Futures Flat Even As Surging Alphabet Leads Tech Higher, Gold Hits New Record

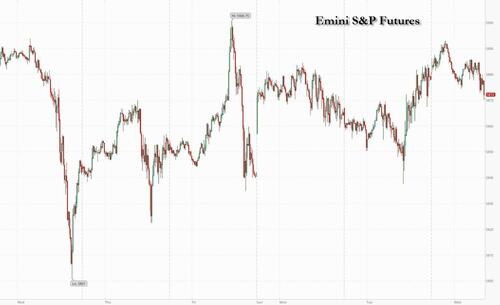

US equity futures are flat, reversing modest overnight gains ahead of the next batch of earnings. As of 8:00am ET, S&P futures were flat while Nasdaq 100 futures are up 0.1%; GOOG was the second of the Mag7 to beat earnings, and the stock is +5.4% pre-mkt after beating across the board on strong cloud growth. AMZN, META, MSFT are all trading up at least 1.7% pre-market. Semis are lower with AMD -8.5% and NVDA -80bps. Bond yields are lower as the curve bull steepens ahead of ADP numbers and US Q3 GDP/Price releases. A Bloomberg gauge of the dollar snapped a three-day advance, and the commodity bid returned led by Energy. META and MSFT are the next Mag7 earnings today. Today’s macro US economic data calendar includes October ADP employment change (8:15am), 3Q advance GDP (8:30am) and September pending home sales (10am).

In premarket trading, Alphabet gains 6%, showing an expensive foray into artificial intelligence is starting to pay off, delivering better-than-expected sales for its cloud-computing business. On the other end, AMD tumbled 8% after the chipmaker’s revenue outlook fell below Wall Street’s expectations, signaling that its artificial intelligence sales are growing slower than some had anticipated. Eli Lilly tumbled 11% after the Mounjaro and Zepound maker lowered its full-year guidance as sales of its blockbuster weight-loss drug fell short of expectations, which the company blamed on inventory issues. Translation: the fat bubble is finally over. Qorvo, whose biggest customer is Apple, tumbled 19% after forecasting revenue and profit far short of estimates. Here are some other notable premarket movers:

- Chipotle (CMG) drops 5% after reporting third-quarter sales that fell just short of Wall Street’s expectations, highlighting the high bar to which investors are holding the chain after it’s outpaced many peers this year.

- Eli Lilly & Co. (LLY) sinks 9% after the company lowered its full-year guidance after sales of its blockbuster weight-loss drug fell short of expectations.

- First Solar (FSLR) falls 7% on a lowered full-year guidance partly due to India market headwinds.

- NerdWallet (NRDS) surges 27% after the consumer finance firm’s third-quarter revenue beat estimates.

- Reddit (RDDT) rises 20% after the company’s sales and forecast beat analyst expectations.

- Visa (V) gains 2% after the payments company’s fiscal fourth-quarter earnings surpassed expectations.

Just about a week away from the Fed’s decision, and less than a week from the presidential election, investors are turning their focus to three high-profile reports in the US that look set to show underlying resilience in the economy and a temporary hiccup in job growth. They’re also positioning for a too-close-to-call US presidential election on Nov. 5.

“The mood in the market today feels more like the calm before the next storm,” said Hebe Chen, a market analyst at IG Markets Ltd. “Traders are on edge, bracing for the incoming tide of uncertainties from multiple sources,” including the US election and major tech earnings.

European stocks decline on another day packed with earnings reports, with all eyes on the UK budget later Wednesday. The euro area’s economy expanded more strongly than expected in the third quarter, data showed Wednesday — with even Germany avoiding the recession it was widely tipped to endure. A measure of economic confidence, however, unexpectedly declined. The Stoxx 600 fell 1% to 512.4 with all 20 sectors in the red but consumer and technology sectors were the worst performers. Here are some of the biggest movers on Wednesday:

- ASM International shares rise as much as 8.1% after the Dutch firm raised the lower end of next year’s sales guidance, seeing continued strength in demand for equipment used to make the next-generation logic and memory chips.

- Puig shares jumped as much as 15%, most on record, after the Spanish luxury beauty company reported 3Q net revenue that rose 11.1% to €1.257b from the same period a year earlier, according to a regulatory filing.

- Aston Martin shares rise as much as 6.2% as analysts highlighted an extended order book and hopes of improving cash flow generation in the UK carmaker’s third-quarter results.

- Georg Fischer shares jump as much as 16% as the Swiss maker of flow-control equipment said it is divesting its machining business to focus on its water unit, which is less cyclical.

- Kion gains as much as 10% following results which generally pleased analysts, especially on the warehouse equipment firm’s Ebit performance.

- Volkswagen shares rally from recent lows after the German carmaker reported third-quarter earnings that Stifel analysts say were “better than feared.”

- Campari shares slide as much as 17% after the Italian beverage maker saw a significant miss in the third quarter, with negative organic sales growth.

- Grenke slumps as much as 29%, the most since Feb. 2021, following a cut to the German leasing finance provider’s guidance for the full year.

- Capgemini shares fall as much as 8.1% after the French IT provider reduced revenue growth guidance for a second consecutive quarter, dragged by a decline in its North America market and weaker client demand in areas including manufacturing.

- Amundi shares drop 5.8% as analysts at Morgan Stanley warned a negative flow mix and an exceptional tax surcharge in France could weigh on forward estimates, overshadowing an otherwise in-line set of results.

Traders have pared their ECB interest-rate cut bets after the euro-area economy grew more than expected – with even Germany avoiding the recession it was widely tipped to endure – and German state inflation readings suggested the national print will top estimates. A measure of economic confidence, however, unexpectedly declined.The German yield curve has flattened as a result, with two-year yields reversing course and rising 2 bps to 2.15%. The euro also got a boost, climbing 0.2% against the greenback. Gilt yields drop across the curve ahead of the budget while the pound falls 0.3%.

A key gauge of Asian equities traded in a narrow range, as gains in Japan were countered by losses in Chinese markets. The MSCI Asia Pacific Index slipped 0.1%, erasing an earlier rise of as much as 0.4%. The biggest contributors to the measure’s advance included Hitachi, Disco and Keyence, while TSMC and Tencent ranked among the major drags. Japanese benchmarks led gains as tech shares tracked advances in their US peers. Local exporters are also expected to benefit from the continued weakness in the yen, while an improved outlook for nuclear power is supporting utility shares. The Bank of Japan is widely expected to stand pat Thursday, having paused its path toward higher interest rates. Key gauges in Hong Kong and mainland China dropped on continued volatility as traders await more decisive moves from Beijing to support the ailing economy and markets. The nation is weighing a package of more than 10 trillion yuan ($1.4 trillion).

In FX, the Bloomberg Dollar Spot Index dropped 0.2%, snapping three days of gains. US 10-year Treasury yield fell 3 basis points to 4.22%. EUR/USD heads for a third daily advance, gains as much as 0.4% to 1.0859, highest since Oct. 21, before halving gains

In rates, treasuries advance across the curve as 10-year note futures extend through to fresh weekly highs into early US session. Long-end leads gains on the day, flattening 2s10s and 5s30s close to Tuesday’s lows. US long-end yields are richer by nearly 4bp, flattening 2s10s, 5s30s spreads flatter by 2bp and 1.5bp on the day; 10-year is around 4.22% with gilts outperforming by 5.5bp in the sector. Gilts bull-flatten ahead of the revised gilt remit, which may skew more debt issuance away from the long-end. German short-dated maturities lag after regional inflation and GDP data saw ECB rate-cut pricing fade. US session includes October ADP employment change and first estimate of 3Q GDP.

In commodities, oil steadied after a two-day decline on the prospect for a further easing of hostilities in the Middle East. WTI rose 1% to $67.90 a barrel. Gold hit a fresh record early on Wednesday rising $11 to $2,786/oz as traders weighed potential market disruption ahead of the election. Bitcoin, seen as a Trump trade, held above $72,000, on the cusp of topping its March high.

Looking at today’s US economic data, the calendar includes October ADP employment change (8:15am), 3Q advance GDP (8:30am) and September pending home sales (10am). Fed officials are in self-imposed quiet period ahead of Nov. 7 policy announcement

Market Snapshot

- S&P 500 futures up 0.2% to 5,884.75

- STOXX Europe 600 down 0.5% to 515.42

- MXAP down 0.1% to 187.04

- MXAPJ down 0.7% to 594.78

- Nikkei up 1.0% to 39,277.39

- Topix up 0.8% to 2,703.72

- Hang Seng Index down 1.5% to 20,380.64

- Shanghai Composite down 0.6% to 3,266.24

- Sensex down 0.5% to 79,966.37

- Australia S&P/ASX 200 down 0.8% to 8,180.36

- Kospi down 0.9% to 2,593.79

- German 10Y yield little changed at 2.30%

- Euro up 0.2% to $1.0839

- Brent Futures up 1.2% to $72.00/bbl

- Gold spot up 0.3% to $2,784.22

- US Dollar Index down 0.20% to 104.11

Top Overnight News

- China’s ~$1.4T fiscal stimulus plan might just stabilize (rather than materially boost) the country’s growth trajectory. RTRS

- Xi Jinping urges Chinese officials to make all-out effort to hit annual growth targets. Beijing has already unveiled a series of stimulus measures, with more expected amid a final push to reach this year’s ‘around 5 per cent’ target. SCMP

- Australia’s CPI cooled in Q3 and Sept (the Sept CPI tumbled to +2.1%, down from +2.7% in Aug and below the consensus forecast of +2.3%), although it’s likely the RBA will hold off on immediately cutting rates. WSJ

- Ukraine and Russia are in preliminary discussions about halting strikes on each other’s energy infrastructure, according to people familiar with the matter. FT

- UBS profit almost doubled estimates, equity trading gains outperformed peers and wealth management saw net new assets of $25 billion. The stock climbed to a 16-year high. European banking needs consolidation and “national interests” shouldn’t get in the way, CEO Sergio Ermotti said. BBG

- The euro-area economy grew more than expected last quarter, with Germany unexpectedly dodging recession. Momentum accelerated in France while Italy was the weak point. The euro ticked up. US GDP, due later, probably slowed to 2.9%. BBG

- John Paulson, a potential Treasury Sec candidate if Trump wins, said he would work w/Musk to slash gov’t spending. WSJ

- Musk warns Trump’s economic agenda will cause “temporary hardship” in the country (Musk said there would be an “initial severe overreaction in the economy” and that the “market will tumble” if Trump wins and enacts his plan). NYT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower after the mixed performance stateside and as participants braced for this week’s key risk events including mega-cap earnings in the US and a deluge of data releases. ASX 200 was pressured by notable weakness in the consumer sectors after Woolworths flagged a challenging fiscal year. Nikkei 225 bucked the trend and extended above the 39,000 status with the BoJ widely expected to refrain from further policy normalisation when it concludes its 2-day policy meeting tomorrow. Hang Seng and Shanghai Comp declined with the former dragged lower by weakness in tech and automakers owing to trade-related headwinds from the threat of higher US tariffs in the event of a Trump election victory next week and after the EU imposed duties on subsidised EVs from China, while the losses in the mainland were initially cushioned following prior reports of a potential fresh fiscal package before eventually succumbing to the broad risk aversion.

Top Asian News

- China responded to US finalised restrictions on Chinese technology in which it called on the US to end the politicisation of economic affairs and hopes the US respects market economy rules, while it sees the US action as damaging to Chinese and American business collaboration.

- MOFCOM said China does not agree with or accept the ruling regarding EU tariffs on Chinese EVs and opened proceedings at the WTO, while it noted the EU’s indication it will continue to consult with China on a price commitment plan.

- EU imposed duties on unfairly subsidised EVs from China while discussions on price undertakings continue with duties of 17% imposed on BYD, 18.8% on Geely and 35.3% on SAIC. Furthermore, Tesla will be assigned a duty of 7.8% and all other non-cooperating companies will have a duty of 35.3%.

- Japanese opposition CDP leader Noda will submit a no-confidence motion against the Cabinet and asked the Japan Innovation Party to vote for him to become PM, although Noda reportedly declined to respond to a request by the Japan Innovation Party.

- Japan Exchange Group announced the Tokyo Stock Exchange will extend trading hours by 30 minutes from November 5th with the new close to be at 15:30 local time (06:30GMT/02:30EDT).

European bourses, Stoxx 600 (-0.8%) began the session entirely in negative territory and continued to gradually trundle lower as the morning progressed. European sectors hold a strong negative bias. Retail just about holds afloat, lifted by post-earning strength in Next. Financial Services was initially propped up by gains in UBS, but has since edged towards the middle of the pile. Tech is found at the foot of the pile, with strong ASM International (+4.3%) results ultimately outmuscled by the dim mood across chip-names after AMD’s Q4 outlook disappointed. US Equity Futures (ES +0.2% NQ +0.2% RTY -0.1%) are mixed and ultimately trading on either side of the unchanged mark ahead of a very busy docket, which includes; US ADP, PCE Prices/GDP Advance and a very busy data docket. In terms of pre-market movers; Alphabet (+5.5%) gains after it beat on Q3 and amid continued optimism surrounding AI which has boosted its cloud business. AMD (-8.5%) reported a mixed set of results, but its Q4 outlook was soft.

Top European News

- UK Chancellor Reeves is to provide armed forces a boost of nearly GBP 3bln in the Budget, according to The Telegraph.

Notable Earnings

- Alphabet Inc (GOOGL) Q3 2024 (USD): Adj. EPS 2.12 (exp. 1.84), Revenue 88.27bln (exp. 86.31bln). Google advertising revenue: 65.85bln (exp. 65.5bln), Google Search & Other revenue: 49.39bln (exp. 49.08bln), Google Cloud revenue: 11.35bln (exp. 10.79bln), YouTube ads revenue: 8.92bln (exp. 8.89bln) Co. shares were higher by 5.9% after-hours

- Advanced Micro Devices (AMD) Q3 2024 (USD): adj. EPS 0.92 (exp. 0.92), Revenue 6.82bln (exp. 6.71bln) Co. shares were lower by 7.6% after-hours

- Snap Inc (SNAP) Q3 2024 (USD): EPS 0.08 (exp. 0.05), Revenue 1.37bln (exp. 1.36bln). Co. shares were higher by 10.6% after-hours

- Visa (V) Q4 2024 (USD): Adj. EPS 2.71 (exp. 2.58), Revenue 9.6bln (exp. 9.49bln). Co. shares were higher by 1.8% after-hours

- Caterpillar Inc (CAT) Q3 2024 (USD): Adj. EPS 5.17 (exp. 5.34), Revenue 16.11bln (exp. 16.08bln).

FX

- USD is marginally softer vs. most peers in what will be a session set to endure a raft of US data including GDP, quarterly core PCE and ADP with the latter (rightly or wrongly) set be used to gauge expectations for Friday’s NFP print.

- EUR is firmer vs. the USD with some support garnered from better growth outturns in Germany and the Eurozone. This matters because the ECB is seemingly increasingly focused on growth dynamics. Albeit, markets are still awaiting inflation metrics tomorrow. The next upside target for EUR/USD comes via the 200DMA at 1.0868.

- GBP flat vs. the USD in the run up to today’s UK budget. As mentioned in our commentary throughout the week, the budget is meant to be expansionary on a headline basis despite a potential squeeze on an individual basis. ING expects the event to not be a game-changer for the GBP, however, if there is to be a negative risk, it stems from the Gilt supply remit. For now, Cable is tucked within yesterday’s 1.2959-1.3058 range and above its 100DMA at 1.2974.

- JPY is ever so slightly softer vs. the USD. Updates out of Japan have seen reports that opposition CDP leader Noda will submit a no-confidence motion against the Cabinet and asked the Japan Innovation Party to vote for him to become PM. USD/JPY is currently caged within yesterday’s 152.75-153.86 range ahead of a busy session of US data.

- Despite a sluggish start to the session, both antipodes have managed to pick themselves up. AUD/USD printed another multi-month low overnight at 0.6538 before moving back into the green.

- SNB Chairman Schlegel says the CHF is a safe haven, which appreciates in times of uncertainty; ready to react to pressure and intervene in FX markets.

Fixed Income

- Bunds were initially firmer going into German GDP/State inflation metrics, but dipped into negative territory following stronger-than-expected Q3 GDP and hotter than the mainland implied state CPIs for October. Thereafter, EZ growth metrics also came in higher than expected but sparked no real reaction as this echoed the lead from Spain & Germany earlier in the session. Bunds currently trading around 132.70.

- Gilts outperform and hold near session highs at around 96.05. Focus for the complex is entirely on the upcoming UK budget, where the reaction will depend on just how much headroom Reeves gives herself and then, more pertinently, how much she utilises; for reference, the Reuters survey looks for the 2024/25 Gilt remit to increase by 17bln from 278bln to 295bln.

- USTs are modestly firmer but ultimately awaiting data and refunding. Q3 GDP is forecast at the 3.0% mark which would be in-fitting with the prior but above the final AtlantaFed GDP Nowcast of 2.8%. Thereafter, we turn to Quarterly Refunding which is largely expected to reiterate the last outing though attention is on any change to their guidance for no increase to coupon or FRN sizes for the next several quarters. Currently sitting at session highs at around 111-04+.

- Italy sells EUR 5.5bln vs exp. EUR 4.75-5.5bln 3.00% 2029 & 3.85% 2035 BTP & EUR 3.5bln vs exp. EUR 3-3.5bln 2033 CCTeu.

Commodities

- Crude benchmarks are in the green, deriving support from the firmer US tone though have faded from best amid the soft European start. Upside which came after a surprise draw in the headline inventory measures last night. Brent’Jan 25 currently sits around USD 71.30/bbl.

- Spot gold is a touch firmer benefitting from the softer yield environment and accompanying USD pressure; a narrative which could well change on upcoming key US data and the latest refunding announcement. Just off a USD 2789/oz peak, which marked yet another ATH.

- Base metals are largely contained, with specifics somewhat light after a busy session yesterday where reporting of Chinese stimulus drove upside in the European morning.

- Private Inventory Data (bbls): Crude -0.6mln (exp. +2.2mln), Cushing +0.3mln, Distillate -1.5mln (exp. -1.4mln), Gasoline -0.3mln (exp. +0.5mln).

- Kazakhstan is to cut its 2024 oil output target from the current 90.3mln tons, according to the Energy Minister.

- India’s gold consumption rose 18% Y/Y in Q3, as investment and jewellery demand jumps, via World Gold Council.

Geopolitics

- Iran’s Defense Minister says “there has been no disruption to missile production since the Israeli attack”.

- Israeli army issues bombing notice to the entire eastern city of Baalbeck and surrounding areas, according to Reuters citing IDF spokesperson.

- Israeli officials cited by Axios noted that Hezbollah is ready to distance itself from Hamas in Gaza and the IDF is close to ending the ground operation in villages in Lebanon that border with Israel, while the army reportedly recommended to PM Netanyahu that the time is right to end the fighting in Lebanon. Furthermore, Haaretz reported the security establishment is unanimous regarding exploiting military achievements in southern Lebanon and Gaza to reach agreements to end the war

- US President Biden’s advisers are to visit Israel to try to seal a deal to end the war in Lebanon, according to Axios.

- Sirens sounded in several areas of Israel after the launch of surface-to-surface missiles from Lebanon, according to Al Arabiya.

- Russia’s Kremlin dismisses FT report that Russia and Ukraine “are in early talks about stopping striking energy infrastructure”.

- Ukraine and Russia are in talks about halting strikes on energy plants, according to FT.

- US confirmed a small number of North Korean troops are already in Russia’s Kursk region, according to Yonhap. It was also reported that South Korea’s defence intelligence agency said it is possible some North Korean troops have been deployed on the battlefield in the Ukraine-Russia war and stated that North Korean troops are not ready for drone warfare in the Ukraine-Russia war.

US event calendar

- 07:00: Oct. MBA Mortgage Applications, prior -6.7%

- 08:15: Oct. ADP Employment Change, est. 111,000, prior 143,000

- 08:30: 3Q GDP Annualized QoQ, est. 2.9%, prior 3.0%

- 3Q GDP Price Index, est. 1.9%, prior 2.5%

- 3Q Personal Consumption, est. 3.3%, prior 2.8%

- 3Q Core PCE Price Index QoQ, est. 2.1%, prior 2.8%

- 10:00: Sept. Pending Home Sales YoY, est. -1.1%, prior -4.3%

- Sept. Pending Home Sales (MoM), est. 1.9%, prior 0.6%

DB’s Jim Reid concludes the overnight wrap

Just when the US Treasury sell-off was starting to gather fresh momentum yesterday, with 10yr yields close to 4.34% as Europe went home, along came a better auction which seemed to help turn things around in a volatile session, leaving it -2.8bp lower on the day at 4.255% with 2yr yields rallying c.8bps off the session highs to close -4.3bps lower. Still, in a sign of the heightened volatility going into the US election, the MOVE index ended the day at its highest level since October 2023.

The 7yr auction saw the highest bid-to-cover ratio since 2020, with bonds issued -2.0bps below the when-issued yield. So an encouraging sign on the demand for Treasuries after lacklustre 2yr and 5yr auctions the previous day. The move lower in yields saw one failed attempt after a weaker JOLTS report which contradicted last month’s bumper payroll release.

Job openings fell to their lowest level since January 2021, at 7.443m (vs. 8m expected). And the report also showed the quits rate of those voluntarily leaving their roles decline from 2.0% to 1.9%, which is the lowest since mid-2015 if you exclude the Covid months of March-June 2020. Although the JOLTS data is always a month behind other data, it is a very good guide to the labour markets so there should be some concern here. We’ll see if we can derive much signal from payrolls on Friday given all the recent storms and strikes.

On the plus side though, the Conference Board’s consumer confidence indicator surged to its highest level since January, at 108.7 (vs. 99.5 expected). Moreover, the difference between those saying jobs were “plentiful” and “hard to get” finally rose after 8 consecutive monthly declines, ticking up to a net +18.3%. So those on the extreme sides of the US employment debate at the moment could find something to cling to in the data.

Even though Treasuries reversed from their recent “Trump trade” association, other such trades continued to be strong. The Trump Media & Technology Group continues to be most correlated with his prospects, and they were up another +8.76% yesterday to their highest level since May. In the meantime, Bitcoin (+5.45%) closed at its highest level since March, at $72,700.

Even with the big moves of late, especially in yields, one view that hasn’t been much in doubt over the last couple of weeks has been the prospects that the Fed will cut rates 25bps next week. The likelihood has predominantly been in the 90-100% range since mid-October. On this Matt Luzzetti put out a note yesterday here explaining why policy rules would support the Fed cutting next week. They also discuss how the case for pausing or skipping will build in 2025, for various reasons which could include the election results. Staying with Matt’s US team, they’ve just published a good use case for AI by plugging in all Powell’s prepared FOMC press conference speeches into our chatDBT model and asking it to score each on a 1-10 hawkometer. They then correlated this to 2yr yields, amongst other variables, and get a good match. They are going to build on this work but if you want to see it please see here for more.

Moving onto equities, they had a mixed day. The S&P 500 (+0.16%) inched closer to its all-time high from a couple of weeks ago even as nearly 70% of its constituents were down on the day. The gain was rather driven by tech stocks, with the NASDAQ (+0.78%) reaching a record high of its own and with the Mag-7 outperforming (+0.88%). After the close we heard from Alphabet, whose results delivered a solid sales and earnings beat, amid strong cloud computing growth. Its shares rose by more than +5% in post-market trading. Those Mag 7 earnings will continue today, with both Meta and Microsoft reporting after the close.

Here in Europe, attention is now turning to the UK’s Budget today, which is the first of the new Labour government that came to office in July. Ahead of that, the 10yr gilt yield (+6.2bps) moved up to 4.31%, which is their highest closing level since June.

Moreover, the spread of 10yr gilts over bunds widened another +1.1bps to 198bps, which is their widest since August 2023. So from a market point of view, the main focus today will be on how much additional borrowing there is, particularly given it was just over two years ago that the mini-budget under Liz Truss sent UK markets into turmoil.

In terms of what to expect, an important focus will be on the new fiscal rules, and Chancellor Rachel Reeves has confirmed that the government is planning to change the way it measures debt in order to fund extra investment. In the meantime, tax rises have also been signalled, and discussions in the press have centered around an increase in national insurance contributions by employers, higher capital gains tax rates, and an extension to the existing freeze on income tax thresholds beyond 2028. See our economists’ preview of it here.

Elsewhere in Europe, markets struggled yesterday. Yields on 10yr bunds (+5.1bps), OATs (+6.7bps) and BTPs (+7.1bps) all moved higher, albeit with trading coming to a close before the rally in the latter part of the US session. Yesterday’s underperformance in Europe should also be viewed in the context of the outperformance over the past few weeks, with 10yr bund yields +21bps higher since the end of September, compared to a +47bp rise for 10yr Treasuries. Also unlike in the US, equities struggled, with the STOXX 600 (-0.57%) closing at a 3-week low. Maybe that’s a mini Trump trade in itself.

Asian equity markets are mostly lower this morning with the Hang Seng (-1.86%) leading losses followed by the CSI (-1.09%) and the Shanghai Composite (-0.86%). Elsewhere, the KOSPI (-1.07%) is also trading noticeably lower with the S&P/ASX 200 (-0.89%) also in the red, ending a three-day winning streak. On the other side of the ledger, the Nikkei (+1.09%) is bucking the regional trend and extending gains for the third consecutive session. S&P 500 (+0.15%) and NASDAQ 100 (+0.15%) futures are seeing small gains with US Treasury yields another basis point lower across the curve.

Coming back to Australia, the headline inflation sank to its lowest level in more than three years in the September quarter, mainly due to softer electricity and fuel prices. The CPI rose +0.2% q/q (v/s +0.3% expected) and slowing substantially from the +1% increase in the prior quarter. Trimmed mean CPI, which is closely watched by the RBA, rose +0.8% q/q, slightly down from +0.9% gain in the previous quarter but around consensus. The labour market in Australia remains strong and inflation is stickier than its DM peers so the data confirms no imminent rate cuts for now.

To the day ahead now, and US data releases include Q3 GDP, the ADP’s report of private payrolls for October, and pending home sales for September. Meanwhile in Europe, we’ll get Euro Area GDP for Q3, the Spanish CPI along with the German CPI and unemployment readings for October. From central banks, we’ll hear from the ECB’s Schnabel, Villeroy and Nagel, along with Bank of Canada Governor Macklem. Earnings releases include Microsoft, Meta, Caterpillar and Starbucks. Finally in the UK, the government will be announcing their Budget.

Tyler Durden

Wed, 10/30/2024 – 08:11