Hunt For ‘Red October’ Over As Earnings & Inflation Kill ‘Goldilocks’ Narrative

The market drifted lower on a combination of 1) disappointing tech prints (MSFT -6% & META -4%), 2) Poor liquidity (according to Goldman Sachs trading desk), and 3) Core PCE posting its biggest monthly gain since April.

Not exactly ‘goldilocks’!!

Inflation surprises are picking up post rate-cut…

Source: Bloomberg

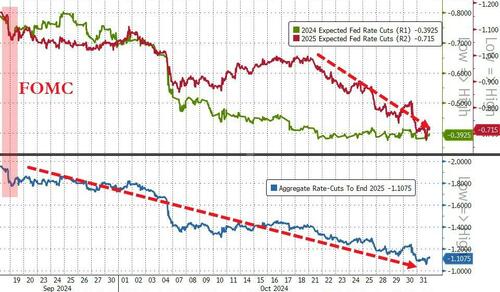

…bolstering the case for a slower pace of rate cuts…

Source: Bloomberg

Goldman’s trading desk noted that market volumes continue to be strong, +14% vs the 20dma, although S&P top of book poor compared to the start of the week.

We are better to buy as a floor (~1B net demand) led by HFs buying pockets of Tech & Industrials (net to buy across almost all sectors) + LOs buying Comms Svcs. LOs stand out as sellers of Macro Products.

A very ugly end to the month for Nasdaq smashed it into the red for October along all the other majors…

Source: Bloomberg

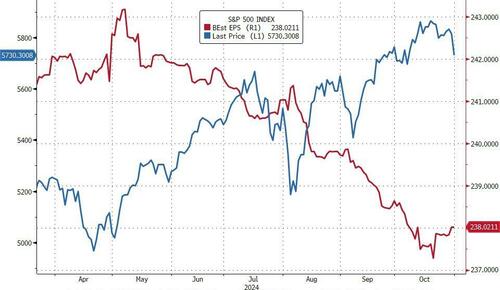

Should we really be surprised by the decline given that EPS expectations have been guided lower for the last six months?

Source: Bloomberg

Hedge funds had a fun day with losses on their VIP Longs offset by gains on their biggest shorts…

Source: Bloomberg

All the MAG7 stocks were lower today led by MSFT, META, and NVDA…

Source: Bloomberg

The basket of MAG7 stocks erased most of the month’s gains today…

Source: Bloomberg

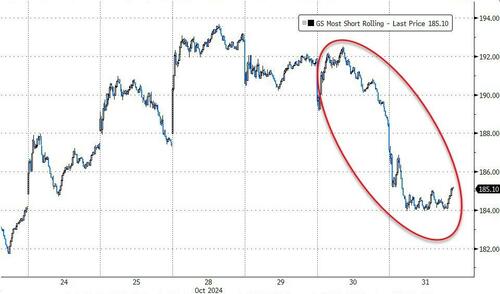

…and Most Shorted stocks shit the bed…

Source: Bloomberg

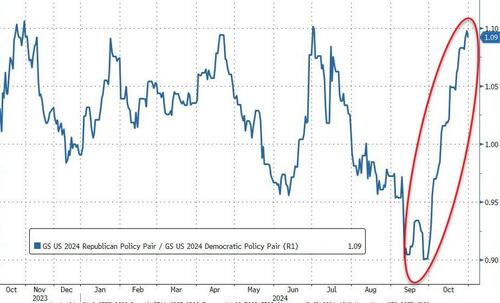

While the major indices ended red, buying “Trump” and selling “Kamala” was a huge winner in October…

Source: Bloomberg

The weakness in stocks should not come as a huge shock given the massive surge in Treasury yields we have seen this month. The belly is up almost 60bps on the month and almost 70bps since The Fed cut by 50bps…

Source: Bloomberg

The yield curve flattened significantly in October and has been flattening sicne The Fed cut, suggesting for anyone who wants to listen that fears of a policy error are very real…

Source: Bloomberg

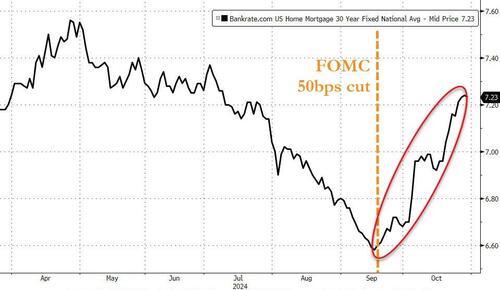

And in the mean time, mortgage rates have soared back above 7.00% in October since The Fed cut…

Source: Bloomberg

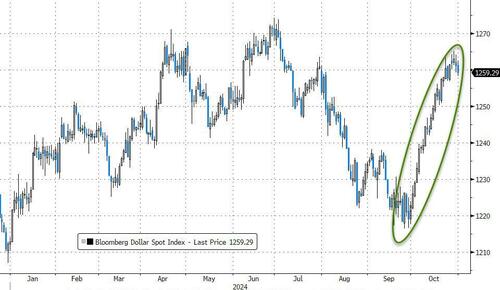

The dollar also soared in October (its biggest monthly rise since Sept 2022) having touched unchanged on the year at the end of Sept (after the rate cut)…

Source: Bloomberg

Despite the dollar strength , gold also exploded higher in October (up for the 8th month of the last 9 ) to a new record high (albeit with some weakness today). Since The fed cut rates, gold has been off to the races…

Source: Bloomberg

Quite a decoupling between the dollar and gold this year…

Source: Bloomberg

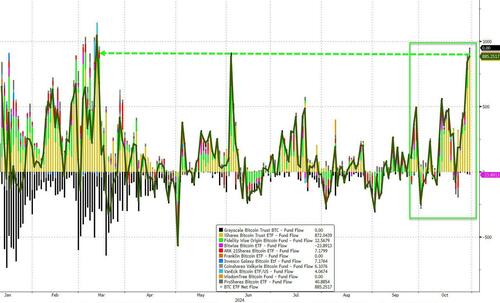

Despite a puke today, Bitcoin had a huge month (best month since May), rallying up to record highs yesterday near $74,000…

Source: Bloomberg

BTC ETF inflows have been huge in October…

Source: Bloomberg

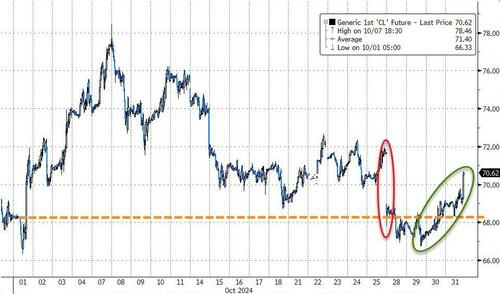

Oil prices rebounded on Israel-Iran retaliation headlines once again and that lifted WTI into the green for the month…

Source: Bloomberg

Finally, bigger picture, since The Fed cut rates, USA Sovereign risk has exploded higher…

Source: Bloomberg

Not exactly resounding support from the market.

…and brace for a structurally higher VIX…

Source: Bloomberg

…not just past next week.

Tyler Durden

Thu, 10/31/2024 – 16:00