Mapping The Shocking Purchasing Power Disparity Of $100 In Each US State

While $100 may seem like it holds the same value across the U.S., that’s far from the reality. The purchasing power of a dollar can vary significantly from state to state, influenced by factors such as the cost of food, utilities, taxes, housing, and transportation.

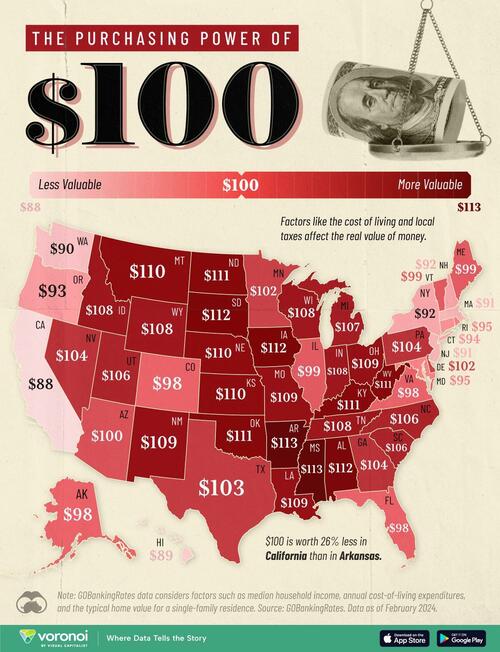

This map, via Visual Capitalist’s Bruno Venditti, illustrates the purchasing power of $100 by state, using data from GOBankingRates compiled as of February 19, 2024.

Methodology

GOBankingRates compiled data from the 2022 Regional Price Parities reoporting by the U.S. Bureau of Economic Affairs. It then used factors such as median household income, sourced from the 2022 American Community Survey, annual cost-of-living expenditures, sourced from the Bureau of Labor Statistics, and typical home value for a single-family residence, sourced from Zillow.

Money is Less Valuable in California

The purchasing power of $100 can vary by as much as 26% from state to state.

California has the lowest purchasing power ($87.50), while Arkansas has the highest ($113.40).

StateReal Value of $100

California$88

Hawaii$89

Washington$90

Massachusetts$91

New Jersey$91

New York$92

New Hampshire$92

Oregon$93

Connecticut$94

Maryland$95

Rhode Island$95

Colorado$98

Florida$98

Virginia$98

Alaska$98

Illinois$99

Vermont$99

Maine$99

Arizona$100

Delaware$102

Minnesota$102

Texas$103

Nevada$104

Pennsylvania$104

Georgia$104

Utah$106

North Carolina$106

South Carolina$106

Michigan$107

Wisconsin$108

Wyoming$108

Tennessee$108

Indiana$108

Idaho$108

Ohio$109

Missouri$109

New Mexico$109

Louisiana$109

Montana$110

Kansas$110

Nebraska$110

Kentucky$111

West Virginia$111

Oklahoma$111

North Dakota$111

Iowa$112

South Dakota$112

Alabama$112

Mississippi$113

Arkansas$113

National Average$103

Among the states where money has the least purchasing power are Hawaii, Washington, and Massachusetts.

On the other hand, Iowa, North Dakota, and Oklahoma join Arkansas as states where $100 stretches further.

To see more content about money, check out this graphic that ranks the 10 best U.S. states to retire in as of 2024.

Tyler Durden

Sun, 09/08/2024 – 21:35