Key Events This Quiet Week: Nvidia Earnings, FOMC Minutes, And Tons Of Fed Speakers

After last week’s non-stop rollercoaster, it will be a quieter week ahead for global macro with perhaps the most interesting event of the week being Nvidia’s earnings on Wednesday. The company always reports a couple of weeks after the main stretch of US earnings season is over so it will act as a potent “digestif” to Q1 reporting. As DB’s Jim Reid reminds us, this time last year the mainstream AI frenzy began around the time of Nvidia’s results where the company climbed over 20% on results day and has now tripled in value over 12 months.

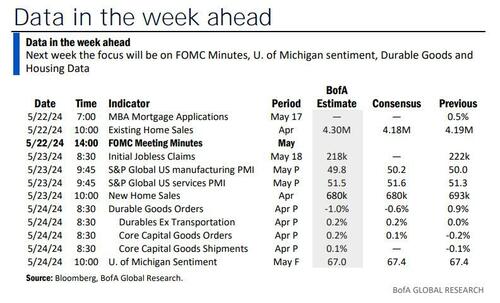

Staying in the US, the FOMC minutes on Wednesday are likely to be the main economic event however, it’s unlikely to contain much new material especially since the meeting we have seen CPI and PPI. Perhaps the busy week for Fedspeak will prove more interesting. Vice Chair Jefferson today and Governor Waller tomorrow are early week highlights with the rest in our day-by-day week ahead at the end as usual. In all, there are a whopping 16 Fed speakers this week. Lagarde and the BoE Bailey speak tomorrow.

In terms of US data, notable releases include durable goods orders (DB forecast +0.5% in April vs +2.6% in March) and the final reading of the University of Michigan’s survey on Friday, as well as housing market data throughout the week. For the UoM survey, inflation expectations will be a highlight as the preliminary reading showed short- and longer-term expectations edging up. The survey is currently transitioning from 100% phone to 100% web-based responses over a 4-month period. So strange or inconsistent readings are possible.

The global flash PMIs on Thursday will be a highlight alongside UK inflation on Wednesday and retail sales and consumer confidence on Friday. DB’s UK economist expects the headline to drop to around 2.2% YoY, 18 months after peaking at 11.1%. He sees core CPI at 3.6% and services at 5.4%, both also down. He sees risks to the headline projection as skewed to the downside. Canada’s CPI is also out tomorrow.

In Germany, PPI tomorrow and the breakdown of Q1 GDP on Friday, are likely the main events in mainland Europe. In Asia, the national CPI in Japan on Friday is the main release. Our Chief Japan economist expects core inflation ex. fresh food to be up 2.2% YoY (2.6% in March) and core-core ex. fresh food and energy up 2.5% (+2.9%), both rising +0.1% on a seasonally-adjusted MoM basis.

Courtesy of DB, here is a day-by-day calendar of events

Monday May 20

Data : China 1-yr and 5-yr loan prime rates, Japan March Tertiary industry index

Central banks : Fed’s Bostic and Barr speak

Earnings : Palo Alto Networks, Zoom, Ryanair

Tuesday May 21

Data : US May Philadelphia Fed non-manufacturing activity, Germany April PPI, Italy March current account balance, ECB March current account, Eurozone March construction output, trade balance, Canada April CPI, Denmark Q1 GDP

Central banks : Fed’s Bostic, Barkin, Barr, Waller and Williams speak, ECB’s Lagarde speaks, BoE’s Bailey speaks, RBA minutes of May policy meeting

Earnings : Macy’s, Lowe’s

Wednesday May 22

Data : US April existing home sales, UK March house price index, April public finances, CPI, RPI, PPI, Japan March core machine orders, April trade balance, EU27 April new car registrations, Sweden April unemployment rate

Central banks : FOMC meeting minutes, Fed’s Bostic, Goolsbee, Collins and Mester speak, BoE’s Breeden speaks, RBNZ decision

Earnings : Nvidia, Snowflake, Target, Analog Devices, TJX, Synopsys

Auctions : US 20-yr Bonds ($16bn)

Thursday May 23

Data : US, UK, Japan, Germany, France and Eurozone May PMIs, US May Kansas City Fed manufacturing activity, April Chicago Fed national activity index, new home sales, initial jobless claims, Eurozone May consumer confidence

Central banks : Fed’s Bostic speaks, BoE’s Pill speaks

Earnings : Lenovo, Workday, Intuit

Auctions : US 10-yr TIPS (reopening, $16bn)

Friday May 24

Data : US May Kansas City Fed services activity, April durable goods orders, UK May GfK consumer confidence, April retail sales, Japan April national CPI, Germany Q1 GDP detail, France May manufacturing confidence, Canada March retail sales

Central banks : Fed’s Waller speaks, ECB’s Schnabel, Centeno, Vasle, Nagel and Muller speak

* * *

Finally, turning to just the US, the key economic data releases this week are the existing home sales report on Wednesday, the durable goods orders report and the University of Michigan report on Friday. The minutes from the May FOMC meeting will also be released on Wednesday. There are several speaking engagements from Fed officials this week, including remarks from Vice Chair for Supervision Barr, Vice Chair Jefferson, Governor Waller, and Presidents Bostic, Mester, Barkin, Williams, Collins, and Goolsbee.

Monday, May 20

No major economic data releases scheduled.

07:30 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will be interviewed on Bloomberg TV. On April 3, Bostic said “if the economy evolves as I expect and that’s going to be seeing continued robustness in GDP and employment, and a slow decline in inflation over the course of the year, I think it will be appropriate for us to start moving [the fed funds rate] down at the end of this year, the fourth quarter.” He also noted that he now expects inflation to drop incrementally through 2024 and 2025 with the 2% target rate reached “sometime in early 2026.”

08:45 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will give welcoming remarks for the Atlanta Fed’s Financial Markets conference.

09:00 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will give the keynote speech at the Atlanta Fed’s Financial Markets conference on monetary policy and bank regulation. A moderated Q&A is expected. On February 14, Barr said, “As Chair Powell indicated in his most recent press conference, my FOMC colleagues and I are confident we are on a path to 2% inflation, but we need to see continued good data before we can begin the process of reducing the federal funds rate.”

09:00 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will give welcoming remarks for the Third Conference on the international roles of the US dollar. The speech text is expected. On March 27, Waller said, “[The recent data] tells me that it is prudent to hold the rate at its current restrictive stance perhaps for longer than previously thought to help keep inflation on a sustainable trajectory toward 2%.” He also noted, “The strength of the US economy and resilience of the labor market mean the risk of waiting a little longer to ease policy is small and significantly lower than acting too soon and possibly squandering our progress on inflation.” Waller also spoke on May 17 but did not comment on monetary policy.

10:30 AM Fed Vice Chair Jefferson speaks: Fed Vice Chair Phillip Jefferson will speak on the US economic outlook and housing price dynamics at the Mortgage Bankers Association Secondary and Capital Markets conference. The speech text is expected. On May 13, Jefferson said that it is appropriate to keep interest rates steady until there is additional evidence that inflation will return to the Fed’s 2% target. He also said, “The diversity of viewpoints among policymakers lends itself to stimulating debates and, ultimately, better policy, but in such a situation, more communication could increase rather than reduce uncertainty about our policies.”

02:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will be interviewed on Bloomberg TV. On May 16, Mester said, “The most likely scenario for the overall economy and that of the region is that the current restrictive stance of monetary policy will continue to help moderate growth and labor market conditions and that this moderation will contribute to the further easing of price pressures.” She also noted, “I expect progress on inflation over time, but at a slower pace than we saw last year.”

07:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will moderate a keynote address by Harvard’s Edward Glaeser at the Atlanta Fed’s Financial Markets conference.

Tuesday, May 21

No major economic data releases scheduled.

09:00 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will give welcome and opening remarks at the Richmond Fed’s Investing in Rural America conference. On May 6, Barkin said he expects high interest rates to slow the economy further and cool inflation to the Fed’s 2% target. He also noted that the strength of the labor market offers the Fed time to gain confidence that inflation is moving sustainably lower before lowering borrowing costs, but there’s a risk continued housing and services inflation will keep price gains elevated — as seen this year.

09:00 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will speak on his outlook for the US economy and monetary policy. The speech text is expected. A moderated Q&A is expected.

09:05 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President Williams will give opening remarks at the 2024 Governance and Culture Reform conference. On May 3, Williams said, “Years of experience—and years of careful analysis—have taught us that, first and foremost, central banks must own the responsibility for maintaining low and stable inflation and have the independence of action to achieve that goal.” He also noted, “The future is uncertain, but as we continue to move closer to our 2 percent longer-run inflation goal, I’m confident we have the foundation of theory and experience to guide us in restoring price stability and set the stage for sustained economic prosperity. We are committed to getting the job done.”

09:10 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will offer brief welcome remarks at the Atlanta Fed’s Financial Markets conference.

11:45 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will discuss the economy, lessons learned from the 2023 liquidity crisis, and regional banking supervision in a fireside chat at the 2024 Regional State Member Bank Director and Executive conference. A moderated Q&A is expected.

07:00 PM Boston Fed President Collins and Cleveland Fed President Mester (FOMC voter) speak: Boston Fed President Susan Collins and Cleveland Fed President Loretta Mester will participate in a panel conversation moderated by Atlanta Fed President Raphael Bostic at the Atlanta Fed’s Financial Markets conference. A moderated Q&A is expected. On May 8, Collins said that it will take longer than previously thought to bring inflation down. She also said that she remains optimistic that inflation can be brought back to the Fed’s goal of 2% in a reasonable amount of time and with a job market that remains healthy.

Wednesday, May 22

09:00 AM Chicago Fed President Goolsbee speaks: Chicago Fed President Austan Goolsbee will give opening remarks at the Chicago Fed Holding Company symposium. On April 19, Goolsbee said, “So far in 2024, that progress on inflation has stalled. You never want to make too much of one month’s data, especially inflation, which is a noisy series, but after three months of this, it can’t be dismissed.”

10:00 AM Existing home sales, April (GS +1.8%, consensus -0.1%, last -4.3%)

02:00 PM FOMC meeting minutes, April 30-May 1 meeting: The May FOMC meeting was mostly uneventful but dovish overall. We saw two takeaways from Chair Powell’s press conference. First, Powell pushed backed strongly against the possibility of rate hikes and emphasized that he is confident that the current policy stance is restrictive. Second, Powell offered no major clues on the timing of a rate cut but struck a consistently dovish tone on inflation. Consistent with our views, he said he took little signal from the inflation uptick in Q1. We have left our forecast unchanged and continue to expect two rate cuts this year in July and November.

Thursday, May 23

08:30 AM Initial jobless claims, week ended May 18 (GS 220k, consensus 220k, last 222k); Continuing jobless claims, week ended May 11 (consensus 1,790k, last 1,794k)

09:45 AM S&P Global US manufacturing PMI, May preliminary (consensus 49.6, last 50.0)

09:45 AM S&P Global US services PMI, May preliminary (consensus 51.3, last 51.3)

10:00 AM New home sales, April (GS -4.0%, consensus -2.6%, last +8.8%)

03:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a Q&A session with an MBA class at the Stanford University.

Friday, May 24

08:30 AM Durable goods orders, April preliminary (GS -2.0%, consensus -0.8%, last +0.9%); Durable goods orders ex-transportation, April preliminary (GS +0.1%, consensus +0.1%, last flat); Core capital goods orders, April preliminary (GS +0.1%, consensus +0.1%, last -0.2%); Core capital goods shipments, April preliminary (GS +0.1%, consensus +0.1%, last -0.1%): We estimate that durable goods orders fell 2.0% in the preliminary April report (mom sa), reflecting weak commercial aircraft orders as well as aircraft order cancellations. We forecast modest increases core measures, including 0.1% increases in both core capital goods shipments and core capital goods orders.

09:35 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will give the keynote address on r-star at a Central Bank of Iceland event in Reykjavík, Iceland. The speech text will be made available.

10:00 AM University of Michigan consumer sentiment, May final (GS 67.9, consensus 67.8, last 67.4); University of Michigan 5-10-year inflation expectations, May final (GS 3.1%, consensus 3.1%, last 3.1%): We expect the University of Michigan consumer sentiment index increased to 67.9 in the final May reading. We estimate the report’s measure of long-term inflation expectations remained unchanged at 3.1%, somewhat above the recent trend, reflecting higher gasoline prices and the higher-than-expected price data reported in 2024.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 05/20/2024 – 09:10