Where’s The Demand? Alibaba Slashes AI Pricing By Up To 97%, Igniting Discount War Across China

The release of OpenAI’s ChatGPT in late 2022 sparked a generative artificial intelligence bubble, and now investors are watching for any signs of its bursting. Nvidia reports earnings results and guidance on Wednesday evening, as the company is arguably the market’s AI bellwether, which will be a crucial test for bulls. Meanwhile, troubling signs are emerging from China, where AI demand appears to be stagnating. This could be an ominous sign for the overhyped AI sector and its lofty valuations.

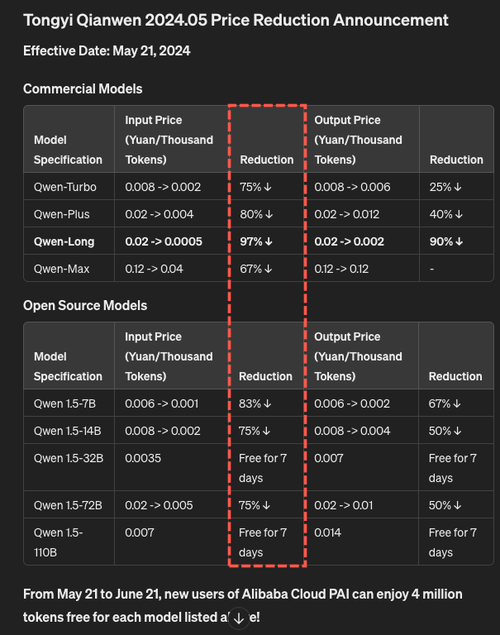

Bloomberg first reported that Alibaba Group Holding Ltd. slashed its AI service prices by up to 97%, igniting a price war among major Chinese tech companies that also cut prices. This price war is evidence of the demand struggles facing the AI sector in China.

Baidu Cloud said it would offer free services based on its Ernie AI models on Tuesday, hours after Alibaba offered deals on nine products built atop its own Tongyi Qianwen. ByteDance Ltd. last week announced pricing for AI services that it said were 99% lower than Chinese industry norms, using Ernie and Alibaba’s Qwen as benchmarks.

Alibaba’s reduced pricing for Language Models (LLM) by up to 97% was posted on the company’s WeChat account.

Bloomberg Intelligence’s Robert Lea explained that Alibaba’s AI price war is in response to ByteDance’s recently launched Doubao LLMs, which are offered at a steep discount to customers. He also expects Baidu, Tencent, and JD.com to respond, worsening the AI price war.

Meanwhile, mentions of AI on first-quarter earnings calls in the US continue soaring.

Companies mentioning AI on earnings calls pic.twitter.com/bWlVZCO3ON

— zerohedge (@zerohedge) May 16, 2024

Everyone on Wall Street is jumping into “The Next AI Trade.”

Tomorrow’s earnings and guidance for Nvidia is a make-or-break for the AI-fueled equity bubble.

AI demand woes in China are undoubtedly an ominous sign that should be monitored.

Tyler Durden

Tue, 05/21/2024 – 12:05