Does It Matter To The Market Who Wins The White House?

During election years, the focus is on the political horse race.

However, after the final poll closes, how have the market and the economy performed under both Democrat and Republican presidents?

In this graphic, Visual Capitalist partnered with New York Life Investments to explore stock market performance, consumer outcomes, and corporate sentiment across each presidential party.

Democrats vs. Republicans: Stock Market Performance

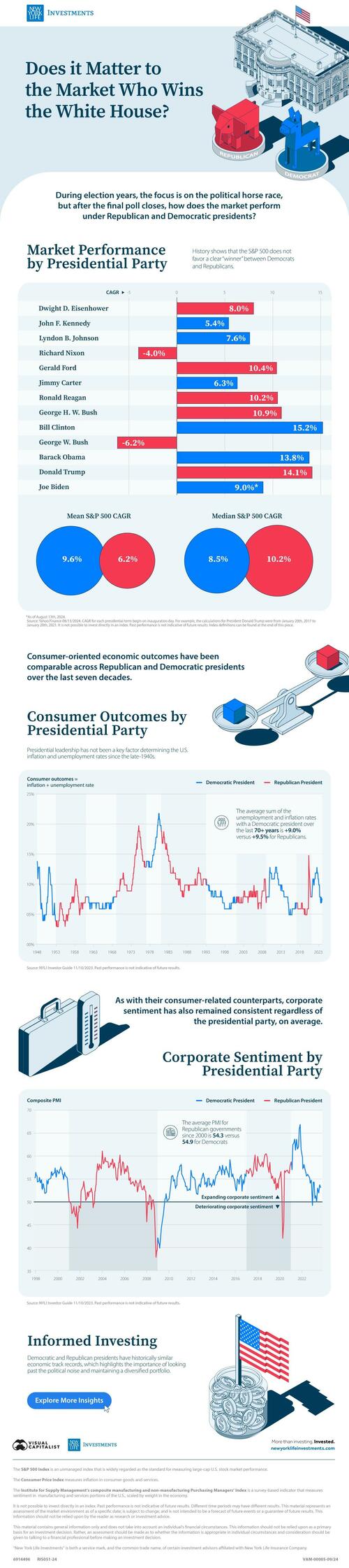

History shows that the S&P 500 does not favor a clear “winner” when it comes to the political party of sitting presidents.

The mean compounded average annual growth rate (CAGR) with Democratic presidents is slightly higher than with Republican presidents. Median performance, however, is higher under Republican presidents.

To date, former President Clinton (D) (+15.2% CAGR) and former President Trump (R) (+14.1% CAGR) have seen the largest stock market gains among past presidents on record.

Democrats vs. Republicans: Consumer Outcomes

Like the S&P 500’s performance, presidential leadership has not been a key factor in determining the inflation rate and unemployment rate in the U.S. since the late-1940s.

The sum of the nation’s inflation rate and unemployment rate together provide a measure of consumer “pain” in the economy.

The average sum with a Democratic president over the last 70+ years is +9.0% versus +9.5% for Republicans.

Democrats vs. Republicans: Corporate Sentiment

As with their consumer-related counterparts, corporate sentiment has also remained consistent regardless of the presidential party, on average.

The Purchasing Managers’ Index (PMI) provides a measure of business sentiment in the economy. A score of below 50 represents deteriorating sentiment and a score of above 50 means sentiment is improving.

The average PMI under Republican presidents since 2000 is 54.3 versus 54.9 for Democrats—nearly identical and both in expansion terrain.

Informed Investing

Looking at past presidents, both Democrat and Republican, there have been roughly consistent market and economic track records. This highlights the importance of looking beyond the political noise and maintaining a diversified portfolio.

Tyler Durden

Sun, 08/25/2024 – 15:45