Final Q2 GDP Beats Estimates On Inventory, Government Boosts; Second Half 2023 Revised Lower

Nobody will care about today’s final revision of the Q2 GDP print for the simple reason that the quarter ended almost exactly three months ago, and from a fundamental standpoint, the only number that matters now is the third quarter, which will be unveiled in a few weeks time. What matters more is that as noted last night, today’s annual update for the National Economic Accounts, which include the National Income and Product Accounts (NIPAs) and the Industry Economic Accounts (IEAs). The update includes revised estimates for the first quarter of 2019 through the first quarter of 2024 and resulted in revisions to GDP, GDP by industry, GDI, and their major components.

We will dig into that in a second, but first, a quick scan on what the Bureau of Economic Analysis reported for its final Q2 GDP estimate: Q2 GDP (final estimate) grew 3.0%, unchanged from the second estimate and higher than the 2.9% consensus estimate.

The second quarter primarily reflected increases in consumer spending, inventory investment, and business investment. Imports, which are a subtraction in the calculation of GDP, increased.

The increase in consumer spending reflected increases in both services and goods. Within services, the leading contributors to the increase were health care, transportation services, and housing and utilities. Within goods, the leading contributors to the increase were motor vehicles and parts and furnishings and durable household equipment.

The increase in inventory investment was led by increases in retail trade and wholesale trade industries that were partly offset by a decrease in mining, utilities, and construction industries.

The increase in business investment primarily reflected an increase in equipment (led by transportation equipment).

Compared to the first quarter, the acceleration in real GDP in the second quarter primarily reflected an upturn in inventory investment and an acceleration in consumer spending that were partly offset by a downturn in housing investment.

Taking a closer look at the components we find the following breakdown:

Personal Income contributed 1.90% of the bottom line 3.00% GDP print, down from 1.95% in the second estimate

Fixed Investment also contributed less than expected, or 0.42%, vs the 0.53% previous estimate

The change in private inventories was a big boost, and in the final revision it added 1.05% or over a third of the bottom line GDP print, up from 0.78% estimated previously

Net trade (exports less imports) ended up being a bigger detractor from the bottom line print, subtracting 0.89%, vs 0.77% previously.

Finally government, that staple of the Biden administration, contributed more than initially expected, adding 0.52% to the bottom line GDP, up from 0.46%.

In summary, today’s print was a nothingburger. What was more important was the data revisions to historical prints, starting in Q1 2019 and going through Q4 2023 and which according to Goldman would wipe out as much as 0.4% to GDP. So what did the data show?

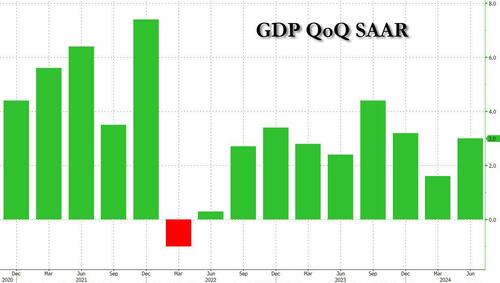

Well, as shown in the pre/post revisions chart below, there was certainly notable revisions to GDP prints, especially in the second half of 2023, where Q3 GDP was cut from 4.9% to 4.4%, and Q4 was trimmed from 3.4% to 3.2%, yet previous quarters were unexpectedly revised higher, starting with Q4 2022 and rhough Q2 2023. Also notable is that much of 2020 and 2021 were revised higher as the BEA now sees a stronger rebound from the covid shock. Lastly, what was amusing, is that the BEA decided to revise the Q2 2022 GDP print from negative (-0.6%) to positive (0.3%) effectively voiding the technical recession that took place in the first half of the year when GDP contracted for two consecutive quarters.

In short: yes, there were downward revisions, but these were interspersed with a bunch of upward revisions by the BEA, which means that GDP remains quite meaningless as an indicator. And how could it be otherwise, when the Fed just started its most aggressive easing cycle after a quarter in which the US economy allegedly grew 3%.

Tyler Durden

Thu, 09/26/2024 – 09:35