China’s ‘National Team’ Gets To Work At Key Psychological Level For Stocks

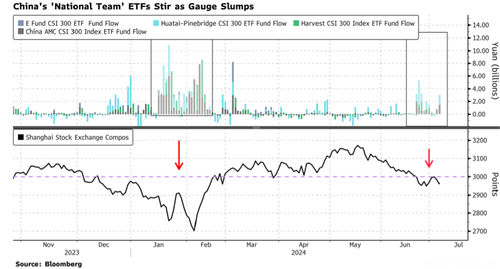

The Shanghai Stock Exchange Composite recently dropped below a key psychological level, reflecting the uninspiring economic recovery and muted credit impulse data. With no stimulus bazooka in sight, the economy struggles amid a property market downturn. The Market Ear recently questioned the future of Chinese stocks after their multi-month rally stalled and reversed in mid-May. However, there are indications that China’s ‘national team’ may have stepped in to purchase stocks.

On June 21, the Shanghai Stock Exchange Composite tumbled below 3,000 points for the first time since late March. There were possible signs the national team stepped in around June 26 to boost the main equity index to near 3,000, but that effort has since failed.

Last month, Shen Meng, director at Beijing-based Chanson & Co., told Bloomberg that the break below the 3,000 level “indicates that the overly stringent policies introduced by the new China Securities Regulatory Commission head have shaken investor confidence and made investors panic in the short term.”

Fast forward to Friday, and the main equity index is trading at about a 1.6% discount to the 3,000 level. According to Bloomberg calculations, exchange-traded funds preferred by China’s sovereign wealth fund have recorded volume spikes, likely indicating increased activity by the national team.

The increasing inflows into the ETFs, including the nation’s biggest Huatai-Pinebridge CSI 300 ETF, added to signs that the so-called “national team” may have stepped in to shore up market confidence ahead of the Communist Party’s Third Plenum later this month. State funds were crucial in stabilizing the stock market when the Shanghai Composite Index plunged in a February rout.

Still, the value of net inflows in the past two weeks is much smaller than purchases by state funds earlier this year, and the buying has done little to stem the ongoing market slump. China’s benchmark CSI 300 Index has finished with its seventh week of declines, the longest losing streak since 2012, due to increasing economic growth pressures at home and tariff disputes with the nation’s major trading partners.

The trading volume of the Huatai-Pinebridge ETF jumped to about 190% of three-month average on Friday, as the benchmark index pared a decline of as much as 1.3% to close just 0.4% lower.-BBG

Bloomberg shows when the Shanghai Stock Exchange Composite dips below 3,000, the volume of ETFs preferred by the national team surges.

For further insights, The Market Ear published a recent note titled “China: Now what?” It’s a comprehensive chartbook breaking down Chinese markets.

Tyler Durden

Fri, 07/05/2024 – 09:20