“If Trump Wins, The Fed Will Stop Cutting At 4.50%”

By Michael Every of Rabobank

We need it like a Jackson Hole in the head

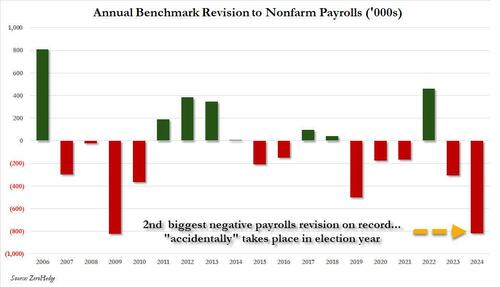

Unlike the key BLS revisions to April 2023-March 2024 payrolls estimates, at -818K the largest drop since the Global Financial Crisis, today’s Global Daily was released at the same time to all – nobody can call to get it early. Losing an average 68K from each monthly jobs report changes the macro picture; subtracting ‘migrant encounters’ starting in October 2020 as proxy for illegal immigration, the peak in cumulative post-Covid net payrolls growth was 7.23m in February 2023, then drifted lower, to just 6.38m as of July; or, does the BLS revision not matter because illegal arrivals are doing the jobs off book rather than US workers? But tell that to the US workers, if so.

Either way, I wear my “DM = EM” (developed markets = emerging markets) T-shirt and wish those thinking they know what’s going on in the US economy from looking at Bloomberg ‘good luck’. I’ve lived in and covered many EM, with eccentricities, conspiracies, and oddities: let’s see how those who’ve only lived in and covered DM cope if/as this structural shift continues.

Which includes the Fed. Their latest minutes show the vast majority of the FOMC opened the door to a rate cut in September, and a few were prepared to do it in July. Our Fed watcher Philip Marey has slightly revised his call ahead of tomorrow’s Jackson Hole central bank Powell-wow (which he previews). Philip still expects the Fed to start cutting in September, which he was saying while the market was screaming months randomly starting from “JANUARY!”. He still expects four 25bp cuts. However, he now thinks these will be in September, November, December, and January rather than stretched out until mid-2025. This is still due to “stag”, not “flation”. We were one of the first banks to forecast a US recession and remain one of the last to keep a mild recession pencilled in. Yet assuming Trump wins the election, the inflationary impact of his economic policies would force the FOMC to stop cutting at 4.50%. Most in the market are screaming lower Fed Funds levels randomly, starting from the figure which pushes asset prices up, or assuming the Fed will do it for them.

As the Financial Times asked yesterday, ‘Whatever happened to the wisdom of the bond market?’ While FX trades like an ADHD toddler who just ingested a 2-litre bottle of soda and a box of hard candy, and equities like a love-struck teenager who thinks a happy ending always looms, bonds are supposed to trade like a boring professor with a pipe. Yet due to algos, the 1987-2020 Greenspan of market time, and the post-2008 ego-trip where, like ugly politicians, bonds were surrounded by adoring crowds for the first time, now rates markets are all “RATE CUTS!”

In pandering to that, the Fed have arguably helped transmogrify the US from industrialised, with a vast middle class, vast open land, vast strategic strength, low public debt, and a low cost of living to financialised, with a shrunken middle class, unaffordable housing, fading strategic strength, high public debt, and a high cost of living. Likewise, the BLS changed from one that accurately measured payrolls (and other series) and knew how to release embargoed data on time, to one that doesn’t do either.

Meanwhile, in a US election cycle with eccentricities, conspiracies, and oddities word has it RFK, Jr. will drop out of the race and endorse Trump on Friday, boosting his odds. Wags have it for a senior admin role like the NIH or even the CIA(!) My suspicion is DM analysts will end up doing what good EM analysts have to re: such political machinations – a version of Fawlty Towers “Don’t mention the war!” But the key is still to understand what’s going on, even if it isn’t written about.

Yet in the EM Middle East, war must be mentioned. Days ago, DM market headline-writers were saying an Israel-Hamas ceasefire and hostage deal “was close”. Those who know the players and their motivations were saying it wasn’t; and at time of writing, it’s still more likely that these talks collapse than succeed. At which point, a regional escalation in the war is likely.

Israel says it has effectively defeated Hamas in Rafah, but it and Hezbollah are already launching larger attacks on each other deeper into new territory even as they wait for the official conclusion of the ceasefire talks one way or the other. Iran is also still waiting to launch its delayed retaliatory strike on Israel, and some are not ruling out Israel pre-empting that with an attack of its own. Of course, we’ve heard similar calls before of late, and it’s possible both sides might extend and pretend a while longer. Ultimately, however, this is not a geopolitical problem that can be solved with the strategic equivalent of “RATE CUTS!” That’s not how real life works; and eventually real life comes to bite those who rely on “RATE CUTS!” as solutions.

With global energy markets focused on sagging Chinese demand, it’s possible even a Middle East war might not have a lasting upwards impact on oil prices unless Iranian and Saudi supply, or the Straits of Hormuz, become involved. That’s not an immediate risk, but were a wider war to start, it’s not going to necessarily stop within a geography that pleases markets. That’s something DM analysts who have experienced little EM geopolitical ‘sharp end’ tend to be slow in pricing for.

To summarise, as DM central bankers meet up at Jackson Hole, they are unsure of the labor market outlook, with risks looking more in one direction – down.

They are unsure of the inflation outlook, with risks perhaps in both directions – up and down. They are unsure of the stability of financial markets after the recent lunatic swings prompted by just a 15bps move from the BOJ.

Moreover, they are unsure of the geopolitical outlook, which informs all of the aforementioned.

They will notice that China just opened an anti-subsidy probe into EU dairy and pork in retaliation for looming EU tariffs on Chinese EVs: welcome to how global trade now ‘works’! More of this to come: much more.

They must also have noticed the ultra-normcore WEF warning: “Make no mistake – the US-driven post-Cold War era ended a while ago (and realistically America’s 2024 election won’t change this). Enduring global leadership, democratic ideals, globalization and liberal values have all been notably challenged and superpowers are overstretched. This is a global legitimacy crisis… This period of muddling through means anything can happen in our post-pandemic era. Look for global risks to be further exacerbated by unexpected, destabilizing shock events.”

As such, any messaging from Powell that can be taken as either synonym or homonym for “RATE CUTS!”, prompting further volatility and financialisation-over-real-economy activity, is something we need like a Jackson Hole in the head.

Tyler Durden

Thu, 08/22/2024 – 09:25