After Urging To Buy The Dip Every Week In 2022, Kolanovic Tells Clients To Buy The Dip… And He Means It This Time

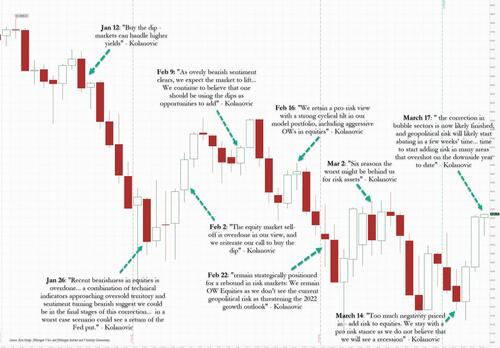

If it sometimes feels like JPMorgan’s global head of markets strategy Marko Kolanovic has turned into a broken record, and tells the bank’s clients (and anyone else) to buy the dip every single week… well, that’s because it’s true.

One almost wonders if JPM has an agenda in trying to get retail investors to buy all day, every day the stocks that the bank’s whale clients are selling (and for those who laugh at this suggestion, do not read the far more bearish commentary from JPM’s trading desk reserved for a smaller and much more “select” list of clients).

So in a historic week when JPMorgan absolutely murdered what may have been the biggest short squeeze in recent history, when Hong Kong-traded Chinese tech stocks and ETFs exploded higher, in some cases as much as 50% on Wednesday just hours after JPMorgan downgraded the entire Chinese internet sector calling it “uninvestable“, Marko Kolanovic is out not with one but two notes in which he tells clients to – you guessed it – buy the dip.

To wit, just three days after the JPMorgan quant, who one year ago was promoted to global markets strategist, bet it all on green perhaps figuring that purely statistically his call to BTFD should finally pan out and in a note on Monday Kolanovic wrote that “Too much negativity priced in – add risk to equities” adding that “we stay with a pro risk stance as we do not believe that we will see a recession”, the Croatian has literally doubled down and on Thursday pushed out a note titled “A time of big risks but even bigger market opportunities”, in which he points to one of the few bearish calls he has made in the past year – “we warned about the commodity supercycle and energy crisis; we also warned about the bubble in innovation, renewables, etc, and on the front page of our year ahead outlook in December we warned about geopolitical risks as a key risk in 2022”, and just to impress those clients who still haven’t bought the dip because perhaps they didn’t see Marko as bullish enough, he writes that “it is our assessment that these forecasts have now nearly fully materialized.” Noting that “while the commodity supercycle will persist, in our view, the correction in bubble sectors is now likely finished, and geopolitical risk will likely start abating in a few weeks’ time (while a comprehensive resolution may take a few months)” and predicts that “markets may anticipate these turning points sooner, and we think it is time to start adding risk in many areas that overshot on the downside year to date.“

In other words, in case you missed all his previous weekly calls to buy the dip, this time he really means it even as he caveats that not all dips should be bought( “not all assets are cheap, and one can still find expensive segments in mega caps, defensives and low volatility stocks that are sensitive to rising rates, a slowing US economy and factor rotations” he writes).

So for those JPM who still have some dry powder left after buying every single dip in 2022 – and there have been many – Marko’s reco is that “there are great opportunities in high beta, beaten down segments that now include innovation, tech, biotech, emerging markets (e.g. China), as well as more broadly in smaller capitalization and more volatile stocks.”

Translation: buy the highest beta, shittest assets out there, because they should go up… or something. Oh, and buy China now after the biggest ripfest in history, just ignore the reco from another JPM strategist who on Monday said not to touch Chinese tech names with a 10 foot pole, right before the biggest short squeeze in Chinese history.

So why should investors buy the dip in the worst-of-the-worst stocks out there? He explains”

These segments are already pricing in a severe global recession, which will not materialize in our view (though it is not possible to rule out a recession in Europe and further slowdown in the US). From the time when we called the bubble, these segments are down 60-80%, which we think is the end of the correction and in some areas represents a liquidity-driven overshoot. In fact, many of these market segments trade at all-time valuation lows (including previous recessions and periods of much higher interest rates).

Perhaps the loudest message from the above is that a recession in the US is now assured, a view which not just this website but other, more astute Wall Street strategists now share.

And while Kolanovic’s thesis could actually make sense if he anticipated a sharp slowdown in growth which would force the Fed to halt rate hikes, cut rates and unleash a new QE, sparking rotation out of value/cyclicals and into growth/deflation stocks (i.e., buy those names the go up when growth and inflation are slowing), bizarrely he actually goes full barbell and tells his readers that he als remains “bullish on commodities and commodity equities, as recent developments are just the bi-product and not the cause of the great supply/demand imbalances that developed over the past years due to underinvesting in ‘dirty’ industries and the COVID crisis.”

In other words, and we agree with this, Kolanovic sees all the same reflationary catalysts that pushed energy stocks higher persisting, at the same time he is also pushing the opposite trade, buying high-beta crap, a trade which makes zero sense in a world where inflation is set to continue to rise, and where the same bubble stocks which he did indeed would drop, are set to continue sliding ever lower as growth and high beta factors continue to get crushed.

In any case, where we do agree with Marko, is his continued energy bullishness, and picking up on a point we made last week when we noted that when looked in the context of the broader S&P, energy is a tiny fraction and is only set to increase, bringing with it far greater capital inflows…

the Energy sector in context pic.twitter.com/bvcQ6QU8rc

— zerohedge (@zerohedge) March 10, 2022

… Marko writes that “investors are asking how far our positive Energy view can go – for a perspective we show the historical weight of the energy sector in the market and some of the supercycle drivers over the past decade.”

His punchline which, again, we agree with, is that “the energy crisis will end when the energy sector attains the same relative weight as during the previous commodity up cycle. This would realign economic incentives, reduce the impact of politically-driven capital allocation and reach a capital clearing point needed to alleviate the crisis.”

Does this then mean that the energy sector will “appreciate multiple times” Kolanovic asks rhetorically, and answers “Not necessarily, as the convergence can take place with some combination of Energy appreciation and a decline of other sectors in case of a continued acute energy crisis” although it certainly assures far more upside for energy stocks, a view which Warren Buffett clearly shares with his continued investment in OXY.

The Croat also correctly notes that “energy is also center and key to geopolitical developments. Historically it was not uncommon that energy was traded between geopolitical enemies during the conflict, however nearly always it was at exorbitant geopolitical cost for the party that was experiencing an energy shortage. This type of energy trade is currently an important factor in 2 geopolitical regions: in Eastern Europe and in the Middle East.“

If Marko would only extend further on this line of thought, he may reach the same striking conclusions published in recent weeks by Zoltan Pozsar, who in the past three years, has boldly taken the title of Wall Street’s most insightful analyst, a title which once belonged to Kolanovic until one day, several years ago, something snapped and Marko decided to trade in his probing market observations for the (much better compensated) political talking points emanating from JPM’s C-suite.

Tyler Durden

Thu, 03/17/2022 – 14:05