Trump ‘Sweep’ Boosts Crypto: Bitcoin Tops $80K, Ethereum Bigger Than BofA

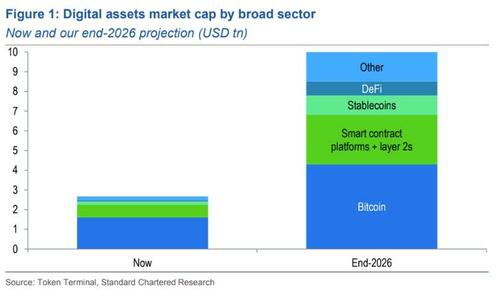

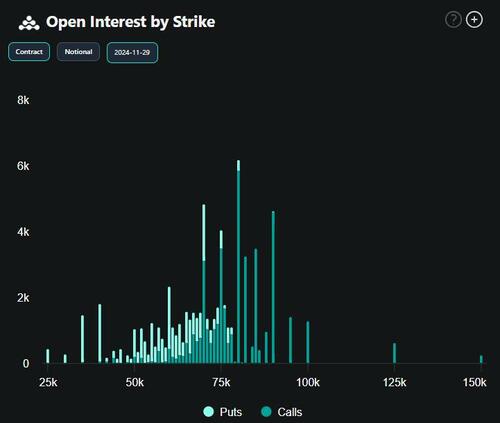

The Republican sweep is the best outcome for digital assets, bringing regulatory and other changes, with Standard Chartered projecting this to drive total crypto market cap to USD 10tn by end-2026 from USD 2.5tn now.

Specifically, StanChart expects the new administration to follow through on the Trump campaign’s proactively positive stance towards digital assets. Furthermore, any changes are likely to come relatively early in the administration to take advantage of Republican control of Congress before the midterm elections in November 2026. We expect the following specific developments:

1. Repeal of SAB 121. SAB 121, an SEC guidance document on digital assets, requires entities that act as custodians for crypto assets to list the assets on their balance sheets and create a corresponding liability of equal value. In effect, this blocks US banks from crypto custody and spot offerings. The removal of SAB 121 is expected to pave the way for further adoption of digital assets by institutional investors.

2. Passage of stablecoin bills. Stablecoins are becoming an important real-world use case for digital assets. Three significant bills aiming to create guardrails for banks to issue stablecoins were brought to the House over the past 12 months, but little progress was made. More progress on this is likely under the Trump administration in early 2025. This should pave the way for the expansion of this use case, further validating the asset class as a whole.

3. Changes at the SEC. The SEC has taken a firm stance against digital assets under current Chairman Gary Gensler. It has brought court cases against Ripple (wherein it suggested that the majority of digital assets are securities) and Grayscale; it was also initially slow to approve spot ETFs. Trump explicitly stated during his campaign that he would replace Gensler.

4. Potential for a Bitcoin reserve fund. Although this is currently a low-probability event, Trump mentioned in July that he would keep any Bitcoin held by the government (210,000 BTCs at the time), so it needs to be kept in mind. Such a move would have a large price-positive impact on such a small asset class.

The U.S. president-elect made cryptocurrency a key part of his campaign this year, promising to protect and boost the industry in America and end the SEC’s crypto crackdown.

Trump had also proposed to develop a strategic Bitcoin reserve and appointing pro-crypto regulators.

Bitcoin topped $80,000 for the first time in history overnight, now up over $10,000 since the election night blowout by Trump.

Source: Bloomberg

Bitcoin ETFs have seen massive inflows in the days since the election…

Source: Bloomberg

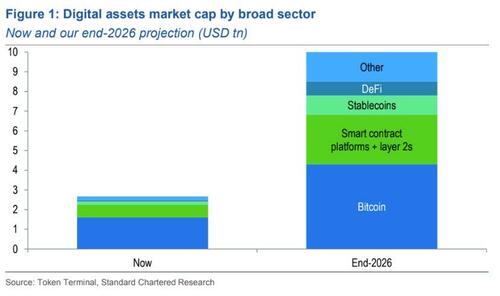

As Standard Chartered’s Geoffrey Kendrick points out, the 80k level is the first large open interest level for BTC calls for the 27 Dec expiry: open interest of 8110 BTC, as per this chart from Deribit:

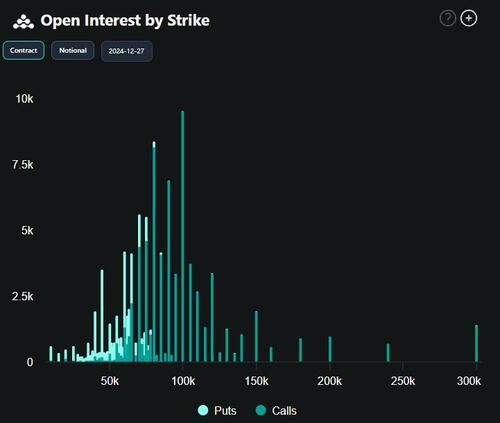

There is also open interest of 5851 BTC at the 29 Nov expiry, as per this chart (again the 80k level):

Beyond 80k these charts show large open interest at 90k, of 4584 BTC for 29 Nov and 6833 BTC for 27 Dec. For the psychological 100k level, the 27 Dec expiry has a large 9461 BTC in open interest.

Kendrick’s forecast also fits with the lagged response to the recent surge in global money supply…

Given current momentum post-election, Kendrick thinks this means 90k becomes the next target, easily achievable ahead of 29 Nov. And then 100k, easily achievable ahead of 27 December. 125k which I forecast for the end of the year is the next level, although I note following the 2016 election a lot of Trump trades peaked around the time of the 20 Jan inauguration (see USD-MXN chart for example).

So if BTC can’t reach 125k by 31 Dec I think it will by 20 Jan. The only other relevant date is 10 December, which is when the Microsoft board is due to vote on whether they will invest in BTC (let’s call that a low probability yes, high impact yes, if they voted to go ahead).

Crypto Rover, for instance, cited Bitcoin’s tendency to establish record highs “50-60 days after the US elections,” noting that the price could reach $100,000 by January 20245 if the fractal plays out as intended.

Source: Crypto Rover

“In the last few days 60,000 BTC were bought by retail investors, 1800 BTC was bought by BlackRock, at the same time only 450 Bitcoin are mined each day and only two million BTC are available to buy on exchanges,” argued analyst Doctor Profit, adding:

“If we continue in this speed we will reach $100,000 by end of year.”

Medium term, Kendrick thinks what we have seen over the past few days continues with BTC to 200k and ETH to 10k by year-end 2025.

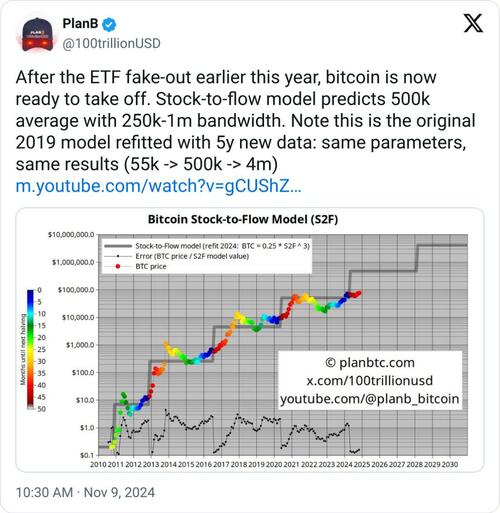

Further out, Bitcoin analyst PlanB’s stock-to-flow model now projects a $500,000 price target for the asset within the next four-year cycle based on the model’s historical data and pattern.

PlanB pointed to Trump’s proposal to create a national BTC reserve as a potential driver for demand, suggesting it could add “200,000 BTCs per year” in buying pressure.

“If history is any guide, if the stock-to-flow model is any guide, then we’ll see sharp price increases from here,” the analyst said.

The stock-to-flow model, which assesses Bitcoin’s value based on its limited supply and scheduled halvings, suggests substantial price growth after each halving event.

While the analyst anticipates BTC price reaching $500,000 in this cycle, he notes a wide variance between $250,000 and $1,000,000 per BTC.

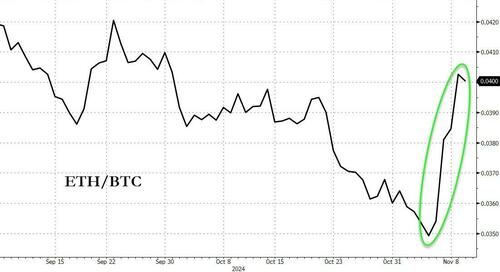

It’s not just bitcoin, Ethereum, the second-largest cryptocurrency by market capitalization, topped $3200 – its highest since August – pushing its market cap to around $383 billion (roughly $40 billion above Bank of America’s market cap).

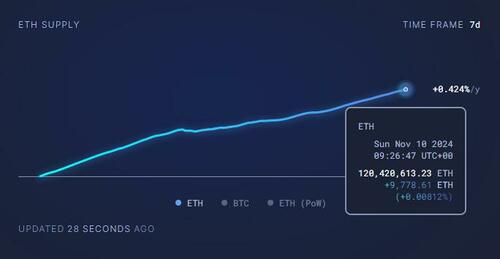

ETH has witnessed its greatest weekly price action since May even as, over the last seven days, ETH supply has been quickly increasing, at an inflationary rate of 0.424% a year – previously deflationary in early-to-mid October.

According to Ultrasound.money data, the current yearly ETH burn rate sits at 452,000 ETH, while the issuance rate is more than double that at 957,000 ETH, resulting in an annual supply increase of 0.42%.

Meanwhile, Vitalik Buterin, the co-founder of Ethereum, introduced the concept of “info finance” on Nov. 9.

Buterin explained that info finance is “a discipline” that begins with “a fact that you want to know” and ends with a market that “optimally” elicits that information from market participants.

The ETH co-founder advocated for prediction markets to collect insights from the community about future events in a way that offers public expectation without media sensationalism or influence.

Finally, as BitcoinMagazine.com reports, historical price analysis suggests that Bitcoin’s current trajectory is strikingly similar to previous cycles. From its lows, Bitcoin usually takes around 24-26 months to break past previous highs. In the last cycle, it took 26 months; in this cycle, Bitcoin’s price is on a similar upward trajectory after 24 months. Bitcoin has historically peaked about 35 months after its lows. If this pattern holds, we may see significant price increases through October 2025, after which another bear market could set in.

Following the anticipated peak, history suggests Bitcoin would enter a bear phase in 2026, lasting roughly one year until the next cycle begins anew. These patterns aren’t a guarantee but provide a roadmap that Bitcoin has adhered to in previous cycles. They offer a potential framework for investors to anticipate and adapt to the market.

Similar timeframes for new highs, cycle peaks, and lows over the previous cycles.

Despite challenges, Bitcoin’s four-year cycle has endured, largely due to its supply schedule, global liquidity, and investor psychology.

Tyler Durden

Sun, 11/10/2024 – 14:35