Yields Will Stay Higher For Longer With Commodities

By Garfield Reynolds, Bloomberg Markets Live reporter and strategist

Surging commodity prices are threatening to bring inflation back through a door that investors thought central banks had slammed shut. That’s bringing yields higher, but the structural boost to fiscal spending that is helping drive demand for raw materials threatens to create a vicious circle for bond investors assuming that 2023 marked the start of a fresh bull run.

USDJPY spikes with rising yields as market realizes that surging commodities are, in fact, inflationary https://t.co/gVYq914z0i

— zerohedge (@zerohedge) May 20, 2024

Commodities this year already erased much of 2023’s declines, perhaps the most obvious sign that the steepest global interest-rate hikes in a generation failed to substantially slow down the world economy. Little wonder that’s accompanied a serious reversal in bets on rapid monetary easing, but investors should be facing up to the potential that any rate cuts that do come will be late and shallow.

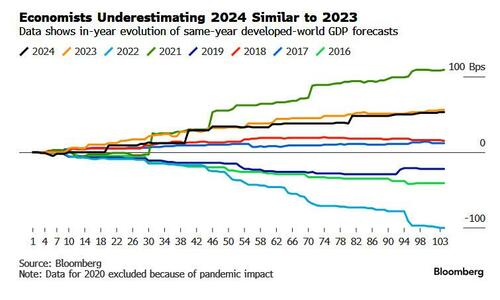

Economists are again being forced to boost growth forecasts. I looked at the evolution of forecasts for developed-world GDP going back to 2016, in each case looking at projections for the then-current year and running through to late May. Both 2023 and 2024 saw the most rapid upgrades in developed-world GDP estimates over the past decade, outside 2021’s pandemic-stimulus-inspired surge. The shift in forecasting by May for each of those years sustained through to the end, except for 2018, when analysts’ initial optimism unwound in the face of Fed hikes plus trade wars.

The regularity with which a range of raw materials has spiked higher this year underscores the way that markets underestimated demand across the global economy.

Onshoring, the green transition and increased defense spending all require more raw materials, and they are all also price-inelastic to at least some degree. China’s demand for such things has held up surprisingly well even as its imploding real estate sector hamstrings economic growth — but then it is engaged in a truly massive effort to switch to renewables for power generation.

It is also among the many that are boosting military spending, after the post-Covid world fully fractured the ever-closer globalization that first started to crack with Trump-era tariffs. The switch back toward a multipolar world also adds to commodities-driven inflation via supply shocks, like the reduction from Russia and Ukraine of various classes of raw materials and tensions in the Middle East.

The reflationary impact of commodities driven by these trends helps explain the pivot toward hawkish holds across key central banks this month. And increased government spending — actual and potential — underscores the upside skew for yields.

The continuing supply shock for bond markets is the bulging pipeline of issuance. Even if demand from aging savers is able to absorb the extra debt — and there are those who are turning toward stocks, gold or even crypto instead — more bonds will mean a higher floor for yields absent savage recessions.

While there are signs of soft patches across most economies, central banks are mostly insistent they can achieve something close to the soft landing they are aiming for. Add in all that fiscal largess, and the best bonds can hope for is to avoid outcomes that lead to fresh rate hikes.

Tyler Durden

Mon, 05/27/2024 – 09:00