One In Five Student Loan Borrowers Avoid Making Payments: Report

Authored by Bill Pan via The Epoch Times (emphasis ours),

One in five borrowers with outstanding student loans have made no payments, as many hold out for potential debt relief, a recent survey reveals.

The survey, published on Sept. 5 by Intuit Credit Karma, found that 20 percent of student loan borrowers said they have yet to make any payments on their loans. This figure rises to 27 percent among borrowers with a household income of less than $50,000.

More than half (55 percent) of respondents reported being unable to afford their student loan payments, while nearly half (49 percent) said they feel “financially unstable.”

The survey underscores the financial strain faced by borrowers, with affordability challenges largely attributed to the high cost of living (69 percent). Many loan holders said they are forced to make difficult trade-offs, with 38 percent saying they are falling behind on other bills—such as auto loans, mortgages, or credit card payments—to meet their student loan obligations. Additionally, 39 percent of borrowers said they are prioritizing paying off higher-interest debt over their student loans.

The report also highlights the difficult financial situations of younger borrowers. Notably, 44 percent of Gen Z and 41 percent of millennial borrowers said they have depleted their savings to manage student loan payments. Overall, about one-third (34 percent) of all borrowers surveyed reported having $0 in savings.

Borrowers who haven’t been making payments should be on high alert, as their credit scores could be impacted once the federal government’s “on-ramp” grace period ends, the survey warns.

During this one-year transition period, payments are due and interest accrues, but missed payments won’t be considered delinquent, placed in default, or reported as such to creditors or debt collectors.

When the grace period ends on Sept. 30, borrowers will again face the usual consequences of missed payments, including default. Defaulting on a loan can damage one’s credit score and may result in the federal government garnishing wages, seizing tax returns, and intercepting Social Security benefits.

The survey suggests that some borrowers appear to have taken “irresponsible advantage” of the soon-to-expire relief. About one in seven (15 percent) of those who have not been making consistent on-time payments admitted they were intentionally avoiding payments, knowing their credit scores would not be impacted during the grace period.

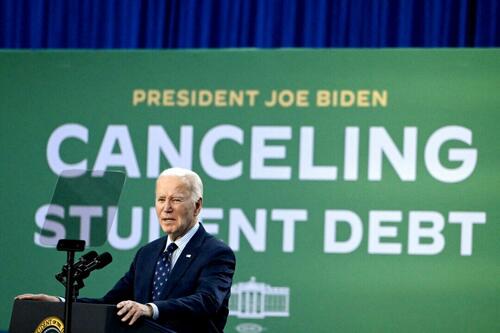

“With Biden’s SAVE plan in limbo, many borrowers face uncertainty about whether they will benefit from lower monthly payments and a clear path to loan forgiveness,” said Courtney Alev, a consumer financial advocate at Intuit Credit Karma, referencing the Biden administration’s income-driven repayment plan currently blocked by court orders.

“While it’s understandable to hope for potential loan forgiveness, borrowers shouldn’t rely solely on it,” Alev said in the survey release. “Those struggling to make payments should proactively reach out to their lenders to explore available options.”

The SAVE plan was designed to reduce monthly payments for borrowers and accelerate the path to having their balance discharged. Approximately 7.5 million borrowers have already signed up for the SAVE plan, and 150,000 have had their debt erased.

Two groups of Republican state attorneys general challenged the plan in two federal district courts. They argued that the Biden administration lacks the legal authority to implement the plan and that it contradicts the U.S. Supreme Court’s decision last summer that struck down an earlier attempt at large-scale student loan cancellation.

On Aug. 28, the Supreme Court denied the Biden administration’s emergency request to temporarily reinstate the SAVE plan. This is not a final ruling, and either or both cases could return to the high court once the federal appeals courts rule on the merits of the dispute.

The survey was conducted online within the United States by Qualtrics on behalf of Intuit Credit Karma between Aug. 3 and Aug. 19 among 1,995 adults ages 18 and older with outstanding student loan debt.

Tyler Durden

Tue, 09/10/2024 – 17:15

Recent Comments