Intel Jumps On Upbeat Guidance

Intel shares are surging after-hours on the back of what can only really be described as “not as bad it could have been” earnings and guidance.

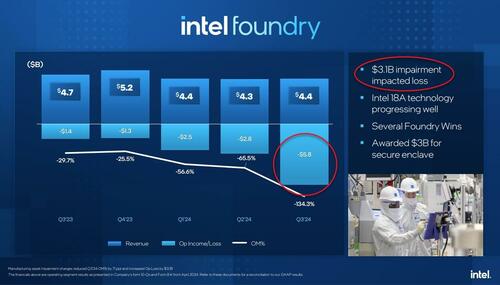

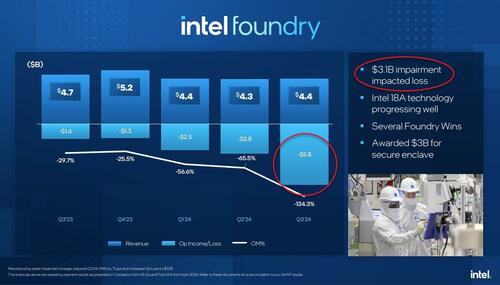

Three months after a painful earnings report that collapsed its share price, the not-quite-so-giant tech company booked nearly $19 billion in restructuring charges but said business trends are now improving.

For the third quarter, Intel reported an adjusted earnings per share loss of 46 cents, compared with Wall Street’s consensus estimate for a 2 cents loss, according to FactSet.

The results may not be comparable to analysts’ estimates as it includes a 63 cents negative impact from impairment charges.

Revenue came in at $13.3 billion, which was above analysts’ expectations of $13.02 billion.

Guidance was increased too…

-

Fourth-quarter revenue will be $13.3 billion to $14.3 billion, the Santa Clara, California-based company said in a statement. That compares with the $13.6 billion analysts estimated on average.

-

The company is projecting a profit of 12 cents a share compared with the 6 cents Wall Street projected.

INTC shares up 10-12% after hours, but in context, there’s a lot of work to be done…

“This was a critical period of time for the company,” CEO Pat Gelsinger said in the interview. “We got a lot done.”

Additionally, Intel said its audit & finance committee approved a series of cost and capital reduction initiatives, including reducing headcount by 16,500 employees.

Tyler Durden

Thu, 10/31/2024 – 16:20