The Rollercoaster Ride Ahead: 15 Years Of Extreme Distortions Will Be Unwound

Authored by Charles Hugh Smith via OfTwoMinds blog,

The rollercoaster ride is about to get “fun,” as in unpredictable, volatile and unnerving for those normalized to extreme distortions “fixing” all things financial.

Humans have a knack for normalizing extremes. We quickly habituate to conditions that would have been intolerable before the extremes were normalized by habituation and recency bias. In no time at all, we’ve persuaded ourselves that living on reds, vitamin C and cocaine is not only normal, it’s healthy.

For 15 years, extreme policies have steadily dragged the economy and the wealthy higher. Now we’re finally at the top of the rollercoaster, so hang on, the ride gets “fun” from here to the bottom. Stripped of normalcy bias, the distortions of hyper-financialization and fraud finally caught up with the global financial system in 2008. The wealthy refused to accept any losses of their immense winnings at the rigged casino and so we’ve been living on debt and a Federal Reserve-engineered “wealth effect” that enriched the top 10% at the expense of the bottom 90% and systemic stability.

That’s the US economy stripped of artifice, propaganda and deception. Whether we “like” it or not, or “disagree” or not doesn’t change what’s ahead, which is a complete unwinding of all the extremes and distortions.

When an economy chooses to live off ever-rising debt and refuses to write off bad debt and book the losses, there are only two possible futures: Japan took the first path in 1989-90, when its credit-asset bubble popped and its wealthy class refused to accept any losses in their bubble-inflated phantom wealth. The net result has been 35 years of stagnation as the vitality has been bled out of Japan’s economy and society.

Japan survives off its soaring debts, zombie companies and immense holdings of foreign assets while its younger generations have given up on marriage, family and home ownership, as all are now unaffordable. If this pathway to national decay sounds like the way to go, take your blinders off and look around: we’re already well down that road.

The other pathway is high inflation which eats wage earners and savers alive. When you rely on debt to fund consumption and the spending of the wealthy (generated by the central bank-induced “wealth effect”), productivity stagnates and all that fresh debt-money pouring into the system pushes inflation into a dynamic of increasing instability.

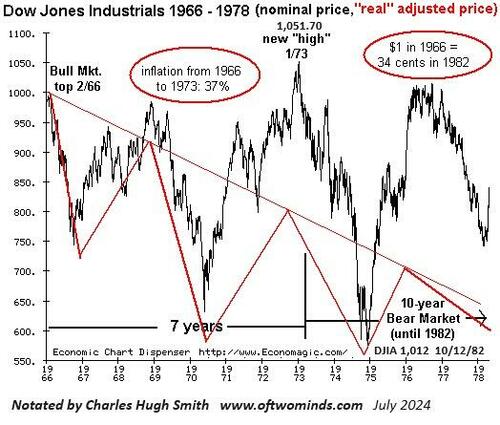

The 1970s stock market reveals how inflation works its magic: stocks noodle up and down for years, and everyone is relieved when the market returns to its previous highs: yea, we’re whole again! Well, no. Adjusted for inflation, “buy and hold” investors lost 2/3 of their capital. (Gamblers lost, too, and eventually gave up on minting money trading stocks.)

The third alternative is the debt-asset bubble pops despite everyone’s best efforts to normalize extremes, and the economy and market crash as all the debt is written off / unwound. Then the result is a classic reversal of the asset bubble, as valuations return to the pre-bubble starting point. This is a preview of what lies ahead:

Let’s run through the extremes that will get unwound whether we “approve” of the unwinding or not. Here’s the Case-Shiller Housing index: housing is unaffordable to all but the wealthy, a massive distortion just begging to be unwound.

Here’s total debt in the US As the dog in the burning cafe says, “this is fine:” normalization at work.

Federal debt is soaring because we’re playing a game of transferring debt expansion from the private sector to the public sector to make things look nice. Sorry, vitamin C and cocaine are still not a healthy diet:

Unfortunately, 15 years of gulping down Delusional had addled the minds of those who believe interest rates are heading back to near-zero and so everything will be “fixed.” The reality is it’s all been “fixed” for 15 years, and that’s why interest rates will move higher regardless of how much Delusional we’re swallowing.

Historically, a range of 5% to 7% is normal, but if we try to “fix” the problem by dropping rates back to 1%, we’ll get 9% to 12% rates at our banquet of consequences.

Here’s what happens as rates normalize: all our money goes to pay interest. Once the credit card is maxed out, our borrow-and-spend consumption dries up: No more GDP “growth” funded by debt.

Corporate profits “earned” by crapifying goods and services and cartel pricing will fall from the stratosphere. Even AI can’t save corporate profits when consumers run out of credit. No matter how many MBAs are fiddling with AI chatbots, they won’t be able to extract blood from stones.

And just as a reminder of who won and who lost during the 15-year ascent to extreme distortions: the super-wealthy scooped the vast majority of the casino’s winnings:

While the bottom 50% lost ground: hey, you never had it so good, right?

The rollercoaster ride is about to get “fun,” as in unpredictable, volatile and unnerving for those normalized to extreme distortions “fixing” all things financial. Click “unlike” if you like, it won’t make any difference. Systems have their own dynamics, and human hubris and magical thinking have no influence.

* * *

Tyler Durden

Tue, 07/30/2024 – 07:20