Core PCE Grows At Slowest Pace In Three Years After Lowest Monthly Increase Of 2024, Spending Drops

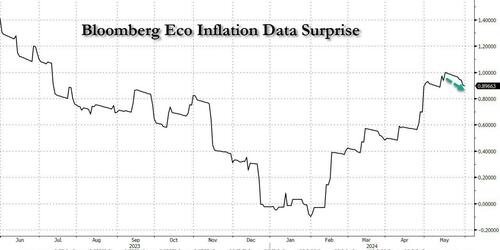

After a somewhat weaker than expected CPI print two weeks ago, and with inflation data generally surprising modestly to the downside…

… the doves’ last chance for “sooner than later” rate-cuts is today’s Core PCE Deflator – often described as The Fed’s favorite inflation signal. And indeed, after last month saw a stronger than expected print in both the headline and core prints, moments ago the Biden Bureau of Economic Analysis confirmed that – just as we previewed – the core PCE dropped from 0.3% to 0.2%, the lowest monthly increase of 2024…

… with all prints coming in just as expected, to wit:

PCE 0.3% MoM, Exp. 0.3%

PCE Core 0.2%, Exp. 0.2%

PCE 2.7% YoY, Exp. 2.7%

PCE Core 2.8%, Exp. 2.8%

Extending the scientific notation a bit, we find that the core PCE print was actually 0.249%, so literally made the rounding to 0.2% by 1 thousandth of a point, down from 0.317% last month. Amusingly, this brings to mind something Governor Christopher Waller said last week: “I look forward to the day when I don’t have to go out two or three decimal places in the monthly inflation data to find the good news.”

Also as previewed, the drop in the annual change in core PCE from just over 2.81% to 2.7537% means that the annual increase in core inflation is now the lowest since April 2021, something which will surely allow the Fed to exhale and maintain its plans to cut rates some time before the election…

… which in turn will give fresh wind to the doves new wings, something which can be seen by the euphoric reaction in futures which have spiked to session lows as yields have dumped after the report.

To be sure, it’s not all roses, and the WSJ’s Fed whisperer Nick Timiraos, aka Nikileaks, writes that while the 12-month change was 2.75%, a three-year low, the 6-month annualized rate was 3.18%, the highest since July.

He also notes that the “3-month annualized rate was 3.46%, down from the previous two months but still higher than any point in 2H 2023” which leads him to concludes that “this report was largely anticipated two weeks ago and won’t change much of anything for the near-term Fed outlook of “wait and see.”

The 3-month annualized rate was 3.46%, down from the previous two months but still higher than any point in 2H 2023

This report was largely anticipated two weeks ago and won’t change much of anything for the near-term Fed outlook of “wait and see.”

— Nick Timiraos (@NickTimiraos) May 31, 2024

Taking a closer look at the data reveals that like last month, the Service sector led the MoM and YoY acceleration in headline PCE.

For the Core PCE print, it was also Services prices too that drove the acceleration.

More importantly, the so-called SuperCore – Services inflation ex-Shelter – dropped led by the first drop in transportation services in 2024.

Income and Spending both rose again on a MoM basis although after March’s 0.7% surge in spending (which was downward revised from 0.8% but still matched the highest since Jan 2023), in April spending rose just 0.2%, below the 0.3% expected as income rose 0.3% as expected, and also a drop from the 0.5% March increase.

This meant that after plunging to just 3.6% last month, the lowest level since Nov 2022, in April the personal savings rate remained unchanged at 3.6%.

And the soaring credit card balance explains how people are getting by.

All this takes place amid the fifth straight month of government handouts.

Finally, while the markets are exuberant at the survey-based disinflation, we do note that it’s not all sunshine and unicorns. The vast majority of the reduction in inflation has been ‘cyclical’…

Tyler Durden

Fri, 05/31/2024 – 08:45