Red Sweep Or Tariff Trouble

By Stefan Koopman of Rabobank

The U.S. presidential election is increasingly becoming the main market focus as the date inches nearer. Polls still show no clear favorite, but market sentiment seems to be shifting in favor of Donald Trump. With the Harris honeymoon officially over, the Trump trade is gaining traction again. This view holds that a Trump win, and a Red Sweep in particular, would be bad for bonds, the euro, the yen, the yuan, and the peso, but a boon for stocks, especially in sectors like financial services, oil, and cryptocurrencies, where tax cuts and deregulation would boost profitability. The thinking goes that less regulation means higher margins, and lower taxes mean more money flowing back to investors.

Trump’s campaign highlights big ideas: tax cuts, deregulation, and tariffs. Investors are zeroing in on the first two, eagerly anticipating another corporate tax windfall against a backdrop of a U.S. economy that’s already doing well. Recent data has been stellar, and the S&P 500 has surged to a fresh high of 5,864, and on top of this traders are rotating into those sectors expected to gain from a potential Red Sweep. Yet this optimism assumes Trump will deliver only the market-friendly aspects of his agenda. In reality, that “most beautiful word in the dictionary” could create significant disruptions.

Back in 2018, trade policy primarily targeted China, with some collateral damage in Europe and Mexico. This time, his proposed tariffs are far more extreme than anything he did during his first term. Unless suppliers have significant profit margins to play with, it is highly likely inflate prices across the economy. We indeed do forecast a renewed rise in US inflation to above 4% at the end of 2025, which would stop the Fed from cutting rates much sooner than the market currently prices. Note too that we’ve kept it very modest with our tariff assumptions.

Moreover, Trump’s immigration plans, which involve the deportation of millions of workers, would create severe labor shortages. In industries already struggling with tight labor markets, this would fuel wage inflation and reduce productivity, pushing prices higher and reducing potential GDP growth. Any economic gains from tax cuts and deregulation would be offset by the broader damage caused by untargeted and indiscriminate tariffs and widespread labor shortages. Trump’s idea that his tariffs will fund his tax cuts is fundamentally flawed, as tariffs mainly transfer surplus from consumers to producers, but don’t generate sustainable long-term revenues.

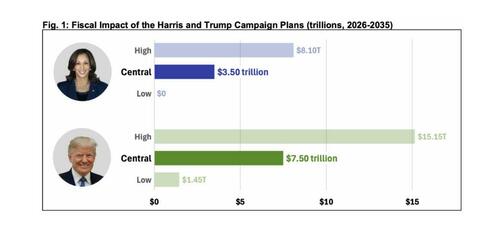

The deficit is also a looming issue. Trump’s proposals could increase the federal debt by up to $7.5 trillion over a decade, at a time when the U.S. economy is already running a deficit of around 7% of GDP.

This would force the government to allocate a larger share of its budget to servicing debt. Although this debt is mostly held by U.S.-based investors, it would further strain the federal budget. It also limits options for countercyclical fiscal policy, particularly in a world where interest rates are no longer pinned to zero and each new dollar of debt tends to generate less growth.

Meanwhile, the contrast between the U.S. and Europe could not be starker. While the U.S. economy powers ahead, Europe is stagnating. Friday’s ECB Survey of Professional Forecasters shows that long-term growth expectations are at an all-time low of 1.3%, with structural issues such as poor productivity, demographic decline, and over-regulation holding back economic potential. This can’t be solved with a couple of rate cuts. Europe’s growth model is broken, and without at least part of the significant investment and reforms that Draghi suggested, it will be condemned to “slow agony”. The big question remains whether Europe has the leadership, money, and willpower to make the necessary changes. If Trump is indeed re-elected, we’ll find out soon enough.

Tyler Durden

Mon, 10/21/2024 – 11:45