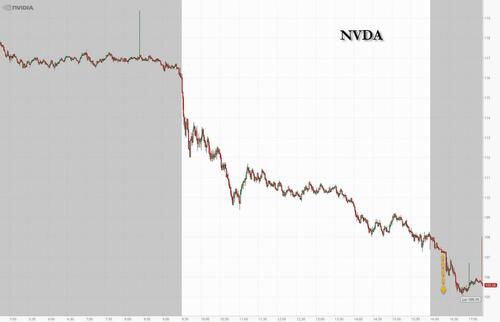

Adding Insult To Margin Calls, Nvidia Receives DOJ Subpoena Making Record Price Drop Even Worse

In what may be described as an attempt to sabotage her own election odds, moments after the close Bloomberg reported that Kamala Harris’ Justice Department – because let’s be honest, Joe Biden is officially a vegetable – sent subpoenas to Nvidia and other companies as it seeks evidence that the chipmaker violated antitrust laws, an escalation of its investigation into the dominant provider of AI processors, in the process sending the stock prices sliding even more.

The DOJ, which had previously delivered questionnaires to companies, is now sending legally binding requests that oblige recipients to provide information, Bloomberg reported citing sources. That takes the government a step closer to launching a formal complaint against a company, which may well have its flaws but monopolizing the industry, when its competitors such as Intel are simply criminally incompetent, is not one of them.

According to antitrust officials, Nvidia is making it harder to switch to other suppliers and penalizes buyers that don’t exclusively use its artificial intelligence chips. Which is idiocy: if anything, it is the capabilities of Nvidia chips that are forcing every tom, dick and harry to order one even if the chatGPT idiocy is nowhere near the paradigm shifting discovery idiots on TV make it seem to be. Meanwhile, all Nvidia is doing is sitting back and capitalizing by selling the “picks and shovels” to those same idiots who in about a year will realize that they spent millions on chips to power chatbots that generate zero returns.

Nvidia shares, which already suffered a record-setting rout on Tuesday when they lost a historic $280 billion in market cap, fell further in late trading after Bloomberg reported on the subpoenas, bringing its total drop today to $340 billion!

Some speculated if the idiots that are runnings Kamala’s campaign are now intentionally looking to sabotage her election odds by crashing the market-leading generals ahead of the November elections.

Kamala’s admin crashing the market by destroying the most important stock in the world 2 months before the election is a bold strategy. https://t.co/KbYeegquMr

— zerohedge (@zerohedge) September 3, 2024

As part of the probe, investigators have been contacting other technology companies to gather information. The DOJ’s San Francisco office – where one Kamala Harris was Attorney General not that long ago – is taking the lead running the inquiry.

As Bloomberg reports, in the DOJ probe, regulators have been investigating Nvidia’s acquisition of RunAI, a deal announced in April. That company makes software for managing AI computing, and there are concerns that the tie-up will make it more difficult for customers to switch away from Nvidia chips. Regulators also are inquiring whether Nvidia gives preferential supply and pricing to customers who use its technology exclusively or buy its complete systems.

Nvidia CEO Jensen Huang has said he prioritizes customers who can make use of his products in ready-to-go data centers as soon as he provides them, a policy designed to prevent stockpiling and speed up the broader adoption of AI.

While the stated reason for the DOJ probe is laughable, what is far more likely is that in typical Democrat fashion, the administration is making it clear it will get its pound of flesh in bribes, kickbacks and penalties, from what is at the moment, the world’s most important company. Analysts project that Nvidia will generate over $120 billion of revenue in calendar 2024, up from $16 billion in 2020, with most of that money coming from its data center unit. In fact, Nvidia is set to bring in more profit this year than the total sales of its nearest rival, Advanced Micro Devices. As for one-time chip giant icon Intel, well… rest in peace.

Tyler Durden

Tue, 09/03/2024 – 17:25