US Futures, Global Stocks Tumble, Japan Crashes Amid Panic Fed Is Now Behind The Curve

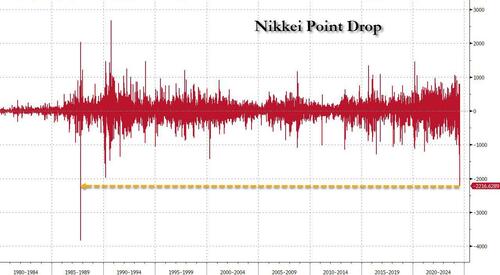

It is a global selling carnage this morning, as risk-off extends across worldwide equity markets but nowhere more so than Japan where the point (if not percentage point) drop in the Nikkei has surpassed Black Monday 1987.

As of 7:45am, S&P futures are down 1.2% as traders worried that the Federal Reserve has been too slow to cut interest rates, and technology earnings disappointed, pushing Nasdaq futures 1.7% lower as Amazon’s Q3 earnings forecast disappointed and Apple reported a surprise plunge in Chinese revenues. While Europe is a sea of red, it is nothing compared to what took place in Asia, where the Topix index crashed 6.1%, the biggest one-day selloff since 2016, as a result of the continued meltup in the yen after the BOJ’s idiotic rate hike – which took place just as Japan’s economy slumped back into contraction and inflation peaked – and given poor risk sentiment in the US. US rates are continuing their downside momentum with the OIS market now pricing in 88bp of rate cuts in 2024. A rally in Treasuries extended into a seventh straight day, with the two-year yield slumping to its lowest in 14 months. The dollar weakened. In FX, low yielding currencies are leading the rally against USD with CNH and JPY up 0.7% and 0.3%, respectively, while higher beta currencies like MXN and NOK are both down 0.6%. Today we get the jobs report (exp. 175K) and the final Factory/Durable Orders report out of the US.

In premarket trading, Exxon Mobil jumped after it exceeded profit expectations after the $63 billion acquisition of Pioneer Natural Resources Co. pushed oil and natural gas output to a record. Chevron shares slid in premarket trading after reporting earnings per share that missed the average analyst estimate. The company also said its headquarters would move to Texas from California. Amazon plunged 8% on concern costs are rising quickly to meet demand for AI services. Intel cratered more than 20% after giving a grim growth forecast and laying out plans to slash 15,000 jobs. Snap dropped 17% as revenue undershot estimates. Here are some other notable movers:

Intel shares plunge 22% after the chipmaker’s forecast for third-quarter revenue undershot the average analyst estimate. In a string of startling announcements, the company said it would slash 15,000 jobs and suspended its dividend starting in the fourth quarter.

Snap shares plunge 18% after the social media company’s revenue undershot estimates and its third-quarter outlook also disappointed amid weakness in brand spending. The update prompted brokers to cut their price targets on the stock, citing the volatile nature of Snap’s business.

Ardelyx shares rise 8.5% Friday after the company reported total revenue for the second quarter that beat the average analyst estimate.

Block shares gain 3% in premarket trading on Friday after the payments company boosted its adjusted Ebitda guidance for the full year, beating the average analyst estimate.

Coinbase shares advance 0.13% after the cryptocurrency trading platform reported second-quarter revenue that beat estimates. Jefferies highlighted the strength in subscription and services revenue, while Canaccord Genuity said Coinbase’s performance underscored the company’s diversifying revenue base.

Cloudflare shares gain 9% after the cybersecurity company’s earnings and outlook surpassed analyst expectations, prompting price target hikes as brokers pointed to a strong performance and execution in a difficult environment. Some analysts also noted that the company is benefiting from Generative AI.

Lexicon Pharma shares fall 15% after the company reported a second-quarter loss of 17c per share.

Microchip Technology drops 6.7% as BofA downgrades the chipmaker to neutral from buy following its results, based on limited catalysts for a short-term recovery. The company also receives a number of price-target cuts from other brokers.

Twilio shares are up 5.7% after the infrastructure-software company reported second-quarter results that beat expectations and gave an outlook that is seen as positive.

The next big data point for the market is Friday’s monthly jobs report, which is expected to show that US employers added workers at a slower pace last month (see our preview here). Forecasters anticipate the monthly US jobs numbers will show moderating job and wage growth in July, underscoring a further softening in the labor market. Payrolls probably rose by 175,000 last month following June’s 206,000 increase, according to the median estimate in a Bloomberg survey.

While Fed Chair Jerome Powell has signaled that rates are likely to be lowered in September, some investors have argued they should move faster to prevent a deeper economic slowdown. Indeed, amid the rout, jumpy markets now see the Fed delivering three consecutive quarter-point cuts in September, November and December — and are pricing a roughly 50% chance that one of those reductions will be 50 basis points. The policy-sensitive two-year yield slumped to its lowest in 14 months, while rates on the benchmark 10-year security held below 4% after falling to that level on Thursday for the first time since February.

“The data is really starting to show signs of concern and that is what’s coming back to bite the Fed,” said Daniela Hathorn, a senior market analyst at Capital.com. “They kept signaling they’d wait for the data, and that was fine until Wednesday, but yesterday’s data has investors fearing whether it waited for too long.”

Risk assets have taken a beating in recent sessions for other reasons too. Lackluster earnings from Microsoft Corp. to Amazon.com Inc. have hurt sentiment that is also being weighed down by concern about the sluggish Chinese economy and a weakening of the earlier euphoria over artificial intelligence. Middle East tensions have also multiplied after the assassination of Hamas’ political chief in Tehran.

It’s all added up to a volatile week for markets, with the VIX Index on track for the highest closing level in nine months. The Nasdaq 100 recorded swings of at least 1.4% over the past three days. A gauge for the Magnificent Seven big tech companies was up 0.3% for the week through Thursday.

The sharp recalibration in expectations for US rates came after the Fed held rates again this week. While Chair Jerome Powell signaled that central bank officials are on course to pare rates at their next meeting, economic reports on Thursday showed rising jobless claims and weaker manufacturing, spooking investors. Ahead of the Fed meeting, former New York Fed President William Dudley and Mohamed El-Erian warned that the Fed risks making a mistake by holding rates too high for too long and are once again behind the curve. That narrative has started to take hold in the past 24 hours. But bond market exuberance means that if Friday’s employment report shows signs of unexpected strength, there’s a risk some traders will dump bullish wagers en masse. According to Bloomberg, a $12 million wager has emerged in options linked to the Secured Overnight Financing Rate, which closely tracks Fed policy expectations, targeting some 225 basis points of easing by the middle of 2025. Even with the recent explosion of bets, the market is pricing in about 160 basis points by then.

“In coming days there may be even a discussion about whether the Fed will have to cut by 50 basis points at the next meeting in order to catch up with the loss of momentum in the economy,” Gary Dugan, chief executive officer of the Global CIO Office, said in an interview on Bloomberg Television. “From the peak a 10%-to-15% correction wouldn’t be strange in this huge change in shift in sentiment in the markets as central banks look well behind the curve.”

The shift in pricing “reflects investors’ growing concern that the FOMC might need to cut rates more quickly than the 25-basis-point quarterly cadence as economic headwinds continue to mount,” said Ian Lyngen, head of US rates strategy at BMO Capital Markets. Powell repeated on Wednesday that the Fed is data dependent when deciding when to lower interest rates, and emphasized that policymakers are mindful of the risk to the the labor market of waiting too long.

“We suggest investors brace for renewed volatility, but avoid overreacting to short-term shifts in market sentiment,” said Mark Hafele, chief investment officer at UBS Global Wealth Management.

European markets are all deep in the red, with the Stoxx 600 tumbling over 1% with technology and finance shares leading the declines. Among industry groups, utilities were the only category of stocks to rise. Europe’s semiconductor sector slumps, following an extended retreat among global tech stocks. Among chip-equipment stocks: ASML -5.2%, ASMI -7.9%, BE Semiconductor -6.5%, VAT Group -7.3%. Among chipmakers, Infineon -3.8%, STMicro -3.8%, Melexis -2.1%, Nordic Semiconductor -4.5%. Here are the other biggest movers:

AXA shares gain as much as 2.7%, as the French insurer’s first-half profit beat estimates and the firm announced the sale of its asset management unit to BNP Paribas

Engie gains as much as 4.4%, the most in a month, after the French energy company reported a strong 2024 guidance upgrade, according to Morgan Stanley

IMCD rises as much as 9% after the Dutch chemicals provider’s first-half results were better than expected, according to KBC

IAG shares rise as much as 6.4%, the most since March, after the British Airways-parent delivered a strong profit beat in the second quarter, helping soothe investors’ concerns after outlook downgrades from sector peers

Ferragamo shares rise as much as 4.7% after the Italian luxury goods maker’s earnings beat estimates

But if Europe was bad, Asia was a disaster: here stocks crashed as sentiment was hit by a triple whammy of a selloff in Japanese equities, a global tech rout and signs of weakness in the US economy. The MSCI Asia Pacific Index plunged as much as 3.6%, the most since February 2021, with Taiwan Semiconductor Manufacturing Co., Mitsubishi UFJ Financial Group and Samsung Electronics Co. among the biggest drags. Japan’s Topix Index entered a technical correction in its worst two-day rout since 2011, while benchmarks in the tech-heavy markets of South Korea and Taiwan fell about 4%. Traders took risk off the table amid signs the investment landscape is shifting. Japanese stocks are falling out of favor as the prospect of further interest-rate hikes by the country’s central bank supports the yen, hitting exporters’ shares. Meanwhile, disappointing earnings from US tech behemoths has cooled optimism over artificial intelligence, triggering a rout that has ensnared Asian chip giants

“The recent strengthening of the Japanese yen coupled with tech sector weakness is poised to significantly impact the Asian stock market,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore. “Given the substantial weight of tech stocks in Asian indices, disappointing results from tech giants could trigger a broader market downturn in Asian markets.”

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The euro and yen top the G-10 FX leaderboard, rising 0.3% a piece against the greenback. The offshore yuan climbs to the highest since May.

GBP/USD fell 0.3% to $1.2707, with the pound headed for its biggest weekly drop since April, following the BOE’s decision to ease policy on Thursday

USD/CHF fell 0.3% to 0.8706 and EUR/CHF was little changed around 0.94189, Swiss inflation held steady in July with a headline of 1.3% matching economist estimates

USD/JPY fell as much as 0.5% to 148.63, with the yen on course for its biggest weekly gain since May after the BOJ’s interest-rate hike on Wednesday

In rates, a rally in Treasuries extended into a seventh straight day ahead of the US jobs report. US 10-year yields fall 3bps to 3.95% – the lowest since early February – ahead of June employment data investors are counting on to reinforce the case for aggressive Fed rate cuts this year. European bonds follow suit. Fed-dated OIS contracts price in around 32bp of easing for the next policy meeting in September, or roughly 32% odds that the central bank’s first move will be a half-point rate cut rather than 25bp.

In commodities oil prices advance, with WTI rising 0.4% to $76.60 a barrel. Spot gold jumps $16 to around $2,462/oz.

Today’s economic data slate includes July employment report (8:30am) and June factory orders (10am). Scheduled Fed speaker slate includes Goolsbee (12pm) and Barkin (8:30pm)

Market Snapshot

S&P 500 futures down 0.9% to 5,428.25

STOXX Europe 600 down 1.4% to 504.81

MXAP down 3.4% to 176.04

MXAPJ down 2.4% to 554.23

Nikkei down 5.8% to 35,909.70

Topix down 6.1% to 2,537.60

Hang Seng Index down 2.1% to 16,945.51

Shanghai Composite down 0.9% to 2,905.34

Sensex down 0.8% to 81,198.44

Australia S&P/ASX 200 down 2.1% to 7,943.24

Kospi down 3.7% to 2,676.19

German 10Y yield little changed at 2.22%

Euro up 0.2% to $1.0812

Brent Futures up 0.6% to $79.98/bbl

Gold spot up 0.7% to $2,464.31

US Dollar Index down 0.22% to 104.19

Top Overnight News

Chevron plans to relocate its headquarters to Houston, Texas from San Ramon, California. The stock fell premarket after it missed profit estimates, adding to pressure on its efforts to acquire Hess. BBG

China’s efforts to boost household spending are expected to help the economy hit the government’s 2024 growth target of roughly 5%, but the authorities may have to do more for consumers from next year or accept slower growth. Trade tensions and local government debt risks leave Beijing few alternatives to revving up consumer stimulus in coming years, but vague promises of “incremental measures” look likely to fall short, analysts say. RTRS

An influential PBOC adviser delivered a rare critique of China’s economic policy for being overly conservative. Huang Yiping urged the government to ramp up fiscal stimulus and set a hard target for inflation. BBG

Once seen as a cautious policy dove, Bank of Japan Governor Kazuo Ueda is now presenting himself as a determined hawk who’s not afraid to lift interest rates a few more times, even in the face of a weakening economy. RTRS

The US has declared Venezuela opposition candidate Edmundo González the winner of the July 28 presidential election, describing the official results favouring President Nicolás Maduro as “deeply flawed”. Antony Blinken, US secretary of state, said on Thursday that “given the overwhelming evidence, it is clear to the United States and . . . to the Venezuelan people that Edmundo González Urrutia won the most votes” and congratulated him on his “successful campaign”. FT

For today’s jobs print GIR is calling for: +165k NFP (+175k consensus, +206k prior), U/E Rate of 4.1% (4.1% consensus, 4.1% prior) and MoM AHE +.3% (+.3% consensus, +.3% prior). The playbook on how to trade stocks around economic data prints that we have been using for most of 2024 has officially flipped as evidenced by the stock market’s reaction to the weak ISM print yesterday. We are no longer in a bad data is good for stocks environment. The fed showed its hand. Cuts are happening. Stocks do NOT want growth scare convos resurfacing. Good econ data is now good for the stock market and vice versa.

AMZN (-8% pre mkt) reported a small miss on total sales at +10%/$148B (vs. the Street $148.7B) but op. income outperformed expectations at $14.7B (vs. the Street $13.5B). The outlook for Q3 falls short of the consensus – the guidance mid-points for Q3 work out to $156.25B on sales (below the Street’s $158.4B forecast) and $13.25B on op. income (below the Street’s $15.6B forecast).

AAPL (+1% pre mkt) reported FQ3 upside on both sales ($85.8B vs. the Street $84.4B) and EPS (1.40 vs. the Street 1.35). China fell short, with sales of $14.72B (vs. the Street $15.2B), but they outperformed in the Americas, Europe, and Asia ex-Japan/China. The FQ4 guide is a bit ahead of the Street – they see sales up 5% (vs. the Street +4.1%) and GMs of 46% (vs. the Street 45.9%). RTRS

INTC (-22% pre mkt) reported a miss on Q2 EPS/revenue, the guidance is very weak (the Q3 sales guidance mid-point is $13B vs. the Street $14.3B), the company is slashing its headcount by 15%, and the dividend is being suspended. BBG

Earnings

Apple Inc (AAPL) Q3 2024 (USD): EPS 1.40 (exp. 1.35), revenue 85.78bln (exp. 84.53bln), Products rev. USD 61.56bln (exp. 60.63bln), iPhone rev. USD 39.30bln (exp. 38.95bln), iPad revenue USD 7.16bln (exp. 6.63bln), Mac rev. USD 7.01bln (exp. 6.98bln), Wearables, home and accessories rev. USD 8.10bln (exp. 7.79bln), Service rev. USD 24.21bln (exp. 23.96bln), Greater China rev. USD 14.73bln (exp. 15.26bln). Shares -0.3% in the pre-market.

Amazon.com Inc (AMZN) Q2 2024 (USD): EPS 1.26 (exp. 1.03), rev. 148bln (exp. 148.56bln). Shares -8.3% in the pre-market.

Intel Corp (INTC) Q2 2024 (USD): Adj. EPS 0.02 (exp. 0.10), rev. 12.83bln (exp. 12.94bln). Shares -21% in the pre-market.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks suffered firm losses following the bloodbath and flight-to-quality stateside which was triggered by weak ISM Manufacturing data, while geopolitical concerns and mixed earnings added to the downbeat sentiment. ASX 200 declined amid the broad weakness and with firm losses seen across all sectors. Nikkei 225 fell beneath 37,000 for the first time since April, while the Topix index followed the benchmark into correction territory. Hang Seng and Shanghai Comp. were pressured which saw the former give up the 17,000 status and the mainland index also retreated, while there were bearish comments on trade from a Mofcom official who stressed the seriousness of difficulties and challenges in foreign trade. SK Hynix (000660 KS) was pressured by over 10% in APAC trade as chip stocks continued to sell off.

Top Asian news

China MOFCOM official said the complexity of the foreign trade environment is rising and we should take into full account the seriousness of the difficulties and challenges in foreign trade, as well as noted that they will use many bilateral mechanisms to help enterprises actively respond to unreasonable trade restrictions.

Japanese Finance Minister Suzuki said they will analyse the impact of forex volatility on the economy and respond appropriately. Suzuki added that stock prices are determined in the market based on various factors such as economic conditions and he is closely watching stock moves with a sense of urgency.

Japanese Industry Minister Saito said economic fundamentals aren’t bad when asked about the sharp fall in the stock market, while he added that a strong movement is seen in investment and wage hikes are continuing.

BoJ’s Uchida to hold a press conference following on from a local business leaders meeting in Hakodate on 7th August

PBoC advisor reportedly said that China should ramp up fiscal stimulus to generate growth and set a firm inflation target, via Reuters citing remarks from advisor Yiping.

Nintendo (7974 JT) Q1 (JPY) Net 80.9bln (exp. 79bln), Operating 54.5bln (exp. 83bln), Recurring Profit 113bln, -55.3%. Switch: Sold 2.1mln units (prev. 3.91mln Y/Y); maintains FY sales forecast of 13.5mln units (prev. 15.7mln)

European bourses are pressured across the board, Euro Stoxx 50 -1.3%, with the ISM-induced downside continuing and being exacerbated by marked pressure in Intel post-earnings. As such, sectors are all in the red; Tech underperforms with heavyweight ASML opening lower by over 6% given INTC, Banking/Finance names hit on the pronounced downside in yields. Overall, the complex has a defensive configuration in-fitting with the broader risk tone. DAX 40, -1.2%, pressured with continued downside in Auto names and also its exposure to the tech-woes through Infineon. FTSE 100, -0.3%, is one of the better performers with large-cap defensive/energy names cushioning the downside, in addition to strength in IAG and GSK on Co. specifics. Stateside, futures are lower across the board, ES -1.0% & NQ -1.7%, NQ lagging given its tech-exposure with RTY -1.5% not far behind given the labour market concerns highlighted by ISM ahead of NFP; post-earnings, INTC -21%, AMZN -8.8% & AAPL -0.4%.

Top European news

European Gas Set for Weekly Surge as Near-Term Risks Mount

Swiss Stocks Are Worst in Europe as Trade Resumes After Holiday

European Banks Slide as Growth Concerns Fan Rate-Cut Bets

Engie Raises 2024 Profit Outlook on Strong Power Generation

European Chip Stocks Slump on Nasdaq Rout, Intel Capex Cut

Novo’s Supply Crunch, Germany’s Pain: EMEA Earnings Week Ahead

FX

DXY pressured overall but with peers generally mixed-rangebound, index holding towards lows in a 104.10-42 range.

EUR recouping from Thursday’s downside and is back on a 1.08 handle, EZ-specifics light with NFP likely to dictate.

Cable continues to slip after the BoE cut on Thursday; 100- & 200-DMAs in focus just below the 1.27 mark at 1.2681 and 1.2647 respectively.

JPY firmer, holding just below the 149.00 mark and benefitting from the ongoing pressure in US yields; Thursday’s base at 148.50 in view in the scenario of a dovish payrolls report.

Antipodeans are a touch firmer but AUD remains in relative proximity to its recent multi-month low of 0.6479.

Fixed Income

Benchmarks continue to climb after the poor ISM Manufacturing report in Thursday’s session, with further upside stemming from the downbeat risk tone on account of marked chip/tech pressure.

USTs as high as 113-00, extending on Thursday’s 112-26 peak with yields pressured across the curve with 3s through 10s now all sub-4.00% and the 2yr as low as 4.10%.

EGBs firmer, in-fitting with the above; Bunds as high as 134.92 with resistance touted at 134.98, 135.00 and then 135.22.

Gilts are directionally in-fitting with peers but nearer to unchanged on the day given the marked outperformance yesterday heading into and after the BoE; holding just off a 100.61 peak, resistance at 100.77 from February.

Commodities

Crude benchmarks in the green despite broader risk aversion as the complex remains propped up by looming geopolitical risks heading into the weekend.

Focus for the weekend is on when/what the middle-eastern response is to the recent strikes on various commanders/key officials; overnight, reports suggested an attack on Israel could be carried out in days.

WTI September currently sits within a USD 76.51-77.28/bbl range with Brent October in a USD 79.70-80.46/bbl parameter.

Spot gold firmer and at the top-end of a USD 2.434-2,468.33.oz intraday range and for the most part holding at yesterday’s USD 2462/oz peak into NFP; base metals are mostly firmer, despite the tone, and perhaps deriving support from recent PBoC remarks which also bolstered the Yuan. Note, the likes of LME Copper and Dalian iron ore are still poised to post a loss for the week.

BHP’s Escondida copper mine workers rejected the contract offer paving the way for a strike, while BHP will request a 5-day government mediation to negotiate with the Escondida union.

Geopolitics

US President Biden and Israeli PM Netanyahu discussed new defensive military deployments, according to the White House.

“American officials estimate that a significant Iranian attack will be carried out against Israel within a few days.”, via IsraelHayom.

“Israeli media: Letter from Knesset members to Netanyahu supporting the incursion into Lebanon”, according to Al Arabiya.

Syrian Observatory says Iranian militias in Deir Ezzor (city in Syria) raise alert; Iranian militias evacuate their headquarters in Albu Kamal in Deir Ezzor, via Al Arabiya.

US Event Calendar

08:30: July Change in Nonfarm Payrolls, est. 175,000, prior 206,000

Change in Manufact. Payrolls, est. -5,000, prior -8,000

Change in Private Payrolls, est. 140,000, prior 136,000

Unemployment Rate, est. 4.1%, prior 4.1%

Underemployment Rate, prior 7.4%

Labor Force Participation Rate, est. 62.6%, prior 62.6%

Average Weekly Hours All Emplo, est. 34.3, prior 34.3

Average Hourly Earnings YoY, est. 3.7%, prior 3.9%

Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

10:00: June Factory Orders, est. -3.2%, prior -0.5%

June Factory Orders Ex Trans, prior -0.7%

June Durable Goods Orders, est. -6.6%, prior -6.6%

June -DurablesLess Transportation, est. 0.5%, prior 0.5%

June Cap Goods Ship Nondef Ex Air, prior 0.1%

June Cap Goods Orders Nondef Ex Air, est. 1.0%, prior 1.0%

Tyler Durden

Fri, 08/02/2024 – 08:03