With Nickel Trading Broken, Goldman Quietly Makes A Market $25K by $37K As LME’s Chief Throws Banks Under The Bus

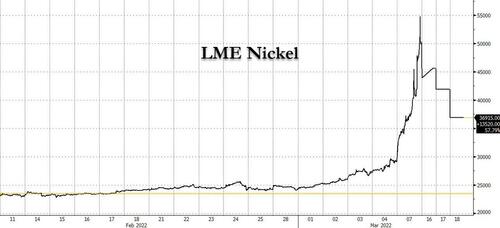

A consortium of banks led by JPMorgan may have succeeded in bailing out Chinese commodity giant, Tsingshan Holding Group, which two weeks ago was facing a potentially terminal margin call of $8 billion forcing the Hong Kong (read China)-owned London Metals Exchange to halt trading and undo billions in trades to avoid putting China’s “big shot” nickel tycoon Xiang Guangda out of business, but that doesn’t mean that nickel trading on the LME is back to normal. Far from it: indeed: nickel has traded chaotically on the LME since it kinda, sorta reopened on March 16 after a 9 day trading halt, only to immediately halt again limit down, and then again and again, on three consecutive sessions…

… forcing the LME to expand its daily halt limit, first at 8%, then to 12% and finally to 15%.

However, Nickel still has a ways to drop now that any pressure on Tsingshan to cover its massive short is gone (courtesy of liquidity guarantees from JPMorgan and others), and thus any attempts to force a squeeze are over, and as the LME price seeks to catch down to the nickel price in Shanghai – currently around $30K per ton – where trading was not suspended and where no traders received preferential treatment as they diligently paid their massive margin calls. All of which means that nickel, which on Friday closed limit-down at $36,915 a ton on the LME, has another 20% to drop to catch down to the Chinese nickel price.

The LME’s shocking inability to do its one main duty – which is to allow price discovery, not to bail out preferential clients – has meant that nickel traders, from commodity producers, to rabid speculators, to fabricators of downstream products such as stainless steel, have been frozen out of a market where there has been a price vacuum for nearly two weeks.

It’s also why enterprising banks such as Goldman Sachs have quietly taken advantage of this opportunity to step into the broken market and offer to trade nickel away from the London Metal Exchange, Bloomberg reports: the bank has been offering to trade contracts in commodity index products, such as the S&P GSCI, whose constituents include nickel.

Of course, Goldman stepping in to provide liquidity when the entire market is shut won’t come cheap, and Goldman’s traders are bidding Nickel at $25,000 a ton, and offering it at $37,000 a ton, roughly $5K on either side of the SHFE Nickel price which closed just under $30K/ton on Friday. It also means that Goldman can make as much as $12K per ton with just one trade, an truly historic commission. The mid-point of Goldman’s bid and offer, $31,000 a ton, is roughly where some traders expect the market to unfreeze, Bloomberg reported earlier.

Meanwhile, with his exchange’s reputation below rock bottom, the embattled boss of the London Metal Exchange decided to throw others under the bus too – not just Putin – and said the banking industry bears “some responsibility” for the conditions that led to a massive short squeeze that broke the nickel market.

According to LME outgoing CEO Matthew Chamberlain, banks last year lobbied against efforts to increase transparency in metals markets; the proposed changes would have allowed the LME to crack down on the large short position held by Tsingshan Holding Group Co. before it caused an unprecedented 250% price spike last week, he said.

He may have a point: while Tsinhshan boss Xiang Guangda has a short position of over 150,000 tons, only 30,000 tons of it is held directly on the exchange. The remainder is held via bilateral, “over-the-counter” deals with banks led by JPMorgan Chase, and including BNP Paribas SA, Standard Chartered Plc and United Overseas Bank, Bloomberg reported.

“The OTC position has caused significant problems for the exchange,” Chamberlain said on Friday in a Bloomberg interview. After the LME made a proposal last year to allow the exchange greater visibility of positions held on the OTC market, “it was rebuffed by a number of banks,” he said. “I don’t think we will allow it to be rebuffed again.”

Chamberlain has called for greater regulation of the over-the-counter commodity markets, comparable to measures taken elsewhere in the wake of the global financial crisis in 2008.

“There will now need to be a mature discussion about how the impact of the OTC market on the exchange can be more properly controlled,” he said. “It’s probably a similar discussion to what we’ve seen post-financial crisis in other asset classes. That really hasn’t been applied to commodities. Maybe that needs to be done”

Of course, Chamberlain doesn’t really care if traders abandon the LME after the nickel fiasco (and after the humiliation his exchange experienced, that wouldn’t be a shock) – in January he announced he is leaving the LME to take on a new role at a blockchain startup. In the interview, he refused to say if he would still leave the LME at the end of April as planned.

The LME, which since 2012 has been owned by Hong Kong Exchange & Clearing Ltd., is the ultimate decision maker on changes to its rules. But it must consult with market participants, and generally strives to keep its core members, which include many big banks, happy. The proposal for greater transparency for over-the-counter positions last year came at the same time as the LME was facing an outcry from users over a proposal to close its open-outcry trading floor, “the Ring,” from which it later backed down.

Chamberlain has faced furious criticism from users for the exchange’s decisions over the past two weeks, after it allowed nickel prices to skyrocket to more than $100,000 a ton, then suspended trading and retroactively canceled $3.9 billion of trades. The restart of nickel trading since Wednesday has also been hit by a series of glitches in the electronic market.

Chamberlain was quick to find guilty parties there too: he blamed the misfiring electronic market on “a bug in the underlying third-party software,” and said that if the LME had waited for all such issues to be ironed out it would have further delayed the market’s reopening.

Still, he acknowledged that the exchange would have “a huge amount of work” to do to regain the trust of investors. “I don’t in any way want to understate the understandable anger. I fully understand why people feel that way.”

Tyler Durden

Sat, 03/19/2022 – 14:00