What Rate-Cuts Can And Cannot Do

Authored by Jeffrey Tucker via The Epoch Times,

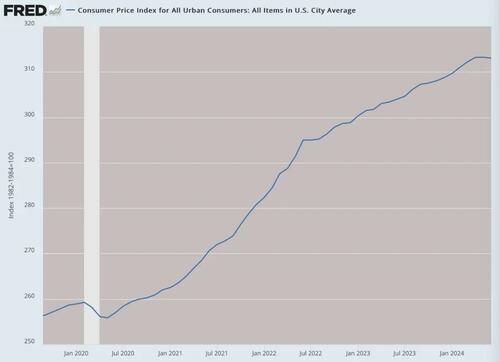

June’s year-over-year Consumer Price Index is still running 3 percent, which is now considered more-or-less on target. Five years ago, that would have been seen as intolerably high. The month-over-month decline of 0.1 percent, the best in a year, was driven by gas and used cars, which are reported as down 10 percent year over year (but still up 30 percent over four years).

So while the financial press trumpeted the great news for consumers, there needs to be some context here. This is a minor blip, heavily influenced by what it excludes not to mention adjustments we cannot see, and easily reversed.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Some people speculate that 3 percent is the new target and that the old 2 percent standard is being deprecated. That very well might be true. That’s very bad news for consumers and small businesses, however. It means that incomes will continue to have a hard time keeping up with purchasing power.

This perception is reinforced by the Producer Price Index (PPI), which garners far less attention, but which clearly shows signs of re-acceleration. The year-over-year changes are worse than in a full year.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Once you adjust income per hour by even the official data, incomes have been severely harmed in recent years.

This report prepares the Federal Reserve for what has been the intention since early in the year. It wanted to cut interest rates in the fall. This seems highly likely. The expectation of the rate cut has been a driving force for higher financials and will continue for the duration. Wall Street is booming in ways that fundamentals simply cannot support, and everyone knows that. Loose credit, however, can indeed keep the magic going for a very long time.

Many people who are hoping to buy a house on a 30-year mortgage might welcome a rate cut. But we need to be clear about what the Fed can and cannot do. It can control its overnight lending rates to member banks. It cannot determine how that will affect the full shape of the yield curve.

It’s entirely possible that with a rate cut, the yield curve will simply become steeper, with rates on 5 and 10-year bonds, including 30-year mortgage rates, staying the same or even rising. It also does not directly affect interest in credit card debt, which is already floating between 20 and 23 percent.

The market function of the yield curve is to allocate credit to its most valued ends. All else equal, higher rates should discourage borrowing and encourage savings. In this cycle, however, that is absolutely not happening. As household income has become squeezed, credit card debt has risen dramatically while delinquent payments are starting to rise also.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Meanwhile, the personal savings rate has fallen instead of risen.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

How can we account for this? It’s rather simple: responding to interest rate signals requires discretionary income, which people simply do not have following the high levels of spending during lockdowns and the subsequent inflationary ravaging of whatever was remaining. It was one of economic history’s greatest head fakes, during which time people thought they were rich only to find they were suddenly poor again.

Measuring precisely how much this is true is not easy. The official inflation numbers may not entirely represent the reality of what people have been experiencing. Over five years, the Consumer Price Index (CPI) registers 23 cents in lost purchasing power of the dollar in terms of U.S. goods and services.

You can find products out there that seem to reflect that, mostly those involving consumer electronics and some items of clothing. But overall? It’s hard to believe that this number represents any real-world basket of goods.

Consider fast food, for example. In 2019, a McDonald’s cheeseburger was $1. Now it is $3.15. A Big Mac was $4. Now it is $7.50. Overall, the prices at the most popular chain are up 141.4 percent. That is a far cry from 23 percent. So too for Chick-fil-A. The signature sandwich was $3.65 but is now $6.55. Overall, prices at this restaurant are up 80 percent. At Burger King, prices are up 85.7 percent, at Taco Bell they are up 57.4 percent, and at In-N-Out Burger, prices are up 55 percent.

These numbers are provided by private industry, as reported by Bloomberg. We have no reason to doubt them.

Let’s talk about housing, which is up 41–49 percent over the same period. This is not included in the CPI, which also does not include interest-rate increases, which are up by 100 percent over this period. The Fed does track both, however, even if the CPI excludes it.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Then you have the health-insurance conundrum. The BLS has premiums falling by 19 percent since 2021 but that number comes from a strange way of subtracting consumed services from premiums. In the real world, inflation in health premiums is exactly reversed, up by 20 percent, according to KFF.

Wherever you drill down to industry data, we find numbers very different from what the Bureau of Labor Statistics (BLS) is reporting. This is owing to every manner of exclusions and adjustments.

Here’s the irony, then. Both government and industry have a strong incentive to play down or otherwise bury the truth about what is happening to prices. And today we are being invited, once again, to celebrate the end of inflation.

In short, there is no real solid grounding for a rate cut anytime in the foreseeable future.

There is an additional long-term problem. If the Fed really does embark on a new rate-cutting policy to forestall statistical recession, what are the risks? We saw this precise scenario in the 1970s. Twice the Fed concluded that it had beat back inflation with rate increases. Twice its rate cuts end up setting off another round of inflation. The Fed back then mistook a short-term trend for long-term victory and ended up with a hyperinflation it could not control.

Let’s add a final word on the financial markets. As incredible as it seems, even though the job market is weak and output is generally moribund, there is probably no imminent threat to rising financials. The frenzy over artificial intelligence has given traders a shiny new toy on which to speculate. It is also typical in credit-soaked economic environments that financials perform well and are the last sector to get hit in a crisis.

No one can wish away the devastation that has been wrought by explosive government spending since the pandemic response began. As a percentage of Gross Domestic Product (GDP), it exceeds the Second World War. The resulting debt needs to find viable markets. That’s where the Fed comes to the rescue, but at great cost.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Many people today are darkly whispering about a great economic crisis that could be coming. But we might be looking in the wrong place. The real problem we face today is a grinding stagnation together with ongoing inflation that could be kicked back into high gear with another rate cut.

That could be our crisis. Perhaps the onset seems slow but four years in the sweep of history is a very short period in which a country and global economy loses its energy and falls into decline.

Tyler Durden

Mon, 07/15/2024 – 05:45