Mainstream Finally Gets It… The AI Investment Play Isn’t Tech, It’s Energy

Almost two months ago, we highlighted what we called at the time ‘The Next AI Trade‘ – that in fact it is not the tech itself, but the electrical power required to run the tech that is the limiting factor on the growth of AI (and Data Center) expansion.

These pages have been warning for years about an electric-power shortage. And now grid regulators and utilities are ramping up warnings. Projections for U.S. electricity demand growth over the next five years have doubled from a year ago. The major culprits: New artificial-intelligence data centers, federally subsidized manufacturing plants, and the government-driven electric-vehicle transition.

In one charted tweet, we summarized the ‘problem’…

A ChatGPT search requires 10x as much power as a traditional Google search pic.twitter.com/khdSbvxsOH

— zerohedge (@zerohedge) May 19, 2024

Sure enough, since our post, “focus across the AI stack has shifted from software and AI tools to the hardware angle, where there could be less of a winner takes all dynamic and many of the incumbents in the market have the potential to capitalize on AI advancements. As a result, we expect the hardware and power oriented industries to catch up to the broader AI theme.”

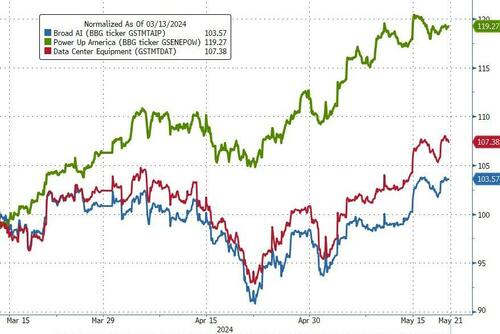

And they have outperformed since…

And now, as Bloomberg’s Simon White details below, the message is hitting the mainstream media that the vast amount of power required by energy-intensive AI models is prompting tech firms to invest in their own energy infrastructure. But it may be too little, too late to prevent another wave of commodity-driven inflation – a backdrop that’s very favorable for the energy and utility sectors, and negative for high-duration tech stocks.

Often the best solution is not the most direct one. In the book Obliquity, British economist John Kay describes how the route taken by the Panama Canal was not the most direct east-west one across Nicaragua, but instead an oblique one in a south-easterly direction through Panama. This was the shortest option and therefore the easiest to build and the quickest for ships to traverse.

Source: Vox; Microsoft; Bloomberg

Likewise, an oblique approach to investing in AI stands to be the more profitable one. Energy-hungry AI models, the risk of power and commodity capacity-constraints and thus a further heightening of inflation risks leave expensively valued, high-duration technology stocks at risk.

Energy stocks, on the other hand, are still cheap, underowned and poised to benefit from rising commodity prices and power demand. They are the oblique route to benefiting from the first stage of the AI progress-explosion.

The rapid advancement made in recent years in AI, especially Large Language Models (LLMs), has led to a burst of investment in the tech industry. The training and operation of such models is energy-intensive. That has led to a rapid rise in expectations for the power needs of dedicated AI data centers. The IEA’s base case is for a little shy of a doubling in global power demand for all types of data centers and cryptocurrency by 2026.

Source: IEA

The need for an enormous amount of “compute” and the inefficiency of current LLMs is the main problem. If Google was to fully incorporate AI into its main search feature, it could see a 10-fold increase in its electricity demand, given a typical Google search request uses an average of 0.3 watt-hours versus 2.9 Wh for a ChatGPT request, according to the IEA.

Western electricity grids have little excess capacity, increasing the risk of bottlenecks. The US grid reached 94% capacity last year, with Europe’s even higher. That’s as the share in demand for AI and traditional data centers, excluding crypto, is projected to rise in these regions. To underscore the point, tech-focused Ireland is expected to see a third of its electricity demand coming from data centers by 2026.

Source: IEA

Capacity will be further constrained by almost a decade of underinvestment in upstream and downstream energy infrastructure. Years of overinvestment during the commodities boom that ended around 2014 led to commodity companies slashing capex and handing back more money to shareholders.

The capex of North American commodity producers only began picking up again in 2021. But at the same time they were massively increasing dividend payouts and buybacks – to the point that they equaled capex spending in 2022 – limiting the amount the firms could spend on new investment and maintenance capital expenditure.

The lags in bringing new energy sources on stream are long, up to four years, and even longer for transmission. There are delays with permissioning and construction both upstream and downstream, as well as waiting lists for key parts in power stations such as transformers. Demand is poised to rise faster than supply is able to meet it, even taking into account recent improvements in efficiency of energy production and power usage.

The stark contrast between energy and tech firms can be seen in the chart below. Tech companies have been ramping up investment – signaling that their demand for power will rise too — while energy’s capex has trended lower over most of the last decade.

Tech firms are not blind to the issues. They are diverting more of their capex to investing in energy infrastructure. Alphabet, Meta and other hyperscalers are directly investing in renewable-energy power plants. Amazon, for instance, has funded a wind farm in the UK and will purchase its entire output. Tech companies are also entering into power purchase agreements (PPAs). These allow the buyers to purchase power directly from renewable energy producers.

Even then, there remain bottleneck risks while tech companies are laser-focused on their green credentials. Apple, Alphabet and Meta were all carbon neutral by 2020, and they and other hyperscalers have committed to being carbon free by 2030, according to McKinsey (whether tech firms will have to backtrack on these commitments is another matter). That puts additional pressure on the prices for the raw materials used in solar panels, wind turbines, etc, such as copper and silver.

On top of that, renewables suffer from intermittency issues — problematic for data centers requiring 100% uptime. More renewables thus means a bigger excess margin is required, and a continued reliance on fossil fuels until the storage problem is fully solved. Also amplifying bottleneck risks is the geographical dislocation of where demand comes from and where supply is, especially in a large country like the US.

The current iteration of generative AIs – with their fundamental limitations (reasoning, planning, understanding) – are unlikely to lead to productivity enhancements as quickly as optimists believe. That means higher inflation is the most likely outcome from the expected rapid rise in tech demand for power.

This comes at a time when we are already in an inflationary regime, where inflation shocks have greater capacity to lead to a persistent rise in price growth. The 1970s were peppered with events – the closing of the gold window, the Arab oil embargo, the Iranian Revolution – that on their own and outside of an inflationary regime may not have led to such persistent price issues.

There lies the rub for tech firms. While they are at the vanguard of AI, their stock prices are most exposed to higher inflation. The tech sector has high duration, with lumpy cash flows expected long in the future, and therefore is the most sensitive to the rising rates that would be likely to accompany another burst of commodity-driven price growth.

Tech was the worst performing US sector versus the S&P in 2022 when inflation was rapidly accelerating and the Fed started to raise rates. On the other hand inflationary environments — especially when they are commodity driven — are a sweet spot for low-duration energy stocks, which was the top outperforming sector in 2022. Utilities did relatively well too, but they stand in better stead this time as a low-duration sector benefiting from rising power demand.

Tech is priced for near perfection with very high valuations, unlike energy and utilities, which are by far the cheapest sectors. Furthermore, energy is also now very underowned. A resurgence in commodity-led inflation would narrow the extreme gap between tech and energy ownership. Energy is now only 4% of the S&P 500 while tech plus Amazon sits at 29%. While we won’t go all the way back there, the gap was close to zero during the GFC.

Tech is likely to be the greatest beneficiary of AI in the long run, but the path there may not be direct. Obliquity provided the most profitable route to the Pacific Ocean. Energy, utility as well as copper stocks stand to do the same for investing in the AI revolution.

Tyler Durden

Tue, 05/21/2024 – 10:05