Missiles Pound Bulk Carrier Twice In A Day In Chaotic Red Sea; Brent Crude Moves Higher

A bulk carrier in the southern Red Sea was struck by missiles for the second time this week, according to an X post by the UK Maritime Trade Operations. These highly contested waters near the Bab al-Mandab Strait are controlled by Iran-backed Houthis, who have been targeting commercial and Western warships since late 2023.

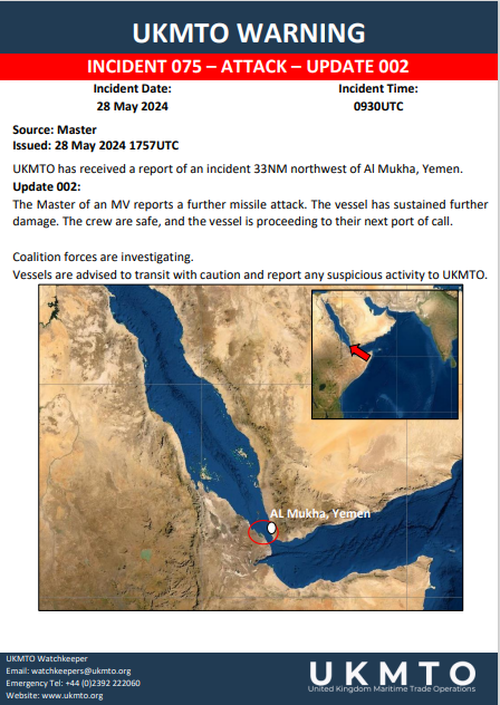

UKMTO reports that the vessel’s “Master” indicated missiles struck the ship for the second time approximately 33 nautical miles northwest of Al Mukha in Yemen.

“The Master of an MV reports a further missile attack. The vessel has sustained further damage. The crew are safe, and the vessel is proceeding to their next port of call,” UKMTO wrote on X.

On Tuesday, Bloomberg cited maritime security firm Ambrey as saying the bulk carrier “Laax” was the targeted ship. The 750-foot-long Greek-owned vessel has since taken on water, causing it to list to one side. It’s flying a Marshall Islands flag with about 80,000 tons of cargo.

According to the Equasis international maritime database, Laax is operated by Grehel Shipmanagement Co., based in Piraeus near Athens.

Data from Bloomberg shows Laax’s last known location was just north of the Bab al-Mandab Strait late Tuesday night. Strategically, the captain could’ve switched off the transponder to avoid further attacks while navigating the strait. The captain has broadcasted “Armguard Onboard” to deter Houthi pirates.

“Houthi rebels have carried out a series of similar attacks in the waterway, which is vital for global shipping, over several months in retaliation for Israel’s war in Gaza,” Bloomberg noted.

Why Houthi rebels are laser-focused on this bulk carrier, striking it with two rounds of missiles, has yet to be revealed. Perhaps it’s the ownership and or cargo linked to Israel or the US.

Continuing attacks in the Red Sea are not entirely unexpected, as the Houthis retaliate against IDF offensives in Gaza. The latest fighting in Rafah will likely trigger more attacks in the Red Sea and other critical maritime chokepoints across the Middle East.

In markets, Brent crude prices topped $84/bbl, adding to gains from Tuesday’s +1.4% move. West Texas Intermediate traded over $80 this morning.

“Geopolitical tensions continue to overshadow the market, but until we see supply losses, I think upside is limited,” Warren Patterson, head of commodities strategy for ING Groep NV in Singapore.

Tyler Durden

Wed, 05/29/2024 – 08:50

Recent Comments