Tesla Soars After Unexpected Jump In Profit Margin Suggests Price War Is Over

Ahead of today’s Tesla earnings report, UBS analyst Joe Spak asked whether Tesla numbers even matter this quarter after the Robotaxi reveal, which disappointed markets. His response is that while they should matter more, Tesla is really about the future/multiple, not the current EV biz (which drives numbers). Of the number that will be report, auto gross margins ex credits remains “the” metric investors follow, and feedback indicates buyside expectations are for flat-to-slightly-higher quarter over quarter (consensus +30bp q/q to 14.9%).

Joe is also looking for an update on Model 2.5 for next year (doesn’t seem to be a focus) and any more Robotaxi details. Additionally, Bloomberg notes that Tesla could give an update on its more affordable vehicle platform today. Earlier this year, Musk said a low-cost model could start production in the first half of 2025.

Analysts were hoping for an update during the company’s robotaxi event earlier this month, but there was no mention of the platform. Tesla hasn’t shared key details about the vehicle, including price and what it would look like. At the same time, Musk has repeatedly said that Tesla is becoming more than just a car company, as it increasingly focuses on artificial intelligence.

As a reminder, Tesla’s third-quarter deliveries rose for the first time this year, but the automaker has an uphill climb to break even for 2024. In 2023, Tesla sold around 1.8 million units; as of the third quarter, 2024 sales stood at just under 1.3 million units. So Tesla will have to sell 514,000 units in 4Q to break even – which is 30,000 EVs more than were sold in 4Q 2023, the company’s all-time peak quarter.

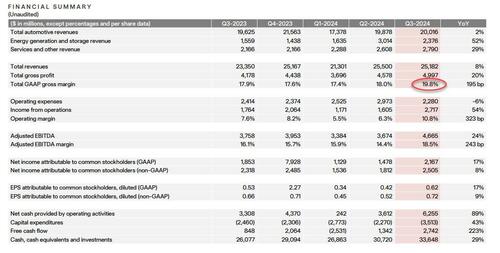

So with that in mind, this is what Tesla just reported for Q3:

Revenue $25.18 billion, missing estimate $25.43 billion

Adjusted EPS 72c, beating estimate 60c (Bloomberg Consensus)

Gross margin 19.8%, beating estimate 16.8%

The all-important automotive gross margin ex-credits, jumped to 17.1%, beating estimates of 14.9%, and up from 14.6% in Q2

Operating income $2.72 billion, beating estimate $1.96 billion

Free cash flow $2.74 billion, beating estimate $1.61 billion

Capital expenditure $3.51 billion, beating estimate $2.56 billion

And visually:

It is notable that while revenues rose 8%, if came in just shy of expectations, Tesla recognized $739 million, in regulatory credit revenues, the second highest quarter in history “as other OEMs are still behind on meeting emissions requirements.”

But the biggest highlight by far is Tesla’s ability to boost margins – both gross and automotive ex-credits – substantially higher YoY and also higher than expected, signaling that Tesla’s “race to the bottom” to steal market share is once again over, and the company is once more focusing on harvesting the benefits of its recent market share gains.

Commenting on the margin line item, Bloomberg notes that if you strip out the reg credits, “Tesla’s saying that profit is being boosted by lower cost per vehicle in terms of production and materials. Energy generation and energy storage is now also starting to perform better.”

One more thing to point out is that the company also commented on “higher FSD revenue recognition YoY for releases related to Cybertruck” and a new feature – Actually Smart Summon (basically you hit a button in the app while your car is on other side of a parking lot and it’s supposed to drive to you). In other words, Tesla is telling is saying that people are paying for this software, and they are listing it as a positive contributor to profit.

Some more good news: Tesla said its Cybertruck has reached profitability for the first time, thanks in part to increases in production for the futuristic pick-up truck.

Turning to Tesla’s outlook, the highlight was the company’s discussion of Volume, where it said the following:

Our company is currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and we believe the next one will be initiated by advances in autonomy and introduction of new products, including those built on our next generation vehicle platform.

Just as important, turning to Tesla’s product outlook, the company said that its “plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025. These vehicles will utilize aspects of the next generation platform as well as aspects of our current platforms and will be able to be produced on the same manufacturing lines as our current vehicle line-up.”

This approach, the company says, “will result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This should help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 50% growth over 2023 production before investing in new manufacturing lines.“

Speaking of auto production, we already said that while Q3 was a solid quarter with 6% growth in total deliveries, it will be up to Q4, when Tesla must sell over 510,000 units to break even vs 2024, which is 30,000 EVs more than were sold in 4Q 2023.

And “despite ongoing macroeconomic conditions,” Tesla expects to achieve slight growth in vehicle deliveries in 2024. This is bullish and indicates that 2024 may be yet another record delivery year for the carmaker.

Elsewhere, the energy business is still going strong, reaping in “a record gross margin” during the quarter. Powerwall deployments set a record for the second straight quarter while the ramp up of Powerwall 3 continues.

Looking at Tesla’s investor deck, we find that the next-generation platform will have a powertrain with an efficiency of 5.5 miles per kWh. Lucid, one of Tesla’s competitors, proclaims that it has the world’s most efficient car – the Lucid Air Pure – that can achieve about 5.0 miles per kWh. Of course, the Lucid vehicle is available now, and Tesla’s next-generation platform may be years away.

Those looking for some more details on what may be the company’s biggest value proposition, there was just a single, indirect reference to the future ride-hailing business in the deck. Tesla says:

“At our ‘We, Robot’ event on October 10, we detailed our long-term goal of offering autonomous transport with a cost per mile below rideshare, personal car ownership and even public transit.”

So anyone hoping for more details here, will be disappointed for at least a few more months although we are confident Elon will tease much more in the interim.

Finally, there was this blurb documenting the company’s transition into an AI giant:

“We deployed and are training ahead of schedule on a 29k H100 cluster at Gigafactory Texas – where we expect to have 50k H100 capacity by the end of October.”

Putting it all together, and the company stock is surging after hours, rising almost 9%, to a huge of $234.89 after closing at $213.65. If this sustains, Tesla is will gain about than $60 billion in market value, which would be the biggest gain since July 2.

Here is the full investor presentation (pdf link)

Tyler Durden

Wed, 10/23/2024 – 16:37