High Yield Bonds: Excess Spread Vs Excess Optimism?

Authored by Charles de Quinsonas via BondVigilantes.com,

With the US Treasury curve yielding above 4%, high yield (HY) bonds still offer mid-single digit yields.

As of the end of September, US high yield, European high yield and emerging markets (EM) corporate high yield bonds were offering 7.0%, 6.1% and 7.4% respectively.

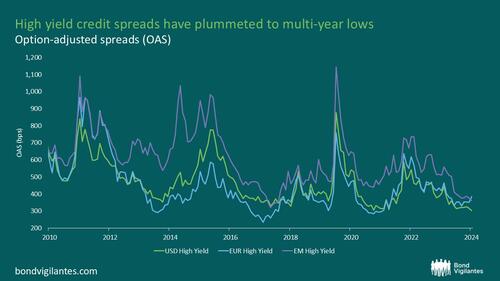

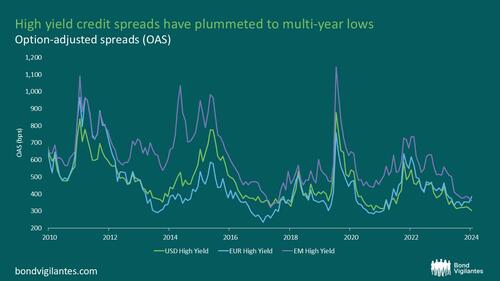

Credit spreads, however, have plummeted to multi-year lows and the eternal debate between all-in yield vs credit spreads continues.

Source: M&G, BofA Global Research, as at 30 September 2024

Credit spreads matter because, at an index level, they need to overcompensate for future defaults.

Otherwise, there would be no reason to invest in high yield bonds, as adjusted for default loss, high yield returns would be in line with the risk-free rate (or worse, if default losses were greater than credit spreads).

Therefore, credit spreads have two main components:

(i) default-implied spreads, which provide a forward-looking view on future defaults and recovery, and

(ii) excess spreads, which, simply put, represent the overcompensation of default risk.

Active management will aim to reduce default loss and increase excess spread.

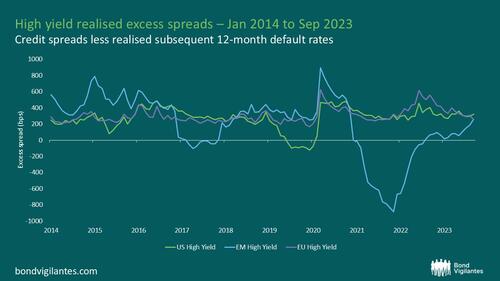

To calculate the actual excess spreads across the US, European, and emerging markets high yield markets, one can subtract from credit spreads the realised subsequent twelve month default rate (adjusted by recovery value).

For example, the US high yield market had credit spreads of 440bps in September 2014. The subsequent 12 months (to Sep-2015) saw a 3% default rate with a recovery rate of 40%, leading to a default loss of 1.83%.

Therefore, investors who bought US high yield in September 2014 enjoyed an actual excess spread of 257bps (440bps minus 183bps of default loss).

Source: M&G, as at 30 September 2024

The results over time are surprising.

While the excess spread in the European high yield market consistently overcompensates for default risk, US high yield and emerging markets corporate high yield excess spreads were negative during some periods, i.e. realised one-year default losses were greater than credit spreads a year earlier.

However, this can be explained by one-off events, namely COVID-19 for US high yield and the Russia/Ukraine conflict for emerging markets high yield.

With that in mind, we believe median numbers are more representative.

Between January 2014 and September 2023, the median excess spreads of US, European and emerging markets high yield were remarkably similar, ranging from 280 to 310bps.

Taking today’s historically tight high yield credit spreads and using 300bps as our base case excess spread, we can derive the implied default loss expectation of the market for the next 12 months. As of end of September 2024, the implied default loss expectations were 0.1% for US high yield, 1.4% for European high yield, and 0.9% for emerging markets high yield. This compares to broker research expectations of 2.5-3% default rates for 2025, across the US, European and emerging markets high yield markets.

Even when adjusted for recovery rates, next year’s default losses are expected to be greater than what current credit spreads are pricing in.

Which will prevail in the next 12 months: excess optimism or excess spreads?

Tyler Durden

Thu, 10/31/2024 – 07:20