Hedge Fund CIO On The Next Leg: “It’ll Be Parabolic. The Talking Heads Will Go Nuts. VIX Will Hit 10”

By Eric Peters, CIO of One River Asset Management

“Still nosebleed long,” grunted Bulldog, selling a few S&P puts for sport. “Bought more stocks, and now I’m buying bonds. Not as a hedge, they’re both going up,” growled Dawg.

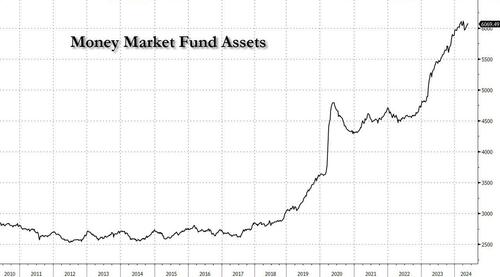

“The Baby Boomers are still too nervous about this market, Gaza, Russia, China, Iran. They got trillions sitting in money market funds. But at some point, as stocks rally, these Boomers are going to get FOMO.” That’s when the last leg higher takes off. “It’ll be parabolic. The talking heads will go nuts. VIX will hit 10.”

And Dawg dropped to the ground with a thud, as if all four legs lost power simultaneously, due to some malfunction.

“But after the blow off top, this market will crash, bigger than anything we’ve seen. Gold is telling you what’s coming.”

* * *

“Over the past few weeks, Ukraine came to us and asked for the authorization to use weapons that were provided to defend against the aggression near Kharkiv,” said Anthony Blinken, “including against Russian forces that are massing on the Russian side of the border.”

Rumors circulated that Biden had approved the use of US weapons for strikes inside Russia’s border. The Secretary of State felt it time to confirm that fact.

When asked if the door was open for the US to allow Ukraine to strike further into Russia, Blinken said the US would continue to “adapt and adjust” moving forward.

Markets were profoundly quiet. The Memorial Day holiday seemed to mark the start of summer trading.

For a couple years our central bankers, economists, strategists, and forward markets have gotten just about everything wildly wrong. Inflation, interest rates, real rates, housing, employment, regional banking, GDP, budget deficits, you name it. But lately, surprises seem to have returned to the pedestrian variety of ten basis points here or there.

And with trillions sitting in money market funds, and equity market sentiment neither overwhelmingly bullish nor bearish, the swings in price are kind of boring.

“What we are in now is a production war,” said a senior NATO official. “The outcome in Ukraine depends on how each side is equipped to conduct this war.”

Russia is producing 3x the number of artillery shells as Nato allies and at just 25% of the cost. And Nato has just 5% of the air defenses it needs on its eastern flank. That is sure to soon change.

It’s all heating up in the Pacific too. Lieutenant General Jing Jianfeng denounced the US as the “source of chaos and tension” in the Indo-Pacific and said its regional strategy aimed to “create division, provoke confrontation and undermine stability”. He accused the US of seeking an Asia-Pacific NATO.

Probably true. But markets don’t care until they care, because of course, traders have no real idea how to trade geopolitical risk.

Tyler Durden

Sun, 06/02/2024 – 19:50