Futures Drop, Yields Rise As Tech Giant Earnings Start With Google On Deck

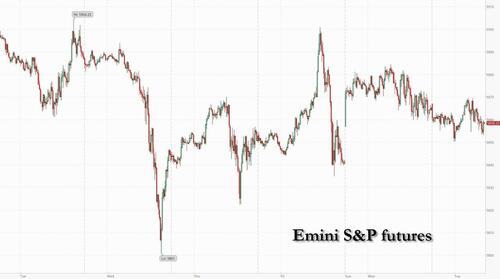

Futures are down small, reversing a modest overnight gain with small-caps underperforming. As of 8:00am ET, S&P futures are down 0.1%, near session lows, while Nasdaq futures are fractionally higher on the session with Mag7 names mixed while GOOG is higher ahead of earnings and semis are seeing a slight bid despite NVDA -60bps. The yield curve is bear steepening with the 10Y yield at 4.30%; the USD is flat. In commodities, oil prices climb along with industrial and precious metals after Reuters reported China is weighing approving over 10 trillion yuan ($1.4 trillion) in additional borrowing in the coming years to shore up the economy and address local governments’ debt risks. WTI is up 1% near $68 a barrel while copper rises 0.9%. Today’s macro data focus will be on JOLTS, Consumer Confidence, and Housing prices. GOOG is the first of 5 of the Mag7 that report this week which may present an inflection point for the group given the reduction in exposure since the summer which has not yet been offset by recent purchases.

In premarket trading, shares of Vans and North Face owner VF Corp. surged 22% after the company reported fiscal Q2 adjusted earnings and revenue that topped analysts’ estimates. CVR Energy shares were down nearly 25% pre-bell Tuesday after the company overnight swung to a fiscal Q3 adjusted loss and posted lower net sales in addition to suspending its quarterly dividend. Here are some other notable movers:

Lixte Biotechnology Holdings (LIXT) shares were up 62% pre-bell Tuesday, rebounding from Monday’s fall.

Shuttle Pharmaceuticals (SHPH) stock was 55% higher after the company said that it has completed the clinical trial site enrollment for a phase 2 study of a treatment candidate for glioblastoma.

Profire Energy (PFIE) shares were up 46% on a pending $125 million takeover by CECO Environmental (CECO).

American Rebel Holdings (AREB) stock was 32% higher following a 1.1% gain in the previous session.

TransMedics Group (TMDX) stock was 23% lower after the company overnight reported Q3 earnings and revenue that trailed analysts’ estimates.

American Well (AMWL) shares were down 10% after a 5.5% gain in the previous session.

US stocks are on a bullish streak this year with the S&P 500 set to gain for a sixth straight month. With the tech behemoths driving the bulk of the rally, investors have been laser focused on earnings growth from the group (full preview here). Of note, analysts expect average profit growth for the industry to slow sharply from the second quarter.

Attention is also on the US presidential election and the Federal Reserve’s rate announcement next week. Traders are almost fully pricing in one rate cut from the central bank, according to swaps data compiled by Bloomberg.

“We could be braced for some volatility over the coming days,” said Mohit Kumar, macro strategist at Jefferies, who said he’s ready to snap up assets cheapened by choppy markets.

European equities rose as positive company updates from the likes of HSBC and Adidas provided some respite in the face of growing market risks. Miners and banks outperform while travel and leisure and real estate are the biggest laggards. Basic resources lead the Stoxx 600 index higher 0.2% to 522.16 with 327 members up, 250 down and 23 unchanged. Here are some of the biggest movers on Tuesday:

HSBC shares gain as much as 4.9% in London after the lender reported better-than-expected earnings and announced a new $3 billion stock buyback, with Morgan Stanley describing the report as solid.

Adidas shares gain as much as 3% after the sportswear company reported a third-quarter operating margin that came in ahead of estimates.

Shoprite shares advance as much as 6.1%, the most since June, after the food retailer said it expects groups sales for the first-quarter to grow above 10%, exceeding Citi’s expectations.

BP shares decline as much as 1.3% after analysts flag company’s planned revision of share buybacks next year will result in a cut in payouts.

Santander shares dropped as much as 3.9% after the Spanish lender reported net interest income that missed estimates.

Lufthansa shares fall as much as 3.9% after the airline company reported Ebit for the third quarter that slightly exceeded analyst estimates, though analysts note the results indicate a low-quality beat.

Wartsila falls as much as 13% after the Finnish marine and energy industry equipment manufacturer’s third-quarter orders fell short of expectations, with fourth-quarter margin commentary also seen as negative.

Novartis shares drop as much as 4.3%, the most in more than three months, as investors weigh the outlook for the pharmaceutical company in 2025, when generic versions of multiple drugs are expected to enter the market.

VusionGroup slumps as much as 11%, the most in five months, with Oddo BHF highlighting weaker-than-expected third quarter results which will see the full-year more back-end loaded for the French maker of smart digital labels.

AT&S shares fall as much as 11% after the Austrian electronics manufacturer cut its revenue forecast for the year in a move Oddo says raises questions around liquidity and the investment case.

Clariant shares drop 7.5% after the specialty chemicals company’s 3Q sales missed due to weakness in its cyclical catalyst business.

Straumann shares slump as much as 10%, most since April, after the Swiss maker of dental equipment delivers in line 3Q sales but analysts note weakness in the US as a worry.

Schibsted shares fall as much as 2.8% after Polaris Media offered 3.15 million Class-B shares in the Norwegian media firm via SEB at a 5% discount to Monday’s close.

Earlier in the session, Asia-Pac stocks were mixed despite the initial tailwinds following the mostly positive handover from Wall St, with gains in the region capped and some markets were choppy owing to a lack of fresh catalysts heading into this week’s key data releases. ASX 200 was led by strength in gold stocks after the precious metal extended on advances, while sentiment was also supported by M&A activity with Myer to acquire apparel brands from Premier Investments. Nikkei 225 recouped opening losses and extended higher amid recent currency weakness and lower unemployment. Hang Seng and Shanghai Comp traded mixed with the former underpinned by tech strength and as participants reflected on earnings releases, while the mainland index swung between gains and losses as EV and child-related policy initiatives were counterbalanced by frictions after the US issued final rules to curb US investments in AI, semis and other tech sectors in China.

In FX, the Bloomberg Dollar Spot Index is treading water, up 0.1%, while the yen bounced off a three-month low triggered by the failure of the ruling coalition to win a majority in parliament for the first time since 2009. Japanese Finance Minister Katsunobu Kato said the government will watch developments in the currency market with a heightened sense of urgency

In rates, treasuries are lower, with US 10-year yields 2bps cheaper on the day at about 4.30%, outperforming bunds in the sector by 1.5bp, gilts by around 1bp. German bonds underperform as 10-year borrowing costs add 4 bps. Losses were pared after a 10-year note futures block trade, apparently initiated by buyer. US session includes $44b 7-year note auction at 1pm New York time; Monday’s 2- and 5-year sales tailed. The compressed Treasury auction cycle concludes with $44b 7-year note at 1pm; WI yield at ~4.20% is about 53bp cheaper than September auction, which stopped through by 0.7bp with a below-average dealer allotment. Economic data slate features consumer confidence and JOLTS job openings.

In commodities, oil prices climb along with industrial metals after Reuters reported China is weighing approving over 10 trillion yuan ($1.4 trillion) in additional borrowing in the coming years to shore up the economy and address local governments’ debt risks. WTI is up 1% near $68 a barrel while copper rises 0.9%. Spot gold rises $6 to $2,749/oz. Bitcoin rises 2% to above $71,000.

Looking at today’s US data calendar includes, we get the September goods trade balance and wholesale inventories (8:30am), August FHFA house price index and S&P CoreLogic home prices (9am), September JOLTS job openings and October consumer confidence (10am) and Dallas Fed services activity (10:30am). Fed officials are in self-imposed quiet period ahead of Nov. 7 policy announcement

Market Snapshot

S&P 500 futures little changed at 5,863.00

STOXX Europe 600 up 0.1% to 521.69

MXAP up 0.1% to 187.29

MXAPJ down 0.2% to 598.59

Nikkei up 0.8% to 38,903.68

Topix up 0.9% to 2,682.02

Hang Seng Index up 0.5% to 20,701.14

Shanghai Composite down 1.1% to 3,286.41

Sensex little changed at 80,015.24

Australia S&P/ASX 200 up 0.3% to 8,249.24

Kospi up 0.2% to 2,617.80

German 10Y yield little changed at 2.32%

Euro little changed at $1.0817

Brent Futures up 0.5% to $71.80/bbl

Gold spot up 0.3% to $2,749.90

US Dollar Index little changed at 104.28

Top Overnight News

US economic data will be a mess in the coming weeks due to the Boeing strike and recent hurricanes, creating complications for the Fed as it proceeds with its easing agenda. WSJ

China could approve at its upcoming NPC meeting the issuance of an extra $1.4T in debt over the next few years to bolster the economy (and the number might rise if Trump wins the US election). RTRS

The number of China’s dollar billionaires has fallen by more than a third in the past three years, according to a “rich list” compiled by research group Hurun, as government crackdowns, weakness in parts of the economy and depressed equity markets take their toll. FT

China’s power demand will grow faster than anticipated this year due to heat waves and the government’s stimulus initiatives. RTRS

Apple iPhone exports from India jump as the company shifts its supply chain away from China. BBG

Japan opposition politician, who could play a critical role in forming the next gov’t, says the BOJ should proceed with tightening at a more cautious pace. RTRS

HSBC’s bonus pool is on course to match last year’s decade high of about $3.8 billion. Shares gained after earnings beat and the bank announced a new $3 billion buyback plan. CEO Georges Elhedery said there’s no plan to break up the group. BBG

Buyers of top-rated CMBS are suffering losses for the first time since the financial crisis. The pain is most acute in a new breed called SASBs, with creditors in office deals from New York to LA set to get only a portion of their investment back. BBG

Citadel’s Ken Griffin said markets expect Donald Trump to win the US election, though the race is “almost a coin toss.” BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed despite the initial tailwinds following the mostly positive handover from Wall St, with gains in the region capped and some markets were choppy owing to a lack of fresh catalysts heading into this week’s key data releases. ASX 200 was led by strength in gold stocks after the precious metal extended on advances, while sentiment was also supported by M&A activity with Myer to acquire apparel brands from Premier Investments. Nikkei 225 recouped opening losses and extended higher amid recent currency weakness and lower unemployment. Hang Seng and Shanghai Comp traded mixed with the former underpinned by tech strength and as participants reflected on earnings releases, while the mainland index swung between gains and losses as EV and child-related policy initiatives were counterbalanced by frictions after the US issued final rules to curb US investments in AI, semis and other tech sectors in China.

Top Asian News

China’s legislative body is considering approving a fresh fiscal package which could be worth over CNY 10tln , via Reuters citing sources. Would include proceeds worth CNY 6tln to address local governments debt risk and up to CNY 4tln to acquire idle land. CNY 10tln to be raised through local government bonds and special treasuries. May announce stronger fiscal package if Trump wins November 5th election.

China’s MOFCOM says it will continue imposing anti-importing duties on imported ethanolamine from the US, Saudi Arabia & others for an additional five years

Japanese PM Ishiba is said to seek a partial coalition with the DPP. In relevant news, Japanese DPP head Tamaki said they will push the government towards policies that increase take-home pay and want to enact at least one or two of their policies, while he favours an extra budget to respond to the aftermath of the Noto earthquake. Tamaki said they have not heard from the LDP about a partial coalition and are exchanging information with the LDP, CDP and Ishin, while he waits for the LDP response on a possible coalition but declined to join the LDP-Komeito ruling coalition and does not understand what a partial coalition would mean. Furthermore, Tamaki said the BoJ should avoid big policy change for now with real wages at a standstill and can review monetary policy if there is certainty that wage growth will exceed 4% at next year’s wage negotiations, according to Reuters and Nikkei.

UK is reportedly open to restarting China trade talks, according to POLITICO.

Japan’s Economy Minister Akazawa says he is closely monitoring currency moves; notes that a weak yen can have various impacts on the economy. Says “Weak yen could push down income and private consumption if wages have not grown enough”

European bourses, Stoxx 600 (+0.2%) initially opened entirely in the green, but sentiment gradually withered as the morning progressed; however, following reports that China’s legislative body is considering approving a fresh fiscal package which could be worth over CNY 10tln, indices managed to pull back off lows and back towards best levels. European sectors are slightly positive; Basic Resources is the clear outperformer with base metals prices lifting from lows, following the aforementioned China stimulus reports. Banks takes second spot, propped up by post-earning strength in HSBC. Travel &

Leisure is found at the foot of the pile, hampered by losses in Lufthansa, whilst Healthcare is weighed on by post-earning weakness in Novartis. European earnings included: Novartis (mixed, raised FY24 guidance), BP

Top European News

ECB’s De Guindos says “we will keep all options open at the forthcoming meeting”; is confident that the ECB will be able to reach the 2% target in the course of 2025.

Germany’s DHK says the economy is expected to contract 0.2% in 2024 (prev. view 0.00%), economy seen stagnating in 2025

FX

USD is broadly steady vs. peers but ultimately still supported into the upcoming US election; today’s docket includes, JOLTS, Advance Goods Trade Balance, Wholesale Inventories & Consumer Confidence. DXY is currently within yesterday’s 104.11-57 range.

EUR is slightly edging out the USD and gaining a firmer footing on a 1.08 handle in quiet newsflow, but ahead of GDP Wednesday and

CPI on Thursday. EUR/USD is currently contained within yesterday’s 1.0782-1.0827 parameters.

GBP is trivially higher vs. the USD ahead of tomorrow’s widely-anticipated UK budget which is expected to be net expansionary,

however, lead to increased taxation at an individual level. For now, Cable is tucked within Monday’s 1.2940-1.3001 range.

JPY is steady vs. the USD with USD/JPY tucked within Mondays’s 152.21-153.88 range. The direction of travel for the pair appears to

remain to the upside.

Antipodeans are both steady vs. the USD after initially lagging peers early doors. AUD/USD has been granted some reprieve by

stimulus headlines out of China with the pair picking up from a 0.6559 session low. NZD/USD was also boosted by the Chinese news

Commodities

WTI and Brent are in the green ; upside could be attributed to a paring of recent losses, geopolitical developments which have focused on reports that Israel is considering reshuffling its hostage negotiation team and reports of a fresh Chinese fiscal package. As it stands, Brent Jan’25 sits just under USD 71.50/bbl.

Spot gold began the European morning on a firmer footing and saw some modest upside following the aforementioned stimulus reports. XAU at a USD 2757/oz peak and is yet to nudge higher to a test of the USD 2758.49/oz record high.

Base metals are bolstered by the stimulus reports around China. Reporting which has seen HG Copper climb from USD 4.34 to over 4.42 while 3M LME is above USD 9.65k, surpassing Monday’s 9.6k peak.

US DoE announced a new solicitation for up to 3mln bbls of oil for delivery to the Strategic Petroleum Reserve from April 2025 through to May 2025.

Saudi Energy Minister says he is committed to maintaining 12.3mln bpd of crude capacity.

BP (BP/ LN) CEO says global oil demand growth is a little below avg in 2024 and 2025 because of China; will return to normal levels when China introduces stimulus.

Geopolitics: Middle East

Iran plans to raise its military budget by 200%, according to Iranian state TV.

Israeli PM Netanyahu is currently focussed on finding any possible solution which could result in a deal, via AJ Breaking; looking into possible changes to the hostage negotiating team.

“Lebanese source to Sky News Arabia: There is no truth to all the information reported by Yedioth Ahronoth regarding the proposal for a settlement in Lebanon”, via Sky News Arabia.

Hezbollah names deputy head Naim Qassem as successor to slain chief Nasrallah, according to AFP.

Israeli PM Netanyahu said they have not received an offer to release 4 hostages in exchange for a 48-hour ceasefire in Gaza,

according to Asharq News.

Israeli Defence Minister Gallant said the Israeli forces’ targeting of Iranian radars and air defence systems will help Israel if it decides to launch a new attack on Iran. Furthermore, he stated the recent Israeli attack led to a change in the balance of power

with Iran and that Iran is no longer able to produce weapons and defend itself as in the past.

Iranian representative to the UN Security Council said Israel and its US backer bear responsibility for the dangerous escalation in the region and most of the bombs that Israel drops on civilians are made by the United States. Iran’s envoy added the US government is complicit in the Israeli aggression and will be punished for its action, while they reserve the right to respond to Israeli aggression at a time of their choosing.

Yedioth Ahronoth reported ongoing talks for a settlement in Lebanon are at an advanced stage with US envoy Hochstein leading these efforts and plans to visit Israel and Lebanon. Western sources said Hezbollah agreed to separate the Lebanon file from Gaza and Hezbollah got the green light from Iran to retreat to northern Litani, while the new proposal includes the deployment of the Lebanese army in the south and begins with a 60-day cessation of hostilities by Israel and Hezbollah, according to Sky News Arabia.

CIA Director floated a 28-day Gaza ceasefire and hostage deal in Doha, according to Axios. It was also reported that the CIA Director and Qatari PM are starting to develop the idea of a partial agreement in the Gaza Strip, while Israel agreed to a temporary ceasefire, but Hamas wants a halt that leads to irreversible Israeli steps, according to Axios and Al Jazeera.

Israel’s parliament passed a bill to ban the UNRWA from operating inside of Israel.

UN Secretary-General Guterres said if Israel’s laws on UNRWA are implemented, it could have devastating consequences for Palestine refugees in occupied Palestinian territory which is unacceptable, while he added there is no alternative to the UNRWA and it is indispensable.

Geopolitics: Other

North Korea is ready for another military satellite launch thanks to Russia’s technological support, according to Yonhap citing South Korea’s spy agency. Furthermore, the report noted that North Korea sent 4,000 workers to Russia this year, while certain high-ranking military officials and troops deployed to Russia might move to the frontline.

Pentagon reportedly suffers from a shortage of air defense missiles due to growing demand and fears running out of interceptor missile stockpile, while the shortage jeopardises US interests in the Pacific, according to WSJ

US Event Calendar

08:30: Sept. Retail Inventories MoM, est. 0.5%, prior 0.5%

Sept. Wholesale Inventories MoM, est. 0.1%, prior 0.1%

08:30: Sept. Advance Goods Trade Balance, est. -$96b, prior -$94.3b

09:00: Aug. S&P/Case-Shiller US HPI YoY, prior 4.96%

S&P/CS 20 City MoM SA, est. 0.20%, prior 0.27%

S&P CS Composite-20 YoY, est. 5.10%, prior 5.92%

10:00: Sept. JOLTs Job Openings, est. 8m, prior 8.04m

10:00: Oct. Conf. Board Consumer Confidence, est. 99.5, prior 98.7

Oct. Conf. Board Present Situation, prior 124.3

Oct. Conf. Board Expectations, prior 81.7

10:30: Oct. Dallas Fed Services Activity, prior -2.6

DB’s Jim Reid concludes the overnight wrap

Back from treetop climbing, zipwires over lakes, daredevil water slides, kayaking and a bolt-on trip to Woburn Safari Park. All good high wire training for the appraisal season that’s has now kicked off here at DB.

Talking of appraisals, it’s now only one week to go to the US election, with prediction, betting and financial markets increasingly leaning towards a Trump victory. Yesterday saw 10yr US yields rise +4.2bps, not helped by a pair of softer Treasury auctions, and despite an outsized -6% drop in oil prices. Elsewhere, the Trump Media and Technology Group rose +21.59% to its highest level since June and Bitcoin has traded at $71k overnight, also the highest level since June after being as low as 53k in the first week of September.

The momentum has shifted a reasonable amount over the last couple of weeks as FiveThirtyEight’s model still had Harris having a 54% probability of victory on October 15, but that’s since reversed and now Trump is a 54% probability to win. The recent Treasury sell-off also likely incorporates the increased probability of a Republican clean sweep, and potentially unconstrained fiscal power. The Republican sweep probability on Polymarket.com was at 28% as recently as October 4 but is now 48% as we type. Over 45 million people have already voted so one side probably already has some momentum, but we won’t of course know who until at least after the polls close next Tuesday night.

It’s very rare to see such a big rise in US yields on a day that oil fell as much as it did (-6.09% for Brent) after Israel’s strikes on Iran on Saturday were focused on military targets rather than any oil facilities. The fall in oil, which was the largest since August 2022, did help drive broad gains for the S&P 500 (+0.27%) with 70% of its constituents higher on the day. The index is now less than 1% away from its last all-time high on October 18. The notable exceptions from the positive mood were energy (-0.65%) and information technology (-0.07%) stocks. The latter came as the Mag-7 (-0.13%) saw a slight decline, mostly due to Tesla (-2.48%) losing some ground after its impressive gain last week. By contrast, the Russell 2000 (+1.63%) posted a solid advance, while the KBW Bank index (+2.15%) rose to its highest level since March 2022. In Europe, the STOXX 600 (+0.41%), the CAC 40 (+0.79%) and the DAX (+0.35%) were also comfortably higher. Attention will swiftly turn to earnings now, including Alphabet due after the US close today.

The moves in Treasuries were fairly uniform across the curve with 2yr yields +3.4bps higher, leaving 2 and 10yr yields at their highest levels since August 1 and July 24, respectively. 10yr real yields (+4.2bps) also moved up to a three-month high of 1.99%. The bond move wasn’t helped by a pair of slightly soft Treasury auctions. A 2yr auction saw the highest primary dealer take-up since December, while 5yr notes were issued +1.6bps above the when issued yield with the primary dealer take up the highest since May. So some signs of investors being more price sensitive in their exposure to Treasuries. Showing how this was perhaps more of a fiscal story or supply story yesterday, rather than an inflation one, at least as a first order effect, the US 2yr inflation swap was down -3.1bps to 2.40%, and of course helped by the slump in oil.

Moreover, with expectations of looser fiscal policy, that’s led investors to keep dialling back how many rate cuts they expect from the Fed next year, and markets are now pricing in their most hawkish path since the market turmoil kicked off back in the summer. For instance, the rate priced in for the December 2025 meeting moved up to 3.54%, having been as low as 2.78% back in mid-September.

Staying with fiscal policy, the Treasury’s latest borrowing estimates were issued late in the US session. This saw borrowing estimates of $546bn for Q4 (down from the previous $565bn estimate) and $823bn for Q1 2025, both of which were somewhat smaller than our rates strategists’ expectations. So a bit better news for bonds but one that awaits a new President.

With a Trump victory increasingly being priced in by markets, this is leaving the current market dynamic in a pretty different place to 2016. Back then, Trump was widely considered the underdog across prediction models and betting markets. So given his victory came as a big shock, it was hardly surprising there was a significant market reaction, with Treasury yields surging over the days afterwards, as the 10yr yield rose by over 40bps over the next three sessions. But this time around, the impact is being increasingly priced in already, so using that 2016 playbook carries risks given the different context, as it’s difficult to believe a Trump victory would be a major surprise in the same way. On that topic, Henry put out a note yesterday thinking about how the market reaction might play out based on previous elections.

Talking of fiscal yet again, back in Europe, attention is increasingly turning towards tomorrow’s UK budget, and gilts continued to underperform their counterparts in Europe ahead of that. For instance, the 10yr gilt yield was up +2.1bps to 4.25%, and the spread of 10yr gilt yields over bunds bounced back to 197bps, less than 1bp from last week’s peak that was the widest spread in the last 12 months. By contrast, yields across the rest of Europe moved lower, including those on 10yr bunds (-0.5bps), OATs (-3.3bps) and BTPs (-1.8bps).

Overnight Asian equity markets are relatively quiet and mixed. The Nikkei (+0.64%) is rising for the second consecutive session, and the S&P/ASX 200 (+0.34%) is also up. Chinese stocks are generally underperforming with the CSI (-0.60%) and the Shanghai Composite (-0.65%) both in negative territory, but with the Hang Seng (+0.38%) breaking higher as we type after being as high at +1% at the open but in negative territory by lunchtime. The KOSPI and US equity futures are flat. US Treasury yields have fallen back around -1.5bps across most of the curve this morning.

Early morning data from Japan showed a fall in the unemployment rate from 2.5% to 2.4% in September, along with a slight increase in the job availability ratio to 1.24, indicating strong labour demand.

In FX, the Japanese yen (+0.20%) is recovering from a multi-month low against the dollar, trading at 152.95. Meanwhile, Yuichiro Tamaki, leader of the Japan Democratic Party for the People (DPP), has opposed further rate hikes by the Bank of Japan (BoJ) following strong election results over the weekend.

To the day ahead now, and data releases in the US include the JOLTS job openings for September and the Conference Board’s consumer confidence for October. Meanwhile in the UK, there’s mortgage approvals for September. Otherwise, earnings releases include Alphabet, Visa, McDonald’s and Pfizer.

Tyler Durden

Tue, 10/29/2024 – 08:18