Nvidia To Replace Intel In The Dow Jones Industrial Average; Stock Jumps

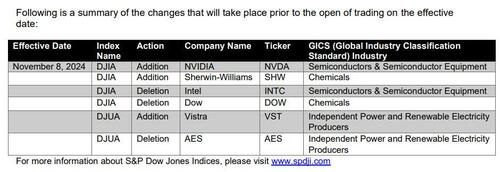

Just when it seemed that Nvidia’s recent record rally was in danger of fizzling, a Deus Ex Machina arrived late on Friday when the determinations committee of S&P Dow Jones Indices, the owner of the Dow Jones Industrial Average, announced that Nvidia would replace Intel on the Dow Jones Industrial Average (which has clearly become anything but), a shakeup to the blue-chip index that replaces a flagging semiconductor company with the primary vendor of GPUs for AI. Separately, Sherwin Williams will unironically replace one-time chemical giant (and Dow Jones eponym), Dow, Inc, in the average as well. The switch will take place on Nov. 8.

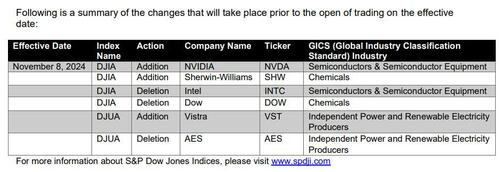

Intel shares were down 1% in extended trading on Friday. Nvidia shares rose 1%.

Nvidia shares have climbed over 180% so far in 2024 as investors bet the company has emerged as the primary beneficiary of the AI boom. The fast rise of Nvidia on the back of its data center AI processors has led it to be one of only a handful of companies with a market cap over $3 trillion, alongside Microsoft and Apple, both of which are already included in the DJIA.

Over the last five years, NVDA and The Dow look a little different but we are sure it will fit right in…

On the other hand, Intel shares have tumbled more than 50% so far this year as the company struggles with manufacturing challenges, new competition for its central processors, and the sad reality that this once glorious chipmaker has missed out on the AI trend.

The Dow contains 30 components and is weighted by the share price of the individual stocks instead of the companies total market value. Nvidia put itself in better position in May, when the company announced a 10-for-1 stock split. While doing nothing to its market cap, the move slashed the price of each share by 90%, allowing it to become a part of the Dow without having too heavy a weighting.

The switch is the first change to the index since February, when Amazon replaced Walgreens Boots Alliance. Over the years, the industrial-heavy Dow has been playing catch up and gaining exposure to the largest technology companies. With the addition of Nvidia, four of the six trillion-dollar tech companies are now in the index. The two not in the index are Alphabet and Meta.

The 30 companies that make up the DJIA currently are shown below:

- 3M

- American Express

- Amgen

- Amazon

- Apple

- Boeing

- Caterpillar

- Chevron

- Cisco

- Coca-Cola

- Disney

- Dow

- Goldman Sachs

- Home Depot

- Honeywell

- IBM

- Intel

- Johnson & Johnson

- JPMorgan Chase

- McDonald’s

- Merck

- Microsoft

- Nike

- Procter & Gamble

- Salesforce

- Travelers

- UnitedHealth Group

- Verizon

- Visa

- Walmart

Some will point out that such Dow Jones moves tend to be a bottom or top tick opportunity, and point to the August 2020 switch in the Dow Jones when Salesforce replaced Exxon. Since then XOM has more than doubled, while CRM is unchanged.

Will the Dow Jones also top-tick Nvidia this time, while unleashing a new golden age for Intel?

Tyler Durden

Fri, 11/01/2024 – 18:50