EM Assets Hit By Negative Macro Backdrop Amid Trump’s Expected Tariff Flurry Sparking Strong Dollar

A Republican sweep has been priced into core markets – stronger US equities, higher Treasury yields, and a more robust dollar – largely pressuring emerging market equities and currencies lower. This time, President-elect Trump is expected to hit China with a barrage of tariffs early in his administration.

Given tariff risks and trade uncertainty, emerging market equities have been sliding as Trump’s projected protectionist trade policies, higher rates, and stronger dollar imply a negative macro backdrop for EM assets.

On Thursday, Bloomberg’s Sebastian Boyd published a list showing Trump’s tariff risks and trade uncertainty represent a negative growth hit for the rest of the world…

-

President-elect Donald Trump’s campaign promises suggest that second-term tariffs may be very different from those in his first term — broader, steeper. Their impact will be complex and much will depend on how other countries and the EU respond. But we can extrapolate from history and make some assumptions.

-

First, tariffs aren’t close to priced in yet. If Trump proceeds with what he’s vowed to do, we will see steep declines in emerging-market stocks and currencies. Equities in more developed countries will also fall, especially in Asia. Health- care stocks and US financials seem to be the best place to shelter.

-

Tariffs are an inflationary tax on US imports. They push up prices, but also inflation expectations and Treasury yields. They will have negative effects on US companies and consumers, but we can assume that they will be tailored to minimize those effects.

-

The impact of tariffs, even highly tailored ones, is likely to be strongly negative outside the US. After tariff announcements in Trump’s first term, the dollar gained and emerging-market currencies and stocks fell, steeply in some cases. And the negatives rolled out beyond just the targeted countries and industries.

-

However, retaliatory tariffs from other countries may also be targeted to produce maximum inconvenience for the US, especially in industries like soy-farming that are strong in Trump-voting areas.

-

Trump’s early experiments with taxing imports were gradual. He started with solar panels and washing machines. Then in March 2018, he imposed tariffs on steel and aluminum from a list of countries which he later expanded.

-

To measure the impact of those tariffs, I merged the S&P 500, Stoxx 600, MSCI Emerging Markets and MSCI Asia Pacific indexes, then removed the smallest 10% of companies by market capitalization, to create a universe of more than 2,000 names. I then measured share-price performance for the three- and six- month periods starting on the last day of February 2018.

-

Chinese stocks saw steep losses. There are more than 400 Chinese stocks in my sample, and 38 of 59 industry sub-sectors fell in the first six months amid concerns that the trade war would widen. Chinese retailers and automakers were among the worst-affected, with a median decline of more than 30%, while apparel & textile products and medical equipment & devices escaped.

-

There was a lot of collateral damage. In the interests of legibility, the chart above shows the 15 largest countries in our sample. Elsewhere, Turkish stocks fell a median 52% in the six months through August 2018. South Africa and Indonesia also had steep losses.

-

In April 2019, Trump threatened a tariff on cars made in Mexico. In June, he backtracked, claiming the threats had worked. In the meantime though, the median loss on Mexican stocks was 16%. The median US stock in the sample slid 0.9%. The S&P 500 oil & gas index fell 10%.

-

At the start of May that year, Trump’s administration announced tariffs on $200 billion of Chinese goods. This time the impact was more limited than it had been in 2018. Over the next three months, Chinese stocks fell a median 7.8%, then bounced back to eke a median 0.6% over a six-month period.

In a separate note, Goldman’s Tadas Gedminas and Teresa Alves told clients last week…

- This time around our expectation is that tariffs against China could be implemented relatively early in the administration, which would likely pose a challenge next year. But our prior work suggests that the market struggles to price this risk ahead of time, with most of the tariff-related price response taking place around actual announcements (as was primarily the case for CNH). This suggests that the market could still maintain the latest price action despite prevailing risks.

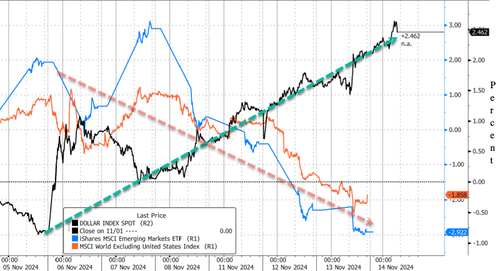

Since last Tuesday, the dollar has reigned supreme, while emerging markets and global stock ex-US have slipped into negative territory.

EM asset underperformance will persist as long as the dollar remains strong.

Tyler Durden

Thu, 11/14/2024 – 07:45