Payrolls Malarkey & Pussy Meltdown Prompts Market Mayhem

Just when you thought you had the trend all figured out, “the most ridiculous payrolls report in years” combined with a “roaring kitty“ sparked utter mayhem across all asset classes.

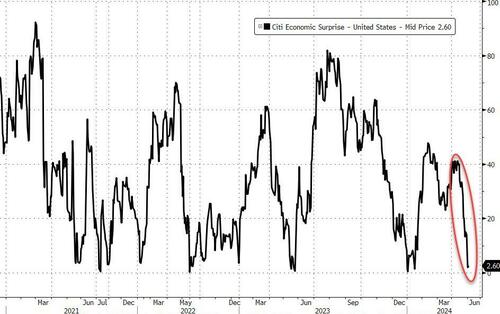

A week of weaker than expected data was met with a barrel of bullshit from the BLS with payrolls beating but unemployment rising as part time jobs soared )for illegal immigrants) and full time jobs plunged leaving the US Macro Surprise Index back at its lowest since Bidenomics was unleashed (with the unemployment rate at 4% for the first time in 3 years)….

Source: Bloomberg

And that sent rate-cut expectations (hawkishly) lower – after a week of dovish exuberance…

Source: Bloomberg

Aside from the macro meltdown, “Roaring Kitty” sparked chaos amid a bizarre live stream that prompted a 40%-plus collapse in GameStop’s share price…

Source: Bloomberg

All of which left Small Caps down on the day and the res of the majors unchanged…

Source: Bloomberg

But on the week, Nasdaq outperformed strongly as Small Caps were slammed…

Source: Bloomberg

Nasdaq outperformed the Russell 2000 every day this week for its best relative weekly performance in seven months…

Source: Bloomberg

Most Shorted stocks tumbled today, going red on the week…

Source: Bloomberg

But MAG7 stocks soared for the 6th week in the last 7 (and the best week in the last 7)…

Source: Bloomberg

The gap between Nasdaq and the 10Y yield is becoming silly…

Source: Bloomberg

But there really was no reason for today’s bond market meltdown a (yield melt-up) as the underlying report was ugly as hell. 2Y Yield ended the week higher (after underperforming today +15bps) but the long-end remained down 10bps on the week (even after an 11bps spike today)…

Source: Bloomberg

The dollar spike to one-month highs…

Source: Bloomberg

Gold was clubbed like a baby seal as the dollar spiked, trading back at one- monthly lows..

Source: Bloomberg

Crypto was also ugly with Bitcoin testing $72,000 and then puking down to find support at $69,000…

Source: Bloomberg

Even though BTC ETFs have seen 18 straight day s on net inflows…

Source: Bloomberg

Oil prices ended lower o the week but bounced back stromgly in the last three days

Source: Bloomberg

Finally, someone is going to be very wrong here…

Source: Bloomberg

Who is your money on?

Because Central Bank liquidity sure ain’t supporting it anymore…

Source: Bloomberg

This won’t end well.

Tyler Durden

Fri, 06/07/2024 – 16:00