The Coming Shift In World Trade

Authored by Jeffrey Tucker via The Epoch Times,

In July of 1944, a year and some months before the official end to the Second World War, allied powers gathered at the Bretton Woods Hotel in New Hampshire to hammer out a new economic order that would dominate the world at war’s end.

The meeting alone expressed great confidence in a coming victory. They were not wrong.

As part of the new plan for the world, a new monetary system would take shape. It would be based in gold, with the dollar convertibility guaranteed at 1/35 an ounce. The right to convert would not be available to average people. It was something guaranteed by nation states and central banks alone, at least those allowed to participate.

In the early days of the conference, the New York Times (NYT) editorialized against the scheme. The pen behind the unsigned editorials was the great economist Henry Hazlitt, who would later gain fame for his book “Economics In One Lesson,” which became one of the best-selling economics books of the century. In fact, it still sells well today.

Hazlitt criticized the proposed new monetary system. He said that by making the dollar the world reserve currency, and guaranteeing convertibility into gold only by large trading nations, the new system could not last. This is because there was no mechanism to police nations’ fiscal and monetary policies. The new system would enable endless expansion of money and credit abroad without consequence. The United States would experience, eventually, a devastating gold outflow. At some point in the future, he predicted, the United States would have to suspend convertibility.

This is precisely what happened, not right away but eventually. In 1971, Richard Nixon stopped the system whereby the United States shipped out gold. He did so to save the system, and bring about a new one. The expectation was that gold would fall in price. The opposite happened. Eight years later, the price had reached $850. The people who bet against the monetary elites were the winners.

There is a backstory to Hazlitt’s writing at the NYT. His brilliant editorials against the Bretton Woods system appeared weekly, and were later collected in a book called “From Bretton Woods to World Inflation.” The publisher of the NYT at some point in 1944, just before the system was ratified, came to Hazlitt and said that the paper would change its editorial stance. It would need to favor and not oppose the new system. At that point, Hazlitt realized that his 10-year tenure at the paper was at an end. He packed up, went home, and started working on a new book that became “Economics in One Lesson.” Writing it took not even two weeks.

I’ve been visiting Hazlitt’s writing from this period as a way to understand the present moment. It’s clear that the elites in those days were setting up a new global machinery. In designing such a system—John Maynard Keynes from the UK was the primary influence—there were several moving parts. There was the monetary system as described above. There was to be a transaction clearing system administered by a new World Bank, the remnants of which survive in the Special Drawing Rights (SDRs) today. There was a financing system in the form of the International Monetary Fund. And there was a new trade system called the General Agreement on Tariffs and Trade (GATT), which later became the World Trade Organization.

These four moving parts—money, clearing, lending, and trading—were designed to work together as if this entire world economy was a machine to be managed, which is precisely how Keynes thought of it. Hazlitt’s objection was that the system was too clever by half, because it could not account for market and political exigencies. It’s one thing for something to work on paper; it’s something else for it to work in reality.

He saw through the problem that the new system did nothing to discipline governments that were party to the deal. He predicted that all governments would take advantage of the opportunity to exchange in reckless fiscal and monetary policies while free riding against the rich nations that were guaranteeing the system against failure.

He was right about this eventually but, in the meantime, the world economy did take a new direction toward what was later called neoliberalism, a managed system that exalted freedom in international trade and fiscal and monetary liquidity above all else.

Why was the system set up this way? The reason is that an entire generation of what were known as enlightened diplomats had become convinced that depression and war (1930s and 1940s) stemmed from trade protectionism and too many monetary guardrails that prevented states from flooding the system in times of crisis.

In other words, the system of 1944 was established mainly to backwards fix what its architects saw as the main problems of the previous two decades. This is human nature. If you live through a house fire caused by an electrical spark, you are going to be extra careful about the soundness of wiring in the future. If your health has failed you for reasons of a bad diet, you are going to be more careful in the future to eat right. And so on. They were more focused on fixing old problems than anticipating new ones.

Thus did the world of the 1950s and 1960s proceed with these fixes in place. The results were spectacular by any historical standard, especially for the United States. But remember Hazlitt’s prediction that the new system would not provide discipline to states in the matter of fiscal and monetary policy. As it turned out, the leading offender in this regard was the United States, which embarked on the Vietnam War at the same time it blew out its provisions in the welfare state. That led to unsustainable economic tensions.

Meanwhile, the trading system that depended entirely on a gold-based settlement system started to flow only one way, which was out. That system broke down as the welfare-warfare state blew up, and finally Nixon put an end to it. In making that decision, he also made a choice to preserve the low-tariff global trading order over the monetary shackles that had hemmed in some element of monetary discipline.

With all limits now removed, inflation took its toll, exactly as Hazlitt predicted. The United States experienced three successive waves in the 1970s, each worse than the last. That excess was finally stopped with the reign of Paul Volcker at the Fed and the presidency of Ronald Reagan, who had promised to control the fiscal side. And yet: there was a Cold War to win, and the Reagan administration too had to make a choice between a balanced budget and its foreign-policy priorities.

Without marching through the policy errors of the following three decades, let us jump ahead to 2016 during a time when (as could have been predicted) the United States has lost vast amounts of its manufacturing sector to foreign competition due to the very system set up in the Nixon era, not to mention victory in the Cold War which opened up a new swath of the world to productive competition with the United States. The new president Donald Trump swore to end the problem, and how? By blowing up the GATT which had been newly labeled the World Trade Organization.

In other words, Trump took a different tact from Nixon: he sought to patch a trade problem with a very old-fashioned system that had been wholly rejected back in 1944. Again, Hazlitt predicted something exactly like this in his writings, as he explained that nations with undisciplined fiscal and monetary problems, operating in a world without domestic convertibility, are bound to suffer monetary outflows and a deprecation of their production base due to foreign competition.

As a result of Trump’s efforts, which were not reversed by the Biden administration, the system of 1944 now lies in ruins with governments around the world newly experimenting with regional trading systems, tariff policies, and even new systems of settlement that could someday unseat the dollar as the world-reserve currency.

In the meantime, the United States has a major problem. Without dramatic domestic reform, it simply cannot compete on the world stage. This is because the U.S. debt avalanche has assisted in boosting the industrial buildup around the world even as the high-value international dollar makes imports cheap and exports expensive with no settlement system in place. This not only leads to perpetual trade deficits but massively subsidizes imports over domestic goods.

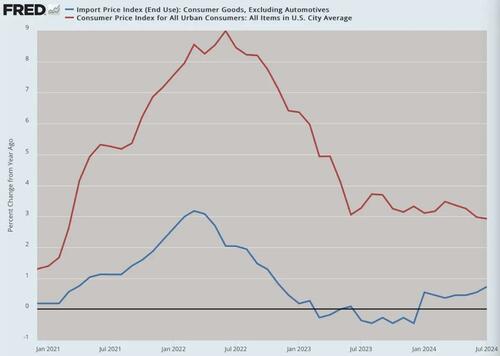

In the last four years of inflation, the U.S. dollar has maintained its strength internationally while decaying domestically. As a result, imports have not suffered nearly as much in inflation as domestic goods, which only entrenches the problem.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

What we are watching now is the final unraveling of the system of 1944 in all its parts, including the tweak of 1971, which introduces grave dangers to the world of both depression and war. The way out of this predicament is not another cockamamie world order constructed by another globalist economic guru like Keynes.

We need a simple return to fiscal and monetary soundness. Above all else, the United States must get its own house in order, with balanced budgets and sound money, even if that means letting go of its imperial ambitions abroad. That is the best and probably only path to restarting the beautiful ambition of a free-trade world.

Tyler Durden

Sat, 09/14/2024 – 08:10