McMaken: Congress Should Fire Jerome Powell

Authored by Ryan McMaken via The Mises Institute,

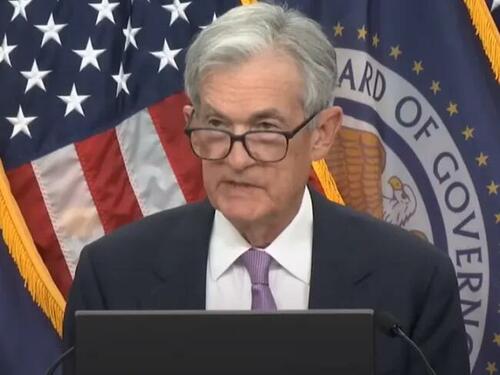

There were a few seemingly tense moments at the FOMC press conference on Thursday when two reporters asked Jerome Powell about the prospect of Donald Trump asking Powell to resign.

The first reporter asked “would you resign if asked to do so by Donald Trump?”

To this, Powell responded with a resounding “no” followed by silence.

A few moments later, Powell was asked by another reporter if it was lawful for Trump to either remove or “demote”—that is, remove Powell as chairman, but leave him on the Board of Governors—Powell.

To this, Powell responded with a forceful “not permitted under the law.”

Apparently, Powell wished to leave no ambiguity whatsoever about this position that he cannot be removed or demoted by a sitting president.

It would agree that the spirit of the law here is that a president not be able to remove a Fed chairman, except for some kind of misconduct. But, ambiguity remains. Even Alan Blinder, a proponent of the myth of “Fed independence,” admits that in the world of political reality, Trump could potentially remove Powell:

Experts who spoke to ABC News acknowledged that some legal ambiguity looms over what type of conduct warrants sufficient cause for removal, but they said a policy dispute is unlikely to meet such a standard. Still, Trump could attempt to push out Powell and test how courts interpret the law, experts added, noting that the case could end up with the conservative-majority Supreme Court.

“Trump could try and he might try,” Alan Blinder, a professor of economics at Princeton University and former vice chairman of the Federal Reserve. “It’s very unlikely that he has that authority, but if he takes this to the Supreme Court, I don’t know what to think of the Supreme Court.”

Instead, Trump could leave Powell in his position on the Fed’s 7-member Board of Governors but demote him from his role as chair, Blinder said.

“That’s a subtle question that has never been tested,” Blinder said, acknowledging a lack of clarity about whether it would be allowed. “We can’t answer that quite as definitively.”

In any case, Trump would likely have to expend some serious political capital if he wants to remove Powell via presidential power.

Yet, Powell’s defiance ought to provoke us to ask why wealthy, pampered, out-of-touch technocrats like Jerome Powell get to act like their removal constitutes some sort of transgression. Central bankers are just bureaucrats, and their removal ought to be regarded with no more trepidation than the removal of an undersecretary of agriculture.

Congress Should Fire Powell, and Not Stop There

Regardless of what Trump’s legal powers may be, it is clear that Congress has the power to remove Powell, just as Congress has the power to abolish the central bank altogether.

The Congress ought to abolish the Fed entirely, of course, but if members lack the stomach for that heroic act, Congress can begin with amending the Federal Reserve Act to make it clear that the chairman of the Fed is not a Holy Person, untouchable by the mere mortals who are actually elected to run the federal government. There are many ways Congress could approach this issue. For example, Congress could rewrite the law to allow Congress to remove the Fed chairman with a majority vote in either house. It doesn’t really matter, so long as central bankers get the message that they’re not special.

While Congress is at it, it could make a few other crucial changes as well. Congress should prohibit the Fed from buying any assets of any kind. This would end the Fed’s habit of buying up mortgage-backed securities and government securities to prop up the banker class and Powell’s buddies—i.e., Janet Yellen—at the Treasury. It would also end the Fed’s ability to manipulate interest rates since the Fed’s main tool here is its “open market operations.”

A second key change that is very necessary is removing the Fed’s so called “dual mandate.” As the Fed likes to often mention, the Fed has a dual mandate of both “stable prices” and “maximum employment.” Congress should immediately abolish the mandate for “maximum employment” because the only purpose this has ever served has been as an excuse for the central bank to inflate the money supply. As is abundantly clear from Fed press conferences and publications, the Fed routinely justifies its dovish policy in terms of fulfilling its mandate to maximize inflation. That is, the Fed often says something to the effect of “we’re embracing easy-money policy because our dual mandate to maximize employment says we have to.” Congress should just delete the mandate.

(By the way, the Fed actually has a third mandate. It’s to ensure “moderate long-term interest rates.” Getting rid of the Fed’s power to purchase assets probably nullifies this mandate in any case, but Congress might as well remove any doubt and totally prohibit the Fed from manipulating interest rates of any kind.)

Fed Independence Has Never Been Used for Good Things

Of course, if Congress were to attempt any of this, Fed simps in the media and in Congress will try to talk about how such things are unprecedented and we must respect “Fed independence.” Media stories in the Fed often claim that attempts by elected officials to rein in Fed technocrats violate “long-standing norms” that respect Fed independence.

This is a fantasy version of history. There is not now, and there has never been, any such thing as Fed independence because the Fed always willingly helps the regime get what it wants.

Early on, Fed independence didn’t even exist in theory, and was explicitly limited in law. Prior to 1935, the Comptroller of the Currency and the Secretary of the Treasury sat on the Fed’s Board, thus ensuring a direct line from the White House to the Fed.

In 1933, of course, Franklin Roosevelt issued an executive order abolishing the gold standard and ordering the Fed to turn over all its gold to the Treasury. So much for “Fed independence” under the Left’s favorite twentieth-century president.

Even after 1935, it was understood that the Fed would always assist the Treasury with funding whenever necessary. This again became obvious during the Second World War when the Fed essentially helped launder funds for the war effort. The Fed agreed in 1942 to peg interest rates on government securities. The Fed also engaged in a variety of price control measures and regulations designed to assist the White House.

Only since the Monetary Accord of 1951 has there been a de jure nod to giving the Fed autonomy on policy. The Fed has never used any of this alleged autonomy to do anything good, however. We’ve seen this proven countless times since the Fed has always gladly done its part to ensure the Treasury gets what it wants. From the Fed’s efforts to finance federal deficits in the 1970s, to the Plaza Accord in 1985, and to the flood of easy money since 2008, the Fed has never used its so-called independence to actually rein in federal profligacy.

What Matters to the Fed Is Protecting the Banking Class

Central bankers have never cared about Fed independence as a way of limiting state power.

According to its own historical narrative, the Fed has now allegedly been “autonomous” for sixty years or more. Has inflation and federal spending been more restrained during that time? Obviously not.

The Fed has always and everywhere been happy to enrich the state, regardless of whatever levels of self-governance it might achieve.

The real reason the Fed wants more independence is so the Fed can also more easily enrich the banker class while also making the Treasury happy. That is, the banking cartel that works hand in glove with the Fed cares deeply about having control over who gets onto the Board of Governors and who gets to be chairman. The elite bankers are perfectly willing to effectively serve the Treasury so long as the cartel gets to have its own people in charge. This is how the banker class ensures that its monopolistic powers are protected, the competition is crushed, and the bailouts are guaranteed.

If the Fed pushes back against the elected government, it’s only if the priorities of the elected government conflict with the Fed’s priority, which is serving the interests of the banker class. Experience makes it abundantly clear that central bankers are fine with endless price inflation. But, the Fed wants to inflate in a way that most suits the Fed and the banking cartel. That’s why Powell and the Fed are so opposed to the idea of being removed from office. There is no higher principle here. There is only power.

Tyler Durden

Wed, 11/13/2024 – 06:30