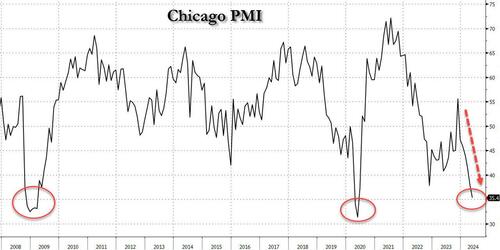

Chicago PMI Unexpectedly Craters To Depression Levels

After unexpectedly slumping last month to 37.9, the Chicago PMI index cratered even more unexpectedly in May, when it defied hopes of a rebound to 41.5, and instead tumbled even more, sliding to a cycle low of 35.4 which was not only below the lowest estimate, but was staggeringly low. To get a sense of just how low, the last two times it printed here was during the peak of the covid and global financial crises…

… which seems to suggest that at least according to Chicago-based purchasing managers, the economy is in a depression.

This is how the final number looked relative to expectations.

Looking at the report we find the following:

Business barometer fell at a faster pace; signaling contraction

New orders fell at a faster pace; signaling contraction

Employment fell at a faster pace; signaling contraction

Inventories fell at a faster pace; signaling contraction

Supplier deliveries fell at a slower pace; signaling contraction

Production fell at a slower pace; signaling contraction

Order backlogs fell at a faster pace; signaling contraction

Did nothing rise? One thing did:

Prices paid rose at a slower pace; signaling expansion

So we have not just a depression, but a stagflationary depression in which everything else is going to hell, except prices: they keep on rising.

And while it is unclear what has prompted this unprecedented bearishness (the surely negative contribution from Boeing is likely to blame for a substantial portion of the apocalyptic outlook), one thing is certain: Goldman will have to come up with even more goalseeked surveys that explain away reality and tell us how purchasing managers really should feel…

… if only they knew just how great Bidenomics was for them.

Tyler Durden

Fri, 05/31/2024 – 10:15