Goldman’s Commentary On Consumer Health Is An Ominous One

As we wrap up the first quarter earnings season and approach the midpoint of the year, a major theme emerging out of corporate America and Goldman analysts is the deteriorating financial health of low-income consumers.

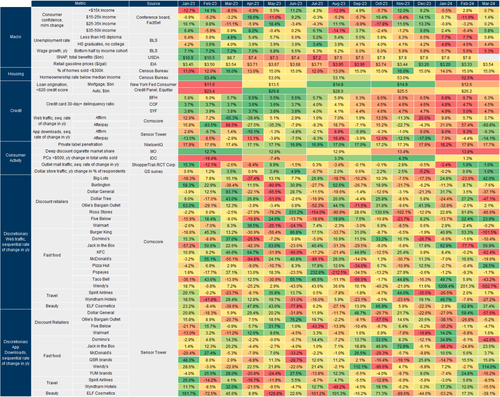

A team of Goldman analysts led by Kate McShane, CFA, published the latest low-income activity dashboard that shows monthly trends have been “mixed recently, noting tailwinds from lower gasoline prices and improved mobility along with headwinds from weaker credit metrics and slowing consumer confidence.”

Let’s remind readers that Goldman’s top consumer trader, Scott Feiler, recently told clients, “Our desk is getting bearish on consumer and our soft landing basket. We think it’s the most vulnerable area of cyclicality, and cyclicals/defensives are priced very optimistically, and we are starting to see a defensive rotation.”

In recent weeks, Goldman analysts headed by Bonnie Herzog noted, “With >75% of the US consumer universe having reported Q1 results, we see indications that the US consumer is proving more stretched than previously anticipated as inflation combined with a bit of softening in the macro (lower payrolls & an uptick in unemployment in April), elevated gas prices & high interest rates continue to eat into spending power & consumer confidence.”

Last week, retail sales data for April missed average estimates. This shows that spending fatigue among the working poor has emerged. Many low-income folks have maxed out credit cards and drained savings to survive the era of failed Bidenomics.

This year, faltering lower-income consumers is a major theme, and Goldamn’s McShane’s latest commentary on consumer companies shows just that.

It’s evident that the lower-income consumer is stretched, and persistent inflation, mainly due to President Biden’s $1 trillion spending spree every 100 days, has decimated whatever is left of the middle class. Stagflation threats are elevated.

Tyler Durden

Mon, 05/20/2024 – 12:40