Seaborne Trade Set For Largest Increase Since 2010 After Red Sea Crisis

Missile and drone attacks by Iran-backed Houthi rebels in the Red Sea and Gulf of Aden have disrupted crucial maritime shipping routes, sparking supply chain snarls. Major shipping companies have been forced to reroute tankers, bulk carriers, and container ships around the Cape of Good Hope to avoid conflict. As a result, shipping rates have surged, and a key measure of global sea transport is on track for its largest annual increase since 2010.

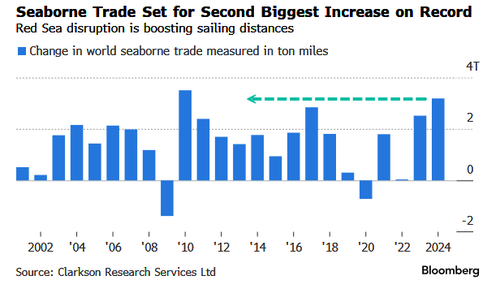

Bloomberg cites new data from shipbroker Clarksons Research that reveals shipping activity measured in ton-miles is set for the second-largest annual increase on record and the highest since 2010. This is primarily because of the instability around critical maritime chokepoints across the Middle East.

The gauge of global sea transport, which multiplies the volume of cargo transported by the distance it sails, is nearing an increase of 5.1% compared to 2023, or 3.2 trillion ton-miles. The jump in the index comes as vessels have been rerouted from the Red Sea to the Cape of Good Hope, adding thousands of miles and weeks to a journey from Asia to Europe.

Attacks in the Red Sea and Gulf of Aden have only worsened in recent weeks. Houthi rebels have launched boat drone attacks against commercial vessels linked to Western nations.

Clarkson analyst Trevor Crowe said longer journeys have been disappointing in the aims of reducing global carbon emissions. Meanwhile, he said an “encouraging start to the year” in trade volumes is also driving up ton miles, indicating that the rise isn’t just due to extended journeys.

Bloomberg noted, “The impact of the Red Sea disruption on ton miles has been most acutely felt in container shipping, with about 690 ships currently sailing around the Cape of Good Hope,” adding, “Average seaborne trade hauls will rise by 2.8% this year compared with 1.8% a year earlier.”

As we’ve noted, a more conventional supply shock is underway—nowhere near the nuclear-level hit by government-enforced lockdowns several years ago. This has put a strain on global containerized shipping capacity, sending rates for 40-foot boxes soaring in recent months.

Rising geopolitical tensions in the Middle East signal further supply chain snarls. This underscores the continued need to improve supply chain resilience by reshoring production.

Tyler Durden

Mon, 07/01/2024 – 18:00