Yields Tumbles After Stellar 7Y Auction Stops Through Most Since Covid Panic

After two ugly auctions yesterday to start the week, moments ago the Treasury concluded the truncated week’s coupon issuance when it sold $44 billion in 7Y paper in what was a stellar auction.

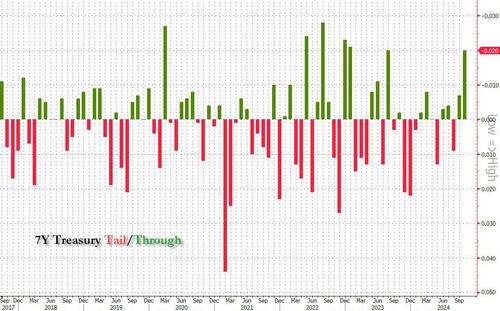

The auction stopped at a high yield of 4.215%, 54bps higher than the 3.668% last month, and the highest since June, but more importantly, it was below the When Issued which traded at 4.235% at 1PM. As a result, the auction stopped through by 2bps, the biggest stop through Jan 2023 (and tied with the Stop in August 2023).

The bid to cover surged from 2.628 to 2.737, the highest since March 2020, the depths of the covid crisis when everyone was scrambling to get Treasury paper.

The internals were also solid, with Indirects awarded 72.0, up from 70.8 and above the six auction average of 70.3. And with Directs awarded 20.6%, up from 20.3% in September and the highest since April, Dealers were left with just 7.5% of the allotment, the lowest since Jan 2023.

Overall, this was a stellar 7Y auction which came at just the right time to soothe market nerves, just as the 10Y was trading at 4.34% – the highest since July – and was set to spike on even a hint of an ugly auction. Instead, the yield promptly tumbled about 4 bps after the auction results were announced, which in turn sparked a new wave of stock buying, and so on.

Tyler Durden

Tue, 10/29/2024 – 13:42

Recent Comments