We expect the University of Michigan consumer sentiment index decreased by 0.3pt to 59.4 in the final March reading.

10:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will discuss monetary policy and financial stability during a virtual panel hosted by the Central Bank of Peru and the Bank for International Settlements. Text and moderated Q&A are expected.

11:30 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will give a speech on inflation at an event hosted by The Citadel Director’s Institute in Charleston, South Carolina. President Barkin wrote on Friday that the FOMC has “moved at a 50-basis point clip in the past, and we certainly could do so again if we start to believe that is necessary to prevent inflation expectations from unanchoring,” but noted that “setting the right pace for rate increases is a balancing act — we normalize rates to contain inflation, but if we overcorrect, we can negatively impact employment, which is the other part of our dual mandate.” President Barkin stressed that “while [the FOMC] could move faster, [it is] already having more impact than you might think” through its effect on financial conditions.

San Francisco Fed President Daly (FOMC non-voter) speaks (time to be announced): San Francisco Fed President Mary Daly will deliver opening remarks at the San Francisco Fed’s Macroeconomic and Monetary Policy conference.

Source: Deutsche Bank, Bank of America, Goldman Sachs

Tyler Durden

Mon, 03/21/2022 – 09:54