Credit Investors Have An America First Problem

By James Crombie, Bloomberg markets live reporter and strategist

Credit investors who think US assets are the only game in town are missing out on better returns in other parts of the world. They’re increasingly exposed to volatility — and even worse performance — as the American economy slows and political risk ramps up.

Global investors have no alternative but to bet heavily on the US, given that’s where most of the liquidity is. It accounts for more than 57% of the high-grade index, up from 55% five years ago, and 62% of junk. But there are better fixed-income opportunities elsewhere.

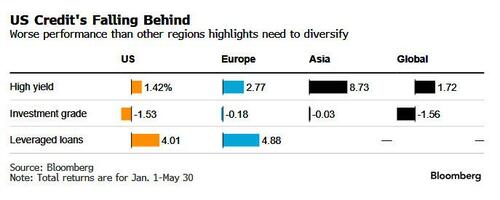

US assets are lagging across the board, from junk and high-grade bonds to leveraged loans. The American economy’s slowing and the Federal Reserve is in no rush to cut, while the European Central Bank looks likely to start easing this month.

US politics are getting more choppy with the potential to rattle credit markets which have been lulled into a false sense of security and are priced for perfection. There’s too much money chasing too few American assets, with wafer thin US credit spreads implying paltry gains to come, and scant cushion when the going gets rough.

European credit markets have the edge as the ECB gets ready to cut rates, which should favor investment-grade bonds. There’s more spread on that continent, but less all-in yield than dollar debt given lower base rates.

The Euro junk index is higher quality — more BB, less CCC rated — than the US. But it’s not without risk. Single B rated bonds in euros may appear relatively cheap, but as my colleague Sebastian Boyd notes, net debt to Ebitda is rising faster. And that cohort is dogged by large and highly-stressed issuers like Altice.

In addition, Europe’s macroeconomic outlook is less supportive than the US. But a drop in euro hedge costs for dollar-based investors to the lowest since November boost the case for a geographical shift.

This year’s best performer is Asian junk in US dollars, which has soared almost 9%. It has an index quality of Ba3/B1, trades at an average price of less than 88 cents on the dollar and a spread of 500 bps over Treasuries, even after rallying hard since October. That compares with a price over 92 and just 310 bps spread on US junk, which is rated one notch lower on average.

Of course, Asian high-yield bonds are cheap for a reason — the index is 17% real estate, much of it in China, which many foreign investors describe as “uninvestable.” But brave buyers betting on the Chinese government fixing the property crisis have a path to outsized bond gains.

There are also opportunities in other large emerging markets, particularly commodity-rich nations like Mexico and Brazil, where rates are also expected to fall faster than in the US. EM corporate debt in dollars has returned more than 2.5% this year, rallying as equivalent US assets slipped into the red. It pays more than double the spread of US high grade for less duration and only slightly lower quality.

Historically, EM has paid more because of greater perceived political risk. But the last few volatile years in Washington have arguably been no less turbulent.

US credit investors have a lot to worry about, from commercial real estate stress and corporate debt defaults to inflation, recession, war and elections. That only intensifies the home bias, as portfolio managers gravitate to what’s familiar — and liquid — in times of stress.

Besides a whole load more complex credit work and analysis, anyone seeking geographical diversification also has to grapple with liquidity constraints and currency hedging costs.

America is too big to ignore in any portfolio. But credit investors are increasingly overweight US assets that appear extremely overvalued compared with history, and relatively rich versus other regions. They risk letting American exceptionalism get in the way of considering other options — as much to generate alpha as to hedge myriad risks coming down the US pike.

Tyler Durden

Mon, 06/03/2024 – 14:20