The Great Freight Recession Is Officially Over

By Craig Fuller of FreightWaves

I’ve been closely following the freight market, and it’s clear that the Great Freight Recession has ended. After the most prolonged freight recession in history, the market has been showing signs of recovery over the past few months. This shift is backed by SONAR data, confirming a market turnaround.

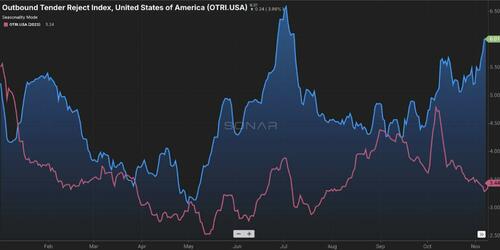

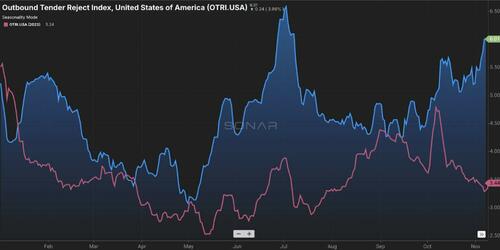

Tender rejections rising: The increase in tender rejections to over 6% signals that the market is tightening. After seeing rejections dip to 3.4% post-Labor Day last year, this change indicates that carriers now have more control in choosing which loads they accept, thus shifting market dynamics in their favor.

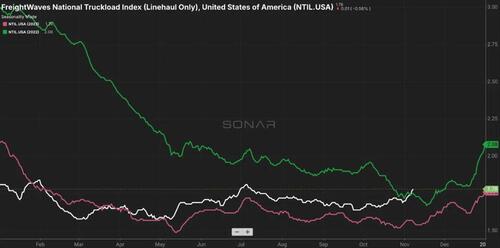

Spot rates increasing: Spot rates are also climbing, surpassing those of 2022 and 2023, which tells me there’s either a surge in demand or a decrease in available capacity, possibly both. This could catch many expecting the low rates to persist off guard. Truckload rates are up to $1.78 from $1.54 a year ago.

Carrier revenge could be coming next year: “Carrier revenge” implies that carriers, after a period of low rates and high competition, might leverage their position to negotiate better rates or reject tenders more selectively in the coming months, affecting shippers’ logistics strategies, especially routing guides.

Decreasing capacity: Speaking of capacity, the upcoming implementation of the FMCSA’s Clearinghouse-II regulations on Nov. 18, 2024, will have a significant impact. Trucking expert Adam Wingfield stated that 177,000 truck drivers could potentially lose their CDLs, further tightening the market as state agencies need to query the Clearinghouse for any licensing actions.

In less than two weeks, approximately 177,000 drivers will have their CDLs revoked due to being in the “prohibited” status in the clearinghouse.

Drivers, make sure to check your clearinghouse status and if you are in a SAP, be sure you are properly set for RTD before the…

— Adam L. Wingfield 🚛👨🏾💻 (@adamlwingfield) November 7, 2024

This regulation requires:

- State Driver Licensing Agencies (SDLAs) to remove the commercial driving privileges of drivers in a “prohibited” status in the Clearinghouse. This action will result in a downgrade of the Commercial Driver’s License (CDL) until the driver completes the return-to-duty (RTD) process.

- SDLAs must query the Clearinghouse before issuing, renewing, upgrading, or transferring CDLs and Commercial Learner’s Permits (CLPs). This step ensures that drivers with unresolved drug or alcohol violations are not allowed to operate commercial motor vehicles.

Political influence: Trump’s election could accelerate freight demand as policy changes could stimulate economic activity, increasing the need for freight services. This includes income and corporate tax cuts, bonus depreciation, pre-stocking for tariffs, investment in domestic manufacturing and the change in freight dynamics from containers to surface (trucking, rail and domestic warehousing).

Immigration deportation: According to the Bureau of Labor and Statistics, 20% of truck driver employees are immigrants. While many of these are legal immigrants into the U.S., there are numerous reports of drivers using international driver’s licenses and fake documents to drive in the U.S.

It is hard to know the percentage here, as the data is sparse (after all, the undocumented workers would not admit it). Having been around the industry, any opportunity to game the system will undoubtedly be used. Are undocumented workers 1% of the population of immigrants or 10%?

I don’t know, but if Trump follows through with his threats of deportations, this could remove some percentage of the trucking industry’s excess capacity and make it harder for carriers that skirt the law to stay in business.

Current sentiment: Following a decisive election, I believe the freight market is recovering and might exceed expectations over the next year.

Don’t rely on lagging data: The current conditions in the freight market have been debated extensively, but with the volatility of freight, it is imperative to make decisions based on the freshest and most accurate data. This can only be accomplished with high-frequency data that offers real-time insights into market direction. SONAR’s high-frequency data is refreshed data and offers real-time supply and demand metrics with the most accurate spot and contract data in freight.

This scenario points towards a robust recovery in the freight market, potentially leading to higher freight rates, a shift in power dynamics between shippers and carriers, and an overall more vibrant market environment.

Shippers are advised to prepare for these changes by locking in rates or diversifying their carrier base to mitigate risks associated with routing guide breakdowns.

Tyler Durden

Sun, 11/10/2024 – 14:00