A Short Overview Of Places With Zero Corporate Taxes

In a globalized world, setting corporate tax rates has often been described as a race to the bottom. By having a lower rate than other nations, a country can hope to attract more businesses (or at the very least, their headquarters). This allows them a windfall of tax revenue that other jurisdictions then miss out on.

For some, the race to the bottom has in fact found the ground: at zero.

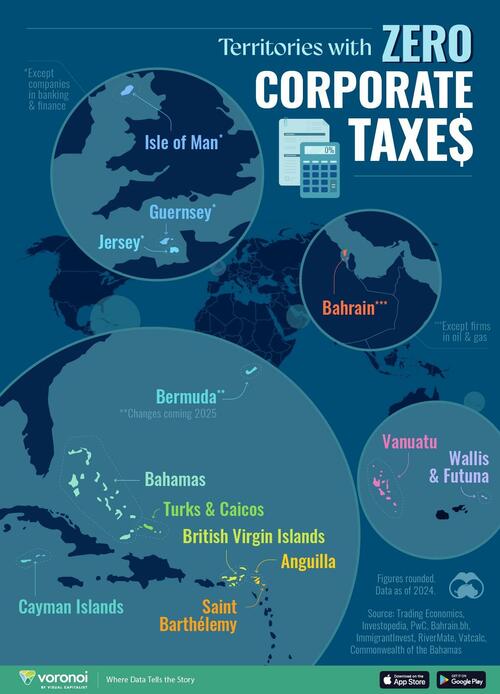

In the following graphic, Visual Capialist’s Pallavi Rao maps the very short list of places with zero corporate taxes.

Data for this map and article is primarily sourced from Trading Economics and PwC Tax Summaries, accessed June, 2024.

Life, Death, and No Corporate Taxes

Small island nations in the Caribbean, Pacific, and the British Isles make up the majority of countries and territories with no corporate tax requirement.

Many of them also don’t have income tax or capital gains taxes either.

*Except companies in banking & finance, cannabis, and firms in retail with taxable profits above £500,000. **Changes coming 2025. ***Except firms in oil & gas.

As a result, these places are the listed headquarters of hundreds of companies from around the world, and often dubbed as “tax havens.”

Aside from tax havens, some countries also have little need for corporate taxes due to revenue from key industries—like oil. However they also come with a fine print worth reading.

For example, Bahrain has no corporate taxes, unless a firm is involved in the oil and gas sector, in which case it attracts a rather steep 46% rate.

In the Crown Dependencies, banking and finance companies have to pay a 10% rate. Property income, retail businesses whose taxable profits are above £500,000 and firms in the cannabis industry also get taxed.

Meanwhile, Bermuda will introduce a 15% corporate tax in 2025. This will only apply to firms that are part of multinational groups with an annual revenue of $800 million or more.

This minimum 15% rate is part of a deal proposed by the OECD in an attempt to prevent multi-billion dollar tax havens. The Financial Times explains: if a country has a corporate tax rate below the minimum threshold, other jurisdictions can apply a “top up” tax to make up the difference. This reduces the incentive for tax havens to have a lower rate as other countries can increase tax revenues at their expense.

Tyler Durden

Wed, 07/10/2024 – 04:15