Yields Slide After Solid, Stopping Through 10Y Auction

On a normal day, the 10Y auction tends to be one of the biggest market events of the week especially when it is the once-in-a-quarter refunding auction. Not today however, because everyone’s attention is far more focused on today’s election result and the sheer collapse in market liquidity. Still, in a day when yields blew out as high as 4.36% after the red hot Service ISM – and a Trump victory – traders were certainly casting nervous stares at the results of today’s auction. So with today’s $42 billion refunding auction of 10Y paper in the books, this is how it did.

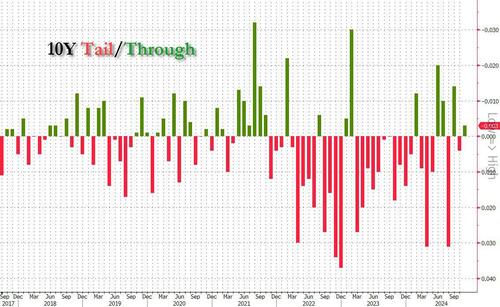

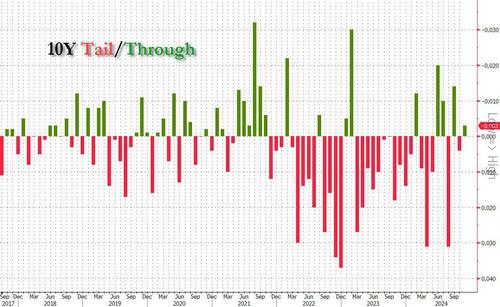

Stopping at a high yield of 4.347%, the auction yielded 28bps higher than last month, and was the highest yielding auction since June. But notably after tailing 0.4bps last month, today’s auction stopped through the When Issued by 0.3bps.

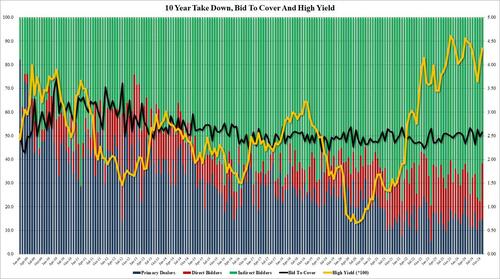

The bid to cover rose to 2.58 from 2.48 last month, and was just above the 2.53 six-auction average.

The internals were less impressive, and far weaker than last month: Indirects took down 61.7%, down from 77.6% in October and below the 71.3 six-auction average; and with Directs soaring to 23.6% from 8.4%, the highest since March 2014, Dealers were left with just 14.7%, just above the recent average of 13.5%

Overall, this was a solid, if not stellar, 10Y auction and the fact that it didn’t tail was seemingly enough to send yields about 3bps lower, from 4.345% before the auction to 4.31%, before reversing some of the drop. Of course, should Trump be declared winner, watch as this kneejerk move lower is kneejerk sharply higher once again.

Tyler Durden

Tue, 11/05/2024 – 13:32