Earnings Call Mentions Of “Consumer Downturn” Soar To Highest Level Since Financial Crisis

Goldman Sachs analyst Scott Feiler told clients this AM the consumer is experiencing a “noticeable slowdown, moderation, or whatever term we choose to use—it’s quite evident by now.”

Across industries—from luxury brands, airlines, and travel companies to fast-food chains, theme parks, and consumer goods companies—profit warnings and management teams have signaled that a consumer slowdown continues to gain momentum.

Low/mid-tier consumers seem to have reached their limit in absorbing price hikes on goods and services, thanks to depleted personal savings and maxed-out credit cards. This is due to a period of elevated inflation and high interest rates under failed Bideonomics.

The second quarter has displayed unmistakable signs of a consumer slowdown, with the latest credit card data from the Federal Reserve also indicating that some consumers have hit a proverbial ‘brick wall.’

For deeper insight into the views of management teams and the analysts who engage with white-collar execs on earnings calls, we’ve identified several key phrases regarding the consumer mentioned on earnings calls that provide a glimpse into the overall tone on Wall Street. Spoiler alert: the tone is not great.

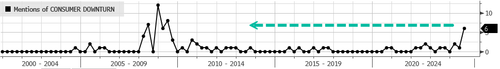

Let’s begin with the number of times “consumer downturn” was mentioned on earnings calls, spiking to six this earnings season, the highest level since GFC.

The number of times “cautious consumer” was mentioned 33 times, a record high.

“Consumer pressure” mentions still lingers near record highs.

“Consumer weakness” mentions surged again.

Talk of “low-income” consumers remains extremely elevated.

Conversations about “credit card debt” are near record highs.

The last time “trading down” spiked on earnings calls was during the GFC.

Talk of “hard landing” remains high.

Perhaps the ‘sudden recession‘ scare earlier this week makes much more sense, given the consumer weakness.

Tyler Durden

Sat, 08/10/2024 – 09:55