US Working Poor Hit By “Weaker Credit Metrics & Mixed Confidence” As Black Friday Nears

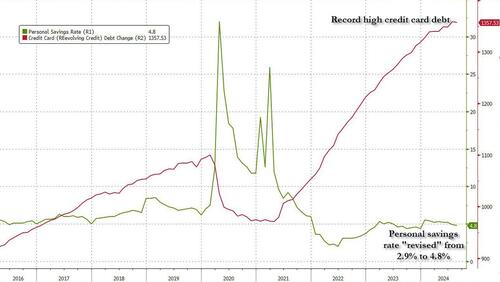

Low-tier consumers are still stuck in a death loop of elevated inflation and high interest rates, unable to afford modern life while racking up insurmountable credit card debts and draining personal savings.

Goldman’s Kate McShane and Mark Jordan sent clients a note on Monday morning providing a snapshot of the overall health of lower-tier consumers.

They found that the health of the lowest-income consumer remains “mixed.”

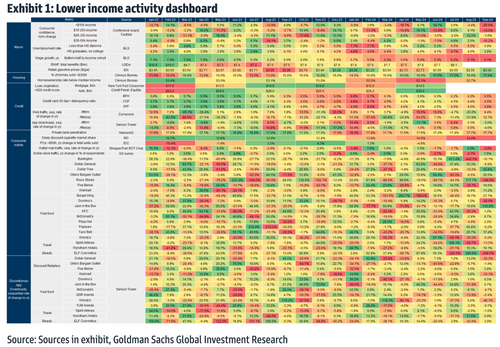

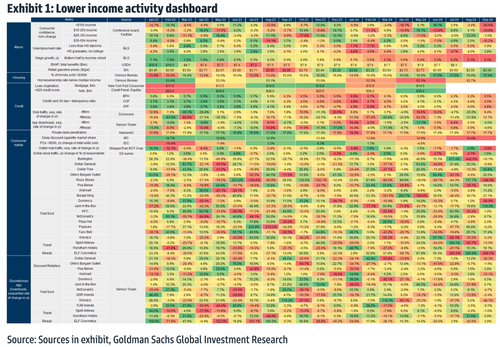

Our lower income activity dashboard analyzes a wide range of data across macro, industry, and higher frequency sources (e.g., app downloads, web traffic, and store traffic) in an effort to evaluate the health of that consumer cohort. We observe that monthly trends that reflect the health of the lower income consumer (defined as households that earn <$30K annually) are indeed mixed, with a possible tailwind coming from lower gasoline prices and improved employment trends and likely offset with headwinds from weaker credit metrics and mixed consumer confidence, while engagement trends reflect a wide range across discretionary retailers.

Overall, the data set suggests a relatively consistent backdrop for the lower end consumer from last quarter with discretionary spending remaining selective. Based on recent earnings commentary, several companies have noted that while the consumer has remained strong, there has been a slight softening/moderation and trade down in consumer demand in Q3 from the lower income consumer.

In aggregate, the consumer might seem alright—especially with the rebound in The Conference Board’s consumer confidence in October. However, many low-income households are plagued with insurmountable credit card debt and drained personal savings—just to afford Biden-Harris’ inflation storm.

The Goldman analysts also highlighted plans surrounding Black Friday for big box retailers, including Walmart, Best Buy, and Target.

BBY: Starting Black Friday Deals a little later than 2023

Starting November 8th, BBY will be releasing early Black Friday deals, with savings on top technology items such as small appliances, TVs, smart home devices, etc. This is 9 days later than 2023. New doorbuster deals will drop every Friday from November 8th to November 20th, with BBY Plus and Total Members gaining early access to the deals every Thursday. BBY’s main Black Friday Sale will occur November 21st to November 30th (1 day longer than last year), bringing thousands of new deals on top brands, including the previous doorbuster deals that dropped earlier that month. Their Cyber Monday sale occurs from December 1st to December 2nd, where shoppers can save up to 50% on top gifts.

Compared to 2023: 2024 Black Friday deals appear to be starting later versus 2023. Last year, Best Buy announced on October 17th its schedule for the holiday season. From October 27th through October 29th, Best Buy members receive early access to Black Friday deals. Starting October 30th, early Black Friday deals will be made available for everyone. November 17th through November 25th, Best Buy will have its official Black Friday sale. The company will end the month with a Cyber Monday event November 26th and 27th.

TGT: Introducing Deal of the Day for 2024 for Target Circle Members v. Deal Weeks only in 2023

From November 1st to December 24th, TGT is launching its “Deal of the Day” program, where Target Circle members have access to one-day deals where select products are up to 50% off. In addition to daily deals, TGT will also be dropping weekly-long deals every Sunday, starting November 3rd. TGT will also have their early Black Friday Sale from November 7th to November 9th, with thousands of new deals on apparel, accessories, toys, kitchen products, bedding, and more.

Compared to 2023: Target announced on October 27th that it is kicking off the holiday season with four weeks of deals. The first week of deals became available Sunday, October 29th and goes through Saturday, November 4th. Each week will feature new deals for customers.

WMT: Similar to 2023 with a slightly later start; discounting WMT+

WMT announced its Black Friday event schedule, which will be broken down into three dates (WMT broke its schedule down into 3 parts last year as well): Event 1 deals will begin November 11th, Event 2 deals will begin November 25th, and Cyber Monday deals will begin December 1st. Walmart+ members will have access to the deals a few hours earlier than regular customers, with some Black Friday deals appearing exclusively only on Walmart.com and the Walmart app. WMT also announced that starting from October 28th to December 2nd, customers can purchase a one-year annual Walmart+ membership for 50% off, to a reduced price of $49/year. This year, WMT is also using GenAI to transform users’ shopping experiences, as the AI tool will offer a more personalized Walmart experience, catering the website based on their predictions of what holiday-related deals customers would want to see. To promote their Black Friday event, WMT is also launching a 10-chapter Deals of Desire advertisement series, where famous actors will advertise WMT’s most sought out Black Friday deals, all while creating drama entertainment to evoke excitement amongst customers.

Compared to 2023: Walmart announced on November 1st that the company is breaking its Black Friday roll out into three events. Event 1 deals begin online Wednesday, November 8th at 3pm ET and continue in stores Friday, November 10th. Walmart+ early access runs 12-3pm ET on Wednesday November 8th. Event 2 begins online Wednesday, November 22nd and in store on Friday, November 24th. Walmart+ early access runs 12-3pm ET on Wednesday November 22nd. Walmart also announced that it will end the month with a Cyber Monday event on November 27th.

Overall, the report suggests cautious optimism for low-tier consumers in response to mounting macroeconomic pressures. This theme has been well in play since early Summer.

Also, looking ahead, spending data from Black Friday and Cyber Monday will provide critical insights into consumer health before the Christmas shopping season begins.

Consumers aren’t too thrilled about spending more and receiving less. #inflation….

Tyler Durden

Tue, 11/05/2024 – 13:20