“Unsustainable” Earnings Trend Is Next Big Worry

By Michael Msika, Bloomberg Markets Live commentator and analyst

For all that European equities face a plethora of headwinds, earnings have stood firm as a source of support. That may be about to change.

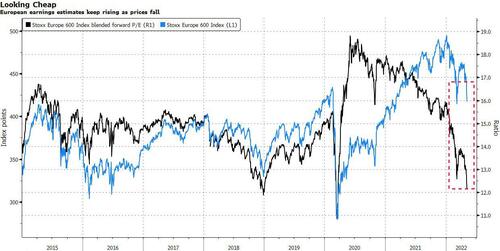

While the first-quarter results season has led to upgrades of Stoxx 600 estimates, signs of cracks are starting to appear, with companies finding it harder to mitigate cost pressures that will only become more acute. So while a combination of rising profit forecasts and falling share prices means European stock valuations have fallen by 22% this year, their cheapness may not last, according to Citigroup strategists.

“The bottom-up consensus forecast for 13% European EPS growth this year seems too optimistic in our view,” say the strategists led by Beata Manthey, seeing the trend in earnings as “unsustainable.”

Manthey expects earnings per share across the region to rise about 3% in 2022, which would imply some big downgrades ahead. EPS forecasts in cyclical and consumer sectors look most vulnerable, she says. Citi isn’t alone. “We think margin risks are building for European equities,” say Morgan Stanley strategists including Ross MacDonald, citing negative EPS versus sales revisions, a lead indicator for margins.

So far, corporates have been able to pass on rising costs to customers, keeping margins at record highs. but as expenses continue to soar, it might become more difficult to do so without hurting demand. MacDonald says risks look more acute for household products, tech hardware, construction materials and semiconductors.

Still, Europe is at least faring better than other regions. A bigger weight of commodity stocks has helped, but even excluding energy and miners, corporates have mostly beaten estimates, and by a wide margin.

According to Deutsche Bank strategists led by Bankim Chadha, European earnings have been 17.5% above consensus this earnings season, due to strength in financials, energy, consumer discretionary and materials.

The bottom-up consensus for EPS in the second quarter, the full year and 2023 has risen in Europe since the season started, while falling in all other regions, Chadha says, also pointing to sales growth near record levels.

Tyler Durden

Tue, 05/10/2022 – 09:21