Market Goes Into PCE With Almost Everyone Neutral Bonds

By Simon White, Bloomberg markets live reporter and strategist

Positioning across most indicators shows investors are fairly neutral USTs going into today’s PCE release. The market is still slightly short, however, which points to more downside risk for yields should PCE come in lower than expectations.

April’s PCE data is released today, and the indifference is palpable. Now that of course tempts fate, but it doesn’t really look like the set-up favors a durable market shock (i.e. one that is sustained after any potential kneejerk reaction). Still, there is some inflation fever in the air today after euro-zone CPI came in higher than expected.

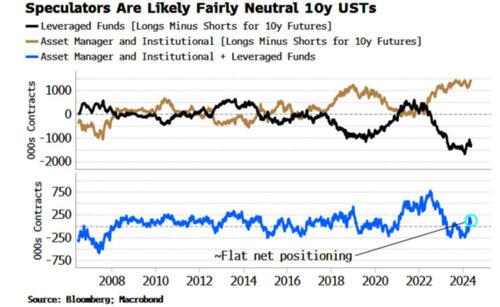

Positioning in USTs looks much more neutral across a collection of indicators. A straight cut of the Commitment of Traders data can be misleading due to the basis trade. But we can infer speculator positioning by netting asset managers and leveraged funds, with the second typically placing a trade with the first. On this basis, it looks like speculators’ positioning is almost flat after being net short for the last few months.

We get a similar picture if we infer positioning of macro/CTA funds based on HFR indices. If we take a multiple regression of the index of funds’ returns with stocks and bonds, we can see that the bond coefficient – an indication of the sensitivity of funds to USTs – has become much less short and is now close to neutral.

Similarly, a proxy based on bond-futures’ open interest infers that positioning is back to nearly flat. And the JP Morgan Treasury Survey for all clients has become progressively less long and is near neutral.

The core PCE deflator is expected at 0.2% on the month. That was at 0.3% on Thursday, as later estimates have been driving the median expectation lower – the market is perhaps more confident of a lower print after the lower-than-expected core PCE price index data also released on Thursday.

With faster-money operators look like they are still leaning a bit short, there’s probably more potential movement to the upside in bonds should we get an even lower print than the 0.2% the market (based on the Bloomberg panel) now expects.

Standing back, stocks are looking overbought versus bonds. A rally in bonds would be one way for this condition to be worked out.

Tyler Durden

Fri, 05/31/2024 – 08:05