Precarious: One Misfortune Away From Insolvency

Authored by Charles Hugh Smith via OfTwoMinds blog,

As a result, a significant percentage of households that are considered middle-class are one misfortune away from insolvency.

We can summarize the changes in our economy over the past two generations with one word: precarity, as life for the bottom 90% of American households has become far more precarious over the past 40 years, despite the rising GDP and “wealth” as measured in phantom capital.

This reality is expressed in the portmanteau word precariat, combining proletariat (someone whose livelihood comes from their labor) and precarious: outside of government employment, work has become far more precarious. Where it was still common 40 years ago to work for a company for much or most of one’s career and have a private-sector pension, now private-sector pensions have vanished, replaced by self-managed 401K funds, and private-sector work is characterized by a series of not just job changes but career changes.

The source of one’s livelihood can dry up and blow away almost overnight, and to fill the hole many turn to gig-work with zero benefits that saddles the worker with self-employment taxes (15.3% of all earnings, as the “self-employed” gig worker must pay both the employee and the employer shares of Social Security-Medicare payroll taxes).

This isn’t true self-employment, of course, as true self-employment means the owner-worker can hope to extract the full value of their labor; in contrast, much of the value of the gig work is skimmed off by corporate platforms (Uber et al.). The gig worker is a precariat wage-slave, not a self-employed owner of their own labor and enterprise.

Forty years ago, households with healthcare insurance being driven into bankruptcy by medical bills was unknown. Now this is commonplace. We’re forced to ask, what exactly does “insurance” even mean if our share of the medical bills is so burdensome that we’re forced into insolvency?

This is just one of many examples of the increasing precarity of life in America. Need dental work? “Insurance” covers only the basics; the rest requires savings, an inheritance, a line of credit or a top 10% income.

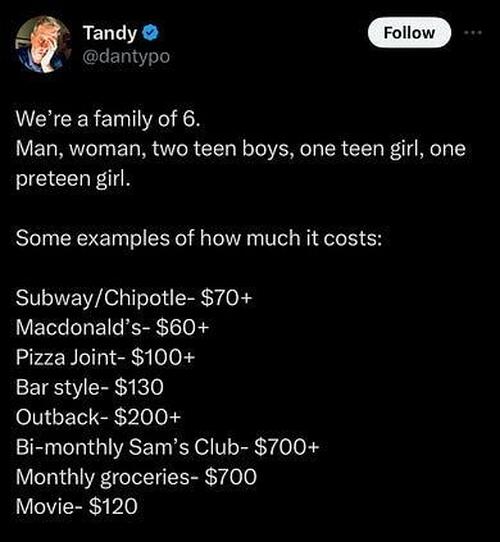

Speaking of income, even a substantial earned income doesn’t go that far nowadays. Consider what a typical family spends on what we consider middle class birthrights: eating out, going to a movie, etc.

This budget of a household earning a top 1% income (top 2% in high-income states) of $500,000 is interesting on several fronts. Those living in lower-cost states may view it as bloated beyond belief, while those living in NYC, Los Angeles, San Francisco et al. will view it as entirely realistic: yes, property taxes are $20,000, “enrichment” childcare costs $42,000, and so on.

What’s not realistic is $5,000 for home maintenance and $18,000 for three vacations a year. Given the age of American houses (40 years being average), the poor quality of a significant portion of recent construction and the soaring cost of labor, $5,000 doesn’t buy much in the way of maintenance. A more realistic estimate for pretty much anything serious is $20,000, and $50,000 is remarkably commonplace for even modest kitchen makeovers. The $18,000 in charitable donations may be sucked up by a new roof.

As for vacations, unless it’s a very short trip, a camping trip or travel to a low-cost destination, $6,000 per vacation may not be realistic.

The point of this exercise is to examine the buffers needed to survive a serious misfortune, such as losing one’s job or a medical crisis. Two generations ago, costs were lower and households generally had enough savings or credit to cover the emergency expense or survive a bout of unemployment. With costs now prohibitive, modest savings are no longer enough.

As a result, a significant percentage of households that are considered middle-class are one misfortune away from insolvency. The concentration of income and wealth into the top 10% isn’t just a statistical abstraction; in the real world, it means the buffers of the bottom 90% have thinned while the buffers of the top 10% have increased: for the family holding hundreds of thousands of dollars in 401K accounts and sitting on $1 million in home equity, a $25,000 medical or home repair bill is an inconvenience, not a push off the cliff into insolvency.

This precariousness extends into small business as well. Costs have soared and buffers have thinned. A great many small enterprises are one misfortune away from closing / insolvency.

As the tide of precarity rises, the apologists and cheerleaders of the status quo are cheerily predicting a “Roaring 20s” of widespread prosperity ahead. Correspondent David E. forwarded this cartoon which captures the current zeitgeist perfectly:

* * *

Tyler Durden

Wed, 05/15/2024 – 17:00