Bill Dudley, Who Urged Powell To Hike Rates in 2019 To Crush Trump, Flip-Flops & Demands Immedate Rate Cut

After fading away into retirement obscurity, punctuated by the occasional op-ed on Bloomberg, where all financial has-beens go to pretend they are still relevant and where they are read by nobody, this morning former Goldman top economist and NY Fed president Bill Dudley made waves again, by violently flip-flopping to his recent stance, in what can only be viewed as another confirmation the Fed is nothing more than a political tool for a faceless, oligarch elite.

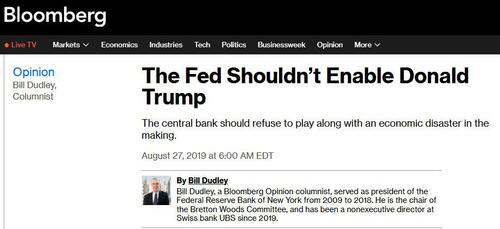

In his post-Fed existence, Bill Dudley is of course best known for writing that infamous August 2019 Bloomberg op-ed, in which he called for the Fed to hike rates into the last months of Trump first administration to scuttle his odds of re-election…

… proving beyond a shadow of a doubt that the US central bank is, among other things, a tool to perpetuate the established status quo and to crush any interlopers who may jeopardize the net wealth imbalance which the Fed has carefully established since its founding in 1913. For those who have forgotten, here is the punchline from Dudley’s op-ed.

I understand and support Fed officials’ desire to remain apolitical. But Trump’s ongoing attacks on Powell and on the institution have made that untenable. Central bank officials face a choice: enable the Trump administration to continue down a disastrous path of trade war escalation, or send a clear signal that if the administration does so, the president, not the Fed, will bear the risks — including the risk of losing the next election.

There’s even an argument that the election itself falls within the Fed’s purview. After all, Trump’s reelection arguably presents a threat to the U.S. and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives. If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020.

And so, having sparked a wave of outrage following this op-ed, even among establishment circles for exposing what the Fed’s real game is all about, Dudley then promptly faded back into obscurity, where he relished publishing his occasional dead wrong op-ed every now and then, most recently in May 30, when Dudley wrote “The Fed Thinks It’s Fighting Inflation. Think Again” adding that “Even at more than 5.25%, the central bank’s short-term interest-rate target might not be high enough to cool the economy.”

His argument was simple: “I think r* is a lot higher than the Fed recognizes — which means the central bank isn’t doing enough to fight inflation” meaning that the neutral rate is much higher than the Fed’s overnight rate, and thus the Fed has not hiked rates enough to fight inflation.

But why “dead wrong”? Well, that’s not our view: it belongs to Dudley himself, because in his latest op-ed this morning, the multi-millionaire who has no idea what a carton of milk or 12-pack of eggs cost, just said ignore everything he has written in the past two years, because – drumroll – the Fed needs to cut rates now.

No really: the op-ed is literally titled “I Changed My Mind” and clarifies that “The Fed Needs to Cut Rates Now” which is hilarious because just over two months ago, the same lunatic argued for (much) higher rates as “the current fed funds rate of 5.25% to 5.50% is exerting negligible restraint on growth and inflation.” What was especially hilarious, was Dudley’s parting paragraph from his May op-ed in which he said “Perhaps the Fed’s mantra, instead of “higher for longer,” should be “higher indefinitely” until inflation moves more convincingly in the desired direction.”

… or, one can now add, “until Trump has a massive lead in the polls against Biden”, because having forgotten everything he advocated at the start of the summer, Dudley, who once upon a time advocated hiking rates to crush Trump’s re-election changes, has reverted back to his basest political animal, and realizing that Biden, pardon Kamala will need all the help from the Fed she can get, Dudley is now advocating for a rate cut… and not just any rate cut but one next week because, well, the US economy may already be in a recession…. a recession which Dudley clearly had no idea about just two months ago and in fact was convinced the economy and inflation were both red hot back then.

So what changed? Well, as usual with Dudley, there are two layers to everything. One is the superficial, i.e., fake and wrong, and then there is the unspoken layer, which is the one that matters.

Addressing the former first, here former Goldmanite Dudley is beyond transparent, taking verbatim the entire Goldman note from last Monday in which his former employer also made the fundamental case for a July rate cut (and which we discussed here). We’ll spare you reading the background, and instead focus on what Dudley said today, which is that after “years of persistent strength of the US economy suggested that the Fed wasn’t doing enough to slow things down” and then, suddenly – and certainly after Dudley’s May 31 op-ed – everything changed:

Now, the Fed’s efforts to cool the economy are having a visible effect. Granted, wealthy households are still consuming, thanks to buoyant asset prices and mortgages refinanced at historically low long-term rates. But the rest have generally depleted what they managed to save from the government’s huge fiscal transfers, and they’re feeling the impact of higher rates on their credit cards and auto loans. Housing construction has faltered, as elevated borrowing costs undermine the economics of building new apartment complexes. The momentum generated by Biden’s investment initiatives appears to be fading.

We, of course, discussed all this last month in “Goldman Exposes Bidenomics Real-World Disconnect: Low-Income Americans Are Struggling With High Prices“, and since the originator of the analysis was Dudley’s old boss (again) we can see how he got wind of the narrative shift.

There was more: confirming yet again that the monthly jobs report has become yet another political Rorschach test in which one sees whatever one wants to, Dudley – who a month ago would have been hammering how strong the US labor market is by looking at the Establishment Survey – now flip-flops and turning to the household employment survey finds that “slower growth, in turn, means fewer jobs” to wit:

The household employment survey shows just 195,000 added over the past 12 months. The ratio of unfilled jobs to unemployed workers, at 1.2, is back where it was before the pandemic. Most troubling, the three-month average unemployment rate is up 0.43 percentage point from its low point in the prior 12 months — very close to the 0.5 threshold that, as identified by the Sahm Rule, has invariably signaled a US recession.

And that’s how easy it is to flip what have been “strong” job reports from the past year – at least according to the Biden admin – to weak ones. We, of course, have discussed all this as well, most recently here “Inside The Most Ridiculous Jobs Report In Years” where we specifically highlighted the staggering divergence between the Establishment (i.e., Payrolls) and Household (i.e., Employment) surveys.

So why, Dudley asks rhetorically completely oblivious to the irony of the question after his last op-ed which called for just this, is the Fed not cutting next week? He offers three reasons:

First, the Fed doesn’t want to be fooled again. Late last year, a moderation in inflation turned out to be temporary. This time around, further progress in reducing year-over-year inflation will be difficult, due to low readings in the second half of last year. So officials might be hesitant to declare victory.

Second, Chair Jerome Powell might be waiting in order to build the broadest possible consensus. With markets already fully expecting a cut in September, he can argue to doves that delay will have little consequence, while building more support among hawks for the September move.

Third, Fed officials don’t seem particularly troubled by the risk that the unemployment rate could soon breach the Sahm Rule threshold. The logic is that rapid labor force growth, rather than a rise in layoffs, is driving the increase in the unemployment rate. This isn’t compelling: The Sahm Rule accurately predicted recessions in the 1970s, when the labor force was also growing rapidly.

All perfectly obvious reasons, and all perfectly wrong because as everyone with half a brain knows, the one and only reason why Powell does not want to cut next week is for obvious optics that doing so now would be clearly a political move, one meant to hurt Trump’s election chances and to boost the cackling idiot of a candidate that Democrat voters never picked, but their DNC superiors did for them.

Dudley, of course, knows this but having been burned by openly suggesting the Fed steamroll Trump in 2019, it would be beyond ludicrous for a former Fed president to go for round two and openly argue that the Fed should cut rates early just to ensure Kamala becomes president, even if that’s precisely what Dudley wants. So, instead of at least having the guts to say what he means – like he did in 2019 – the ex-Goldmanite multi-millionaire tries to virtue signal and blame the Fed for the coming recession which will be its fault if it doesn’t cut rates now.

Historically, deteriorating labor markets generate a self-reinforcing feedback loop. When jobs are harder to find, households trim spending, the economy weakens and businesses reduce investment, which leads to layoffs and further spending cuts. This is why unemployment, having breached the 0.5-percentage-point threshold, has always increased a lot more — the smallest rise was nearly 2 percentage points, trough to peak.

Although it might already be too late to fend off a recession by cutting rates, dawdling now unnecessarily increases the risk.

To be sure, it is possible that Powell will do just what Goldman – and Dudley – want, and shock the market next week with a rate cut which nobody expects and in doing so will hammer the final nail in any remaining speculation it is apolitical and won’t do everything in its power to crush Trump.

And while the market would normally see right thought Dudley’s laughable attempt to once again hammer Trump, this time it’s not so sure, because as Nomura’s Charlie McElligott writes this morning “we see ex Fed and current Bloomberg opinion writer Bill Dudley pulling a full-tilt U-turn, departing the “high for longer” camp, and instead, now calling for a Fed cut, preferably as soon as NEXT WEEK—as the lagged and variable impact of prior tightening is now hitting the economy, with tapped consumers, slowing momentum from Biden’s fiscal stim, softening labor (references Sahm rule, naturally), all while inflation pressures have abated.” In turn, this growing possibility of a shock from the Fed, is hammering yields and hitting consensus FX positioning, which is “now experiencing ~-2.5 to -3 z-score moves lower in G10FX Momentum and Carry –strats over the past two weeks, largely as a function of the Yen rallying through key levels vs USD, but also too, seeing significant movement in GBP / NOK / SEK / NZD / EUR against the Greenback as well.“

The irony of all this is i) just how stupid and transparent it all is and ii) even if the Fed does cut next week, it is unlikely to have any impact on the outcome of the election in November, but it will certainly make Trump notice and when – not if – the president rightfully retaliates at the all out political central bank, taking the next and final step in destroying the dollar’s reserve status – everyone will be so very shocked that Trump finally dragged the current financial regime beyond the Rubicon.

Tyler Durden

Wed, 07/24/2024 – 12:25