Stellar 10Y Auction Sees Surge In Foreign Demand, Near Record Stop Through

Unlike yesterday’s subpar, tailing 3Y auction, moments ago the Treasury sold $39BN in a 10Y reopening auction (9-Year, 11-month), which was nothing short of stellar.

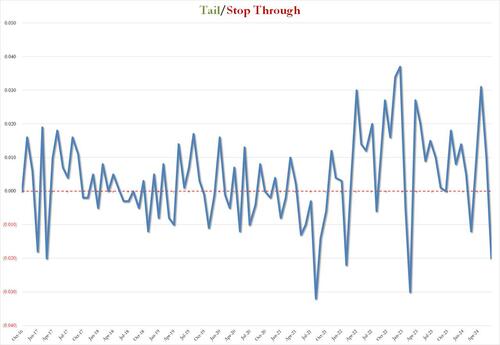

The high yield stopped at 4.438%, down 5bps from last month’s 4.4830%, and stopped through the When Issued by 2.0bps, which not only followed three consecutive tails, but was the biggest stop through since February 2023.

There’s more: the bid to cover shot up to 2.67 from 2.486, the highest since Feb 2022, and was well above the six-auction average of 2.50.

The internals were also stellar, with Indirects taking down 74.5%, the most since February 2024 when foreigners took down 79.5%. And with Directs awarded 13.8%, down from 18.7% in May and the lowest since August 2021, Dealers ended up holding 11.6%, the lowest since August 2023.

Overall, this was a stellar auction, arguably the best 10Y sale in well over a year, and understandably yields slumped 3bps to session lows on the news…

… yet still a long to go before they fade the farcical gap from Friday’s payrolls which were far, far weaker than the Biden admin hoped to make them seem as we explained. In any case, anyone worried that there is a buyer’s strike ahead of tomorrow’s CPI, or that the print come in hot, is about to be disappointed.

Tyler Durden

Tue, 06/11/2024 – 13:24